Mastercard on Agentic Payments: How AI Agents, Tokenization, and Authentication Will Redefine Digital Commerce

As commerce enters the era of AI-driven transactions, Mastercard is helping define what secure, trusted digital payments look like when machines act on behalf of people.

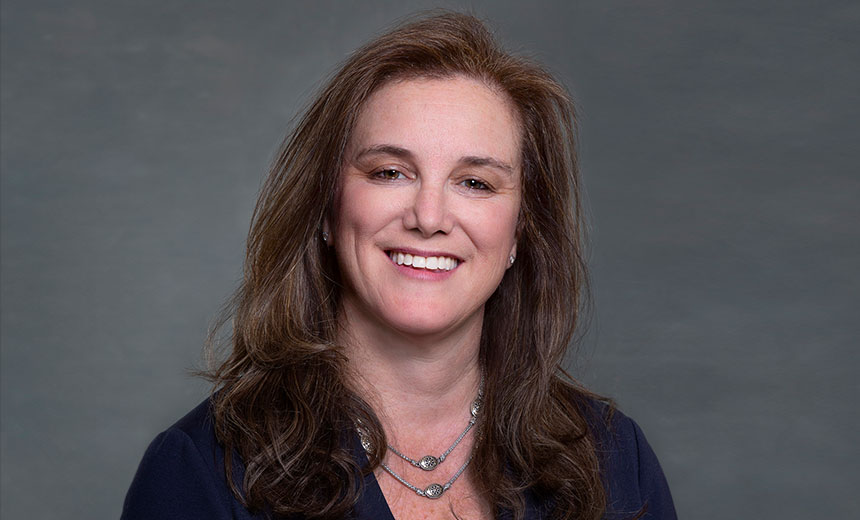

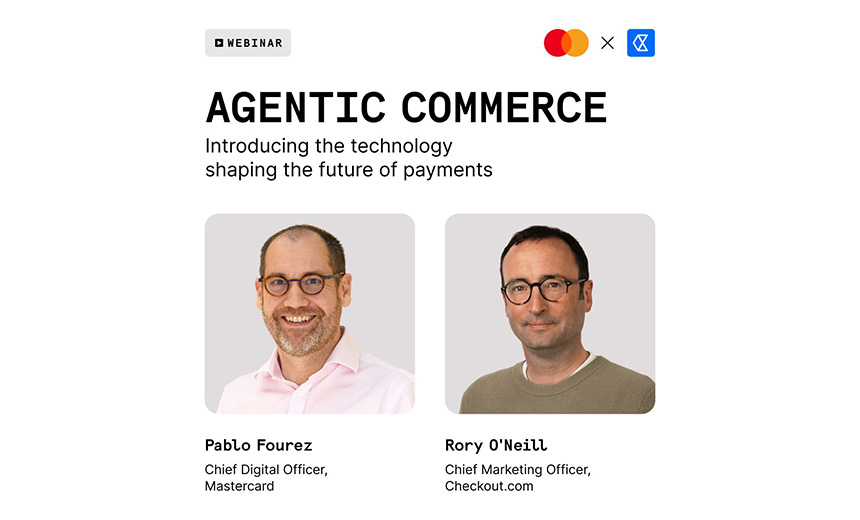

In this on-demand discussion, Pablo Fourez, Chief Digital Officer at Mastercard, joins Rory O’Neill, Chief Marketing Officer at Checkout.com, to explore how agentic payments — powered by tokenization, biometric authentication, and intent-based consent — will reshape the architecture of digital commerce.

They examine how Mastercard’s approach to security, identity, and trust is enabling businesses to prepare for a future where AI agents transact autonomously while keeping users in control.

Key Takeaways:

- Know Your Agent (KYA): How a new layer of identity verification helps differentiate trusted AI agents from malicious bots in digital transactions.

- How Mastercard is extending its tokenization and authentication infrastructure to power safe, transparent AI-led transactions.

- The role of Know Your Agent (KYA) and biometric passkeys in building trust between merchants, acquirers, and AI-driven systems.

- How Mastercard is helping shape emerging standards like agent-to-agent protocols (A2A) and API interfaces to ensure interoperability and fraud prevention.

- Why adding intent and consent data to payment tokens is key to maintaining traceability and accountability across every digital transaction.

![Post-Quantum Cryptography - A Fundamental Pillar in the Future of Cybersecurity [ES]](https://ismg-cdn.nyc3.cdn.digitaloceanspaces.com/articles/post-quantum-cryptography-fundamental-pillar-in-future-cybersecurity-es-image_large-7-a-28821.jpg)