Automating Trading Strategies in MQL5 (Part 39): Statistical Mean Reversion with Confidence Intervals and Dashboard

Introduction

In our previous article (Part 38), we developed a Hidden RSI Divergence Trading system in MetaQuotes Language 5 (MQL5) that identified hidden bullish and bearish divergences using swing points, applied clean checks with bar ranges and tolerance, filtered signals via customizable slope angles on price and RSI lines, executed trades with risk management, and included visual markers with angle displays on charts. In Part 39, we develop a Statistical Mean Reversion system with confidence intervals and a dashboard.

This system analyzes price data over a defined period to compute statistical moments like mean, variance, skewness, kurtosis, and Jarque-Bera statistics, generates reversion signals based on confidence intervals with adaptive thresholds and higher timeframe confirmation, manages trades with equity-based sizing, trailing stops, partial closes, and time-based exits, while providing an on-chart dashboard for real-time monitoring. We will cover the following topics:

By the end, you’ll have a functional MQL5 strategy for statistical mean reversion trading, ready for customization—let’s dive in!

Understanding the Statistical Mean Reversion Strategy

The statistical mean reversion strategy leverages the tendency of prices to revert to their historical mean after significant deviations, enhanced by statistical analysis to identify non-normal distributions where such reversions are more probable due to asymmetry and tail risks.

For a buy setup, the price drops below the lower confidence interval with negative skewness signaling potential upside momentum from oversold conditions; for a sell setup, the price exceeds the upper interval with positive skewness indicating overbought conditions likely to correct downward, both filtered by Jarque-Bera statistics for non-normality confirmation and kurtosis thresholds to avoid excessively leptokurtic markets.

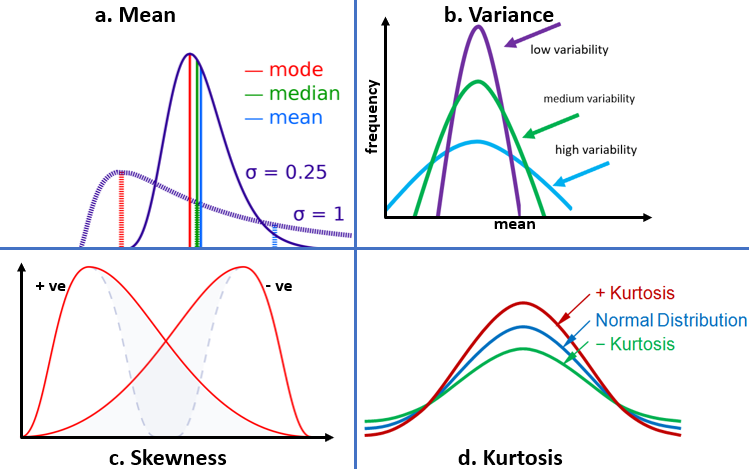

When using this strategy, we further refine entries by aligning them with higher timeframes for trend context. We implement dynamic risk controls, such as equity percentage sizing, base stop-loss and take-profit distances, trailing stops for profit locking, partial position closures at predefined profit levels, and time-based exits, to mitigate prolonged exposure. By integrating these statistical and risk elements, we aim to capture reliable reversion opportunities in volatile markets. Have a look below at the statistical distributions expressed diagrammatically that we will be using.

The Jarque-Bera moment includes a combination of the skewness and kurtosis moments. We will represent it during implementation, do not worry. Our plan is to compute these statistical moments including mean, variance, skewness, kurtosis, and Jarque-Bera over a set period, generate buy or sell signals when price breaches confidence intervals with adaptive skewness thresholds and non-normality filters, confirm with optional higher timeframe data, execute trades using risk-based or fixed lots with base SL/TP, apply trailing stops, partial closes, and duration limits for management, and display real-time metrics via an on-chart dashboard, creating a comprehensive system for statistical reversion trading. In a nutshell, this is what we will be achieving at the end of the article.

Implementation in MQL5

To create the program in MQL5, open the MetaEditor, go to the Navigator, locate the Experts folder, click on the "New" tab, and follow the prompts to create the file. Once it is made, in the coding environment, we will need to declare some input parameters and global variables that we will use throughout the program.

//+------------------------------------------------------------------+ //| StatisticalReversionStrategy.mq5 | //| Copyright 2025, Allan Munene Mutiiria. | //| https://t.me/Forex_Algo_Trader | //+------------------------------------------------------------------+ #property copyright "Copyright 2025, Allan Munene Mutiiria." #property link "https://t.me/Forex_Algo_Trader" #property version "1.00" #property strict #include <Trade\Trade.mqh> #include <Math\Stat\Math.mqh> #include <ChartObjects\ChartObjectsTxtControls.mqh> //+------------------------------------------------------------------+ //| Input Parameters | //+------------------------------------------------------------------+ input group "=== Statistical Parameters ===" input int InpPeriod = 50; // Period for statistical calculations input double InpConfidenceLevel = 0.95; // Confidence level for intervals (0.90-0.99) input double InpJBThreshold = 2.0; // Jarque-Bera threshold (lowered for more trades) input double InpKurtosisThreshold = 5.0; // Max excess kurtosis (relaxed) input ENUM_TIMEFRAMES InpHigherTF = 0; // Higher timeframe for confirmation (0 to disable) input group "=== Trading Parameters ===" input double InpRiskPercent = 1.0; // Risk per trade (% of equity, 0 for fixed lots) input double InpFixedLots = 0.01; // Fixed lot size if InpRiskPercent = 0 input int InpBaseStopLossPips = 50; // Base Stop Loss in pips input int InpBaseTakeProfitPips = 100; // Base Take Profit in pips input int InpMagicNumber = 123456; // Magic number for trades input int InpMaxTradeHours = 48; // Max trade duration in hours (0 to disable) input group "=== Risk Management ===" input bool InpUseTrailingStop = true; // Enable trailing stop input int InpTrailingStopPips = 30; // Trailing stop distance in pips input int InpTrailingStepPips = 10; // Trailing step in pips input bool InpUsePartialClose = true; // Enable partial profit-taking input double InpPartialClosePercent = 0.5; // Percent of position to close at 50% TP input group "=== Dashboard Parameters ===" input bool InpShowDashboard = true; // Show dashboard input int InpDashboardX = 30; // Dashboard X position input int InpDashboardY = 30; // Dashboard Y position input int InpFontSize = 10; // Font size for dashboard text //+------------------------------------------------------------------+ //| Global Variables | //+------------------------------------------------------------------+ CTrade trade; //--- Trade object datetime g_lastBarTime = 0; //--- Last processed bar time double g_pointMultiplier = 1.0; //--- Point multiplier for broker digits CChartObjectRectLabel* g_dashboardBg = NULL; //--- Dashboard background object CChartObjectRectLabel* g_headerBg = NULL; //--- Header background object CChartObjectLabel* g_titleLabel = NULL; //--- Title label object CChartObjectLabel* g_staticLabels[]; //--- Static labels array CChartObjectLabel* g_valueLabels[]; //--- Value labels array string g_staticNames[] = { "Symbol:", "Timeframe:", "Price:", "Skewness:", "Jarque-Bera:", "Kurtosis:", "Mean:", "Lower CI:", "Upper CI:", "Position:", "Lot Size:", "Profit:", "Duration:", "Signal:", "Equity:", "Balance:", "Free Margin:" }; //--- Static label names int g_staticCount = ArraySize(g_staticNames); //--- Number of static labels

We begin by including essential libraries: "#include <Trade\Trade.mqh>" for trade operations, "#include <Math\Stat\Math.mqh>" for statistical calculations like moments and distributions, and "#include <ChartObjects\ChartObjectsTxtControls.mqh>" to handle chart objects for the dashboard display. Next, we define grouped input parameters for user configuration. In the "Statistical Parameters" group, "InpPeriod" defaults to 50 as the lookback for stats, "InpConfidenceLevel" at 0.95 sets the interval confidence (range 0.90-0.99), "InpJBThreshold" at 2.0 filters non-normality via Jarque-Bera (lowered for more signals), "InpKurtosisThreshold" at 5.0 caps excess kurtosis (relaxed threshold), and "InpHigherTF" as 0 disables or selects a higher timeframe for confirmation.

Under "Trading Parameters", "InpRiskPercent" at 1.0 enables equity-based risk (0 for fixed lots), "InpFixedLots" at 0.01 sets static sizing if risk is off, "InpBaseStopLossPips" at 50 and "InpBaseTakeProfitPips" at 100 define base risk/reward distances, "InpMagicNumber" as 123456 identifies trades, and "InpMaxTradeHours" at 48 limits duration (0 to disable). For "Risk Management", "InpUseTrailingStop" as true activates dynamic stops, with "InpTrailingStopPips" at 30 for distance and "InpTrailingStepPips" at 10 for adjustment increments; "InpUsePartialClose" as true enables partial exits, closing "InpPartialClosePercent" at 0.5 of the position at 50% profit.

In "Dashboard Parameters", "InpShowDashboard" as true toggles the visual panel, with "InpDashboardX" and "InpDashboardY" at 30 for positioning, and "InpFontSize" at 10 for text scaling.

We then declare global variables: "trade" as a CTrade instance for order handling, "g_lastBarTime" initialized to 0 to track processed bars, "g_pointMultiplier" at 1.0 to adjust for broker digit differences, and chart objects like "g_dashboardBg", "g_headerBg", "g_titleLabel" as NULL for dashboard elements, along with arrays "g_staticLabels[]" and "g_valueLabels[]" for labels. We define "g_staticNames[]" as a string array holding fixed dashboard texts like "Symbol:", "Mean:", etc., and set "g_staticCount" to its size via the ArraySize function for iteration. With that done, we can start with the easiest operation, which is creating the dashboard that we need. Let us have that logic in a function.

//+------------------------------------------------------------------+ //| Create Dashboard | //+------------------------------------------------------------------+ bool CreateDashboard() { if (!InpShowDashboard) return true; //--- Return if dashboard disabled Print("Creating dashboard..."); //--- Log dashboard creation // Create main background rectangle if (g_dashboardBg == NULL) { //--- Check if background exists g_dashboardBg = new CChartObjectRectLabel(); //--- Create background object if (!g_dashboardBg.Create(0, "StatReversion_DashboardBg", 0, InpDashboardX, InpDashboardY + 30, 300, g_staticCount * (InpFontSize + 6) + 30)) { //--- Create dashboard background Print("Error creating dashboard background: ", GetLastError()); //--- Log error return false; //--- Return failure } g_dashboardBg.Color(clrDodgerBlue); //--- Set border color g_dashboardBg.BackColor(clrNavy); //--- Set background color g_dashboardBg.BorderType(BORDER_FLAT); //--- Set border type g_dashboardBg.Corner(CORNER_LEFT_UPPER); //--- Set corner alignment } // Create header background if (g_headerBg == NULL) { //--- Check if header background exists g_headerBg = new CChartObjectRectLabel(); //--- Create header background object if (!g_headerBg.Create(0, "StatReversion_HeaderBg", 0, InpDashboardX, InpDashboardY, 300, InpFontSize + 20)) { //--- Create header background Print("Error creating header background: ", GetLastError()); //--- Log error return false; //--- Return failure } g_headerBg.Color(clrDodgerBlue); //--- Set border color g_headerBg.BackColor(clrDarkBlue); //--- Set background color g_headerBg.BorderType(BORDER_FLAT); //--- Set border type g_headerBg.Corner(CORNER_LEFT_UPPER); //--- Set corner alignment } // Create title label (centered) if (g_titleLabel == NULL) { //--- Check if title label exists g_titleLabel = new CChartObjectLabel(); //--- Create title label object if (!g_titleLabel.Create(0, "StatReversion_Title", 0, InpDashboardX + 75, InpDashboardY + 5)) { //--- Create title label Print("Error creating title label: ", GetLastError()); //--- Log error return false; //--- Return failure } if (!g_titleLabel.Font("Arial Bold") || !g_titleLabel.FontSize(InpFontSize + 2) || !g_titleLabel.Description("Statistical Reversion")) { //--- Set title properties Print("Error setting title properties: ", GetLastError()); //--- Log error return false; //--- Return failure } g_titleLabel.Color(clrWhite); //--- Set title color } // Initialize static labels (left-aligned) ArrayFree(g_staticLabels); //--- Free static labels array ArrayResize(g_staticLabels, g_staticCount); //--- Resize static labels array int y_offset = InpDashboardY + 30 + 10; //--- Set y offset for labels for (int i = 0; i < g_staticCount; i++) { //--- Iterate through static labels g_staticLabels[i] = new CChartObjectLabel(); //--- Create static label object string label_name = "StatReversion_Static_" + IntegerToString(i); //--- Generate label name if (!g_staticLabels[i].Create(0, label_name, 0, InpDashboardX + 10, y_offset)) { //--- Create static label Print("Error creating static label: ", label_name, ", Error: ", GetLastError()); //--- Log error DeleteDashboard(); //--- Delete dashboard return false; //--- Return failure } if (!g_staticLabels[i].Font("Arial") || !g_staticLabels[i].FontSize(InpFontSize) || !g_staticLabels[i].Description(g_staticNames[i])) { //--- Set static label properties Print("Error setting static label properties: ", label_name, ", Error: ", GetLastError()); //--- Log error DeleteDashboard(); //--- Delete dashboard return false; //--- Return failure } g_staticLabels[i].Color(clrLightGray); //--- Set static label color y_offset += InpFontSize + 6; //--- Update y offset } // Initialize value labels (right-aligned, starting at center) ArrayFree(g_valueLabels); //--- Free value labels array ArrayResize(g_valueLabels, g_staticCount); //--- Resize value labels array y_offset = InpDashboardY + 30 + 10; //--- Reset y offset for values for (int i = 0; i < g_staticCount; i++) { //--- Iterate through value labels g_valueLabels[i] = new CChartObjectLabel(); //--- Create value label object string label_name = "StatReversion_Value_" + IntegerToString(i); //--- Generate label name if (!g_valueLabels[i].Create(0, label_name, 0, InpDashboardX + 150, y_offset)) { //--- Create value label Print("Error creating value label: ", label_name, ", Error: ", GetLastError()); //--- Log error DeleteDashboard(); //--- Delete dashboard return false; //--- Return failure } if (!g_valueLabels[i].Font("Arial") || !g_valueLabels[i].FontSize(InpFontSize) || !g_valueLabels[i].Description("")) { //--- Set value label properties Print("Error setting value label properties: ", label_name, ", Error: ", GetLastError()); //--- Log error DeleteDashboard(); //--- Delete dashboard return false; //--- Return failure } g_valueLabels[i].Color(clrCyan); //--- Set value label color y_offset += InpFontSize + 6; //--- Update y offset } ChartRedraw(); //--- Redraw chart Print("Dashboard created successfully"); //--- Log success return true; //--- Return true on success }

We define the "CreateDashboard" function to set up an on-chart visual panel for displaying strategy metrics if "InpShowDashboard" is true, otherwise returning true immediately. We log the creation start with Print, then check if "g_dashboardBg" is NULL and create a new "CChartObjectRectLabel" instance, using its "Create" method with parameters like subwindow 0, name "StatReversion_DashboardBg", position based on "InpDashboardX" and "InpDashboardY + 30", width 300, and dynamic height calculated from "g_staticCount" times ("InpFontSize + 6") plus 30; if creation fails, log the error from "GetLastError" and return false. We set properties such as "Color" to clrDodgerBlue for the border, "BackColor" to "clrNavy" for the fill, "BorderType" to BORDER_FLAT, and "Corner" to CORNER_LEFT_UPPER.

Similarly, for the header, if "g_headerBg" is NULL, we create another "CChartObjectRectLabel" at "InpDashboardX" and "InpDashboardY" with height "InpFontSize + 20", applying matching color and border settings, logging, and returning false on failure. For the title, if it is NULL, we instantiate a "CChartObjectLabel" and create it centered at "InpDashboardX + 75" and "InpDashboardY + 5" with name "StatReversion_Title"; we then configure "Font" to "Arial Bold", "FontSize" to "InpFontSize + 2", "Description" to "Statistical Reversion", and "Color" to "clrWhite", handling errors by logging and returning false.

We free and resize "g_staticLabels" to "g_staticCount", setting an initial "y_offset" as "InpDashboardY + 30 + 10", then loop to create each static label as a new "CChartObjectLabel" with name "StatReversion_Static_" plus index, positioned at "InpDashboardX + 10" and current "y_offset"; set "Font" to "Arial", "FontSize" to "InpFontSize", "Description" from "g_staticNames[i]", and "Color" to "clrLightGray", calling "DeleteDashboard" and returning false on any creation or property error, incrementing "y_offset" by "InpFontSize + 6" each time.

Likewise, we free and resize "g_valueLabels", reset "y_offset", and loop to create value labels named "StatReversion_Value_" plus index at "InpDashboardX + 150" and "y_offset", with empty initial "Description", "clrCyan" color, and same font settings, handling errors similarly. Finally, we invoke ChartRedraw to refresh the display, log success, and return true. Using the same format now, we can create a function to update and delete the dashboard as below.

//+------------------------------------------------------------------+ //| Update Dashboard | //+------------------------------------------------------------------+ void UpdateDashboard(double mean, double lower_ci, double upper_ci, double skewness, double jb_stat, double kurtosis, double skew_buy, double skew_sell, string position, double lot_size, double profit, string duration, string signal) { if (!InpShowDashboard || ArraySize(g_valueLabels) != g_staticCount) { //--- Check if dashboard enabled and labels valid Print("Dashboard update skipped: Not initialized or invalid array size"); //--- Log skip return; //--- Exit function } double balance = AccountInfoDouble(ACCOUNT_BALANCE); //--- Get account balance double equity = AccountInfoDouble(ACCOUNT_EQUITY); //--- Get account equity double free_margin = AccountInfoDouble(ACCOUNT_MARGIN_FREE); //--- Get free margin double price = iClose(_Symbol, _Period, 0); //--- Get current close price string values[] = { _Symbol, EnumToString(_Period), DoubleToString(price, _Digits), DoubleToString(skewness, 4), DoubleToString(jb_stat, 2), DoubleToString(kurtosis, 2), DoubleToString(mean, _Digits), DoubleToString(lower_ci, _Digits), DoubleToString(upper_ci, _Digits), position, DoubleToString(lot_size, 2), DoubleToString(profit, 2), duration, signal, DoubleToString(equity, 2), DoubleToString(balance, 2), DoubleToString(free_margin, 2) }; //--- Set value strings color value_colors[] = { clrWhite, clrWhite, (price > 0 ? clrCyan : clrGray), (skewness != 0 ? clrCyan : clrGray), (jb_stat != 0 ? clrCyan : clrGray), (kurtosis != 0 ? clrCyan : clrGray), (mean != 0 ? clrCyan : clrGray), (lower_ci != 0 ? clrCyan : clrGray), (upper_ci != 0 ? clrCyan : clrGray), clrWhite, clrWhite, (profit > 0 ? clrLimeGreen : profit < 0 ? clrRed : clrGray), clrWhite, (signal == "Buy" ? clrLimeGreen : signal == "Sell" ? clrRed : clrGray), (equity > balance ? clrLimeGreen : equity < balance ? clrRed : clrGray), clrWhite, clrWhite }; //--- Set value colors for (int i = 0; i < g_staticCount; i++) { //--- Iterate through values if (g_valueLabels[i] != NULL) { //--- Check if label exists g_valueLabels[i].Description(values[i]); //--- Set value description g_valueLabels[i].Color(value_colors[i]); //--- Set value color } else { //--- Handle null label Print("Warning: Value label ", i, " is NULL"); //--- Log warning } } ChartRedraw(); //--- Redraw chart Print("Dashboard updated: Signal=", signal, ", Position=", position, ", Profit=", profit); //--- Log update } //+------------------------------------------------------------------+ //| Delete Dashboard | //+------------------------------------------------------------------+ void DeleteDashboard() { if (g_dashboardBg != NULL) { //--- Check if background exists g_dashboardBg.Delete(); //--- Delete background delete g_dashboardBg; //--- Free background memory g_dashboardBg = NULL; //--- Set background to null Print("Dashboard background deleted"); //--- Log deletion } if (g_headerBg != NULL) { //--- Check if header background exists g_headerBg.Delete(); //--- Delete header background delete g_headerBg; //--- Free header background memory g_headerBg = NULL; //--- Set header background to null Print("Header background deleted"); //--- Log deletion } if (g_titleLabel != NULL) { //--- Check if title label exists g_titleLabel.Delete(); //--- Delete title label delete g_titleLabel; //--- Free title label memory g_titleLabel = NULL; //--- Set title label to null Print("Title label deleted"); //--- Log deletion } for (int i = 0; i < ArraySize(g_staticLabels); i++) { //--- Iterate through static labels if (g_staticLabels[i] != NULL) { //--- Check if label exists g_staticLabels[i].Delete(); //--- Delete static label delete g_staticLabels[i]; //--- Free static label memory g_staticLabels[i] = NULL; //--- Set static label to null } } for (int i = 0; i < ArraySize(g_valueLabels); i++) { //--- Iterate through value labels if (g_valueLabels[i] != NULL) { //--- Check if label exists g_valueLabels[i].Delete(); //--- Delete value label delete g_valueLabels[i]; //--- Free value label memory g_valueLabels[i] = NULL; //--- Set value label to null } } ArrayFree(g_staticLabels); //--- Free static labels array ArrayFree(g_valueLabels); //--- Free value labels array ChartRedraw(); //--- Redraw chart Print("Dashboard labels cleared"); //--- Log clearance }

We define the "UpdateDashboard" function to refresh the on-chart panel with current strategy data, accepting parameters like "mean", "lower_ci", "upper_ci", "skewness", "jb_stat", "kurtosis", "skew_buy", "skew_sell", "position", "lot_size", "profit", "duration", and "signal" for display values. We first check if we are allowed to show it or label size mismatches the count, logging a skip and returning early if so. We retrieve account details: "balance" via AccountInfoDouble with ACCOUNT_BALANCE, same for equity and free margin, and current "price" from the iClose function on the symbol, timeframe, and shift 0, for the current.

We populate a "values" string array with formatted data like symbol, timeframe enum via the EnumToString function, price with _Digits precision using DoubleToString, statistical metrics rounded appropriately, position info, and account figures. We set a "value_colors" array for conditional coloring, such as cyan for non-zero stats, lime green for positive profit or red for negative, and similar logic for signal and equity vs. balance. Looping through "g_staticCount", if each "g_valueLabels[i]" is not NULL, we update its "Description" to "values[i]" and "Color" to "value_colors[i]", otherwise log a warning for null labels. We call the ChartRedraw function to refresh visuals and log the update with signal, position, and profit.

Next, we create the "DeleteDashboard" function for cleanup, checking if "g_dashboardBg" is not NULL to invoke its "Delete" method, free memory with delete, set to NULL, and log deletion; repeat this for "g_headerBg" and "g_titleLabel". For arrays, we loop over "g_staticLabels" size from ArraySize, deleting, freeing, and nulling each non-NULL element; do the same for "g_valueLabels". We then free both arrays with the ArrayFree function, redraw the chart, and log that the labels are cleared. We can now call these functions in the initialization event handlers.

//+------------------------------------------------------------------+ //| Expert Initialization Function | //+------------------------------------------------------------------+ int OnInit() { trade.SetExpertMagicNumber(InpMagicNumber); //--- Set magic number trade.SetDeviationInPoints(10); //--- Set deviation in points trade.SetTypeFilling(ORDER_FILLING_FOK); //--- Set filling type // Adjust point multiplier for broker digits if (_Digits == 5 || _Digits == 3) //--- Check broker digits g_pointMultiplier = 10.0; //--- Set multiplier for 5/3 digits else //--- Default digits g_pointMultiplier = 1.0; //--- Set multiplier for others // Validate inputs (use local variables) double confidenceLevel = InpConfidenceLevel; //--- Copy confidence level if (InpConfidenceLevel < 0.90 || InpConfidenceLevel > 0.99) { //--- Check confidence level range Print("Warning: InpConfidenceLevel out of range (0.90-0.99). Using 0.95."); //--- Log warning confidenceLevel = 0.95; //--- Set default confidence level } double riskPercent = InpRiskPercent; //--- Copy risk percent if (InpRiskPercent < 0 || InpRiskPercent > 10) { //--- Check risk percent range Print("Warning: InpRiskPercent out of range (0-10). Using 1.0."); //--- Log warning riskPercent = 1.0; //--- Set default risk percent } // Initialize dashboard (non-critical) if (InpShowDashboard && !CreateDashboard()) { //--- Check if dashboard creation failed Print("Failed to initialize dashboard, continuing without it"); //--- Log failure } Print("Statistical Reversion Strategy Initialized. Period: ", InpPeriod, ", Confidence: ", confidenceLevel * 100, "% on ", _Symbol, "/", Period()); //--- Log initialization return(INIT_SUCCEEDED); //--- Return success } //+------------------------------------------------------------------+ //| Expert Deinitialization Function | //+------------------------------------------------------------------+ void OnDeinit(const int reason) { DeleteDashboard(); //--- Delete dashboard Print("Statistical Reversion Strategy Deinitialized. Reason: ", reason); //--- Log deinitialization }

In the OnInit event handler, we configure the trade object by setting its magic number with "trade.SetExpertMagicNumber" passing "InpMagicNumber", deviation to 10 points via "SetDeviationInPoints", and filling type to ORDER_FILLING_FOK using "SetTypeFilling" for precise order execution. We adjust the "g_pointMultiplier" based on broker digits: if "_Digits" is 5 or 3, set it to 10.0 for proper pip scaling; otherwise, keep it at 1.0. To validate inputs, we copy "InpConfidenceLevel" to a local "confidenceLevel" and check if it's outside 0.90 to 0.99, logging a warning and defaulting to 0.95 if so; similarly, for "InpRiskPercent", validate against 0 to 10, warning and resetting to 1.0 if invalid. You could actually set your own. These are just arbitrary ranges that we choose.

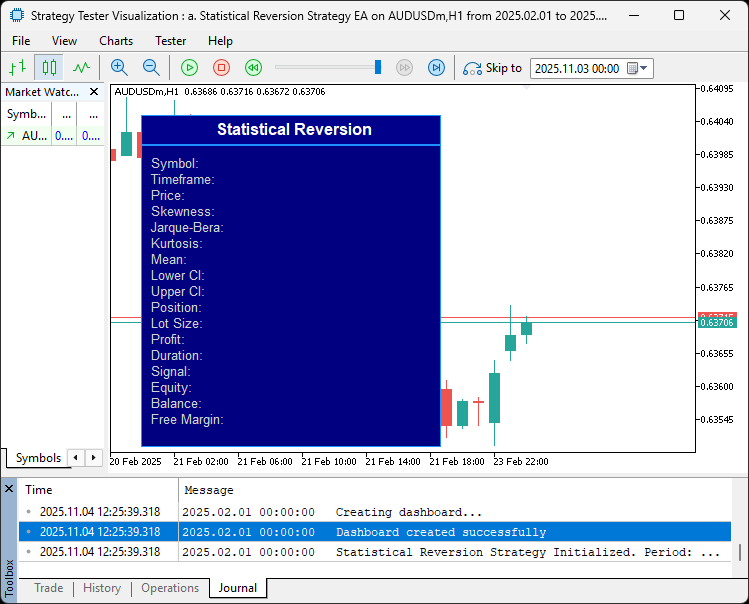

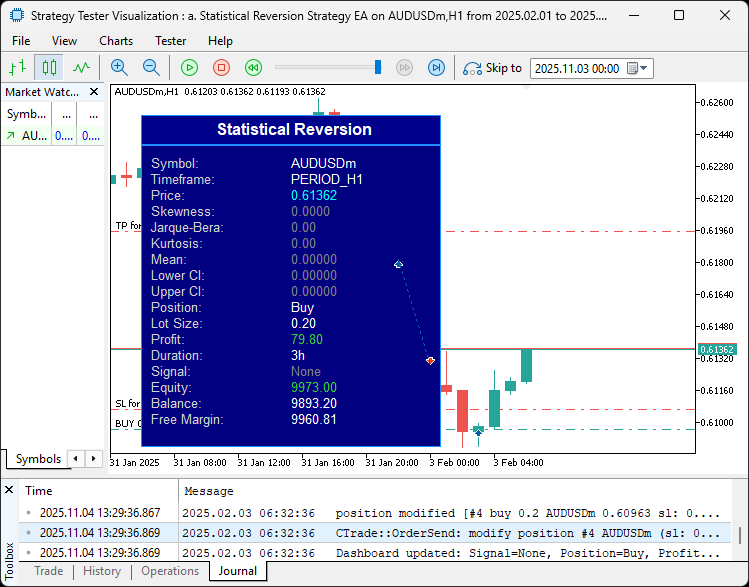

If the dashboard is enabled and "CreateDashboard" fails, we log the issue and proceed without it. Finally, we print an initialization message with period, confidence percentage, symbol, and timeframe from "Period", returning INIT_SUCCEEDED. For the OnDeinit event handler, which takes a constant integer "reason", we call "DeleteDashboard" to clean up visuals and log deinitialization with the provided reason. On compilation, we get the following outcome.

From the image, we can see that we are all good to go. Let us define some helper functions that we will need in the dashboard and statistical updates.

//+------------------------------------------------------------------+ //| Normal Inverse CDF Approximation | //+------------------------------------------------------------------+ double NormalInverse(double p) { double t = MathSqrt(-2.0 * MathLog(p < 0.5 ? p : 1.0 - p)); //--- Calculate t value double sign = (p < 0.5) ? -1.0 : 1.0; //--- Determine sign return sign * (t - (2.515517 + 0.802853 * t + 0.010328 * t * t) / (1.0 + 1.432788 * t + 0.189269 * t * t + 0.001308 * t * t * t)); //--- Return approximated inverse CDF } //+------------------------------------------------------------------+ //| Get Position Status | //+------------------------------------------------------------------+ string GetPositionStatus() { if (HasPosition(POSITION_TYPE_BUY)) return "Buy"; //--- Return "Buy" if buy position open if (HasPosition(POSITION_TYPE_SELL)) return "Sell"; //--- Return "Sell" if sell position open return "None"; //--- Return "None" if no position } //+------------------------------------------------------------------+ //| Get Current Lot Size | //+------------------------------------------------------------------+ double GetCurrentLotSize() { for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Iterate through positions if (PositionGetSymbol(i) == _Symbol && PositionGetInteger(POSITION_MAGIC) == InpMagicNumber) //--- Check symbol and magic return PositionGetDouble(POSITION_VOLUME); //--- Return position volume } return 0.0; //--- Return 0 if no position } //+------------------------------------------------------------------+ //| Get Current Profit | //+------------------------------------------------------------------+ double GetCurrentProfit() { for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Iterate through positions if (PositionGetSymbol(i) == _Symbol && PositionGetInteger(POSITION_MAGIC) == InpMagicNumber) //--- Check symbol and magic return PositionGetDouble(POSITION_PROFIT); //--- Return position profit } return 0.0; //--- Return 0 if no position } //+------------------------------------------------------------------+ //| Get Position Duration | //+------------------------------------------------------------------+ string GetPositionDuration() { for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Iterate through positions if (PositionGetSymbol(i) == _Symbol && PositionGetInteger(POSITION_MAGIC) == InpMagicNumber) { //--- Check symbol and magic datetime open_time = (datetime)PositionGetInteger(POSITION_TIME); //--- Get open time datetime current_time = TimeCurrent(); //--- Get current time int hours = (int)((current_time - open_time) / 3600); //--- Calculate hours return IntegerToString(hours) + "h"; //--- Return duration string } } return "0h"; //--- Return "0h" if no position } //+------------------------------------------------------------------+ //| Get Signal Status | //+------------------------------------------------------------------+ string GetSignalStatus(bool buy_signal, bool sell_signal) { if (buy_signal) return "Buy"; //--- Return "Buy" if buy signal if (sell_signal) return "Sell"; //--- Return "Sell" if sell signal return "None"; //--- Return "None" if no signal } //+------------------------------------------------------------------+ //| Check for Open Position of Type | //+------------------------------------------------------------------+ bool HasPosition(ENUM_POSITION_TYPE pos_type) { for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Iterate through positions if (PositionGetSymbol(i) == _Symbol && PositionGetInteger(POSITION_MAGIC) == InpMagicNumber && PositionGetInteger(POSITION_TYPE) == pos_type) //--- Check details return true; //--- Return true if match } return false; //--- Return false if no match } //+------------------------------------------------------------------+ //| Check for Any Open Position | //+------------------------------------------------------------------+ bool HasPosition() { return (HasPosition(POSITION_TYPE_BUY) || HasPosition(POSITION_TYPE_SELL)); //--- Check for buy or sell position }

First, we implement the "NormalInverse" function to approximate the inverse cumulative distribution function (CDF) for a standard normal distribution, taking a probability "p" and computing a "t" value via MathSqrt on the negative log of the adjusted "p" (mirrored if above 0.5), determining a "sign" based on whether "p" is below 0.5, then returning the signed rational approximation using polynomial terms for accuracy in confidence interval calculations.

Next, we define helper functions for position and signal queries. The "GetPositionStatus" function checks for open buys or sells using "HasPosition" with POSITION_TYPE_BUY or "POSITION_TYPE_SELL", returning the type or "None" if absent. "GetCurrentLotSize" iterates backward through positions from PositionsTotal minus 1, verifying symbol with PositionGetSymbol and magic via "PositionGetInteger" against "InpMagicNumber", returning the volume from "PositionGetDouble" with "POSITION_VOLUME" if matched, or 0 otherwise. Similarly, "GetCurrentProfit" retrieves profit using "POSITION_PROFIT".

For "GetPositionDuration", we loop to find a matching position, get its open time as a datetime from PositionGetInteger with "POSITION_TIME", subtract from TimeCurrent to compute hours, and format as a string like "Xh", defaulting to "0h" if none. "GetSignalStatus" simply returns "Buy" or "Sell" if the respective boolean is true, else "None". We create "HasPosition" to detect open positions of a specific ENUM_POSITION_TYPE, looping through positions and checking symbol, magic, and type with "PositionGetInteger" for "POSITION_TYPE", returning true on match. An overload without type checks for any by calling the typed version for buy or sell. We can now use these functions, do the statistical computations, and generate signals. Here is the logic we use to achieve that.

//+------------------------------------------------------------------+ //| Expert Tick Function | //+------------------------------------------------------------------+ void OnTick() { // Check for new bar to avoid over-calculation if (iTime(_Symbol, _Period, 0) == g_lastBarTime) { //--- Check if new bar UpdateDashboard(0, 0, 0, 0, 0, 0, 0, 0, GetPositionStatus(), GetCurrentLotSize(), GetCurrentProfit(), GetPositionDuration(), GetSignalStatus(false, false)); //--- Update dashboard with no signal return; //--- Exit function } g_lastBarTime = iTime(_Symbol, _Period, 0); //--- Update last bar time // Check market availability if (!SymbolInfoDouble(_Symbol, SYMBOL_BID) || !SymbolInfoDouble(_Symbol, SYMBOL_ASK)) { //--- Check market data Print("Error: Market data unavailable for ", _Symbol); //--- Log error UpdateDashboard(0, 0, 0, 0, 0, 0, 0, 0, GetPositionStatus(), GetCurrentLotSize(), GetCurrentProfit(), GetPositionDuration(), "None"); //--- Update dashboard with no signal return; //--- Exit function } // Copy historical close prices double prices[]; //--- Declare prices array ArraySetAsSeries(prices, true); //--- Set as series int copied = CopyClose(_Symbol, _Period, 1, InpPeriod, prices); //--- Copy close prices if (copied != InpPeriod) { //--- Check copy success Print("Error copying prices: ", copied, ", Error: ", GetLastError()); //--- Log error UpdateDashboard(0, 0, 0, 0, 0, 0, 0, 0, GetPositionStatus(), GetCurrentLotSize(), GetCurrentProfit(), GetPositionDuration(), "None"); //--- Update dashboard with no signal return; //--- Exit function } // Calculate statistical moments double mean, variance, skewness, kurtosis; //--- Declare statistical variables if (!MathMoments(prices, mean, variance, skewness, kurtosis, 0, InpPeriod)) { //--- Calculate moments Print("Error calculating moments: ", GetLastError()); //--- Log error UpdateDashboard(0, 0, 0, 0, 0, 0, 0, 0, GetPositionStatus(), GetCurrentLotSize(), GetCurrentProfit(), GetPositionDuration(), "None"); //--- Update dashboard with no signal return; //--- Exit function } // Jarque-Bera test double n = (double)InpPeriod; //--- Set sample size double jb_stat = n * (skewness * skewness / 6.0 + (kurtosis * kurtosis) / 24.0); //--- Calculate JB statistic // Log statistical values Print("Stats: Skewness=", DoubleToString(skewness, 4), ", JB=", DoubleToString(jb_stat, 2), ", Kurtosis=", DoubleToString(kurtosis, 2)); //--- Log stats // Adaptive skewness thresholds double skew_buy_threshold = -0.3 - 0.05 * kurtosis; //--- Calculate buy skew threshold double skew_sell_threshold = 0.3 + 0.05 * kurtosis; //--- Calculate sell skew threshold // Kurtosis filter if (kurtosis > InpKurtosisThreshold) { //--- Check kurtosis threshold Print("Trade skipped: High kurtosis (", kurtosis, ") > ", InpKurtosisThreshold); //--- Log skip UpdateDashboard(mean, 0, 0, skewness, jb_stat, kurtosis, skew_buy_threshold, skew_sell_threshold, GetPositionStatus(), GetCurrentLotSize(), GetCurrentProfit(), GetPositionDuration(), "None"); //--- Update dashboard with no signal return; //--- Exit function } double std_dev = MathSqrt(variance); //--- Calculate standard deviation // Adaptive confidence interval double confidenceLevel = InpConfidenceLevel; //--- Copy confidence level if (confidenceLevel < 0.90 || confidenceLevel > 0.99) //--- Validate confidence level confidenceLevel = 0.95; //--- Set default confidence level double z_score = NormalInverse(0.5 + confidenceLevel / 2.0); //--- Calculate z-score double ci_mult = z_score / MathSqrt(n); //--- Calculate CI multiplier double upper_ci = mean + ci_mult * std_dev; //--- Calculate upper CI double lower_ci = mean - ci_mult * std_dev; //--- Calculate lower CI // Current close price double current_price = iClose(_Symbol, _Period, 0); //--- Get current close price // Higher timeframe confirmation (if enabled) bool htf_valid = true; //--- Initialize HTF validity if (InpHigherTF != 0) { //--- Check if HTF enabled double htf_prices[]; //--- Declare HTF prices array ArraySetAsSeries(htf_prices, true); //--- Set as series int htf_copied = CopyClose(_Symbol, InpHigherTF, 1, InpPeriod, htf_prices); //--- Copy HTF close prices if (htf_copied != InpPeriod) { //--- Check HTF copy success Print("Error copying HTF prices: ", htf_copied, ", Error: ", GetLastError()); //--- Log error UpdateDashboard(mean, lower_ci, upper_ci, skewness, jb_stat, kurtosis, skew_buy_threshold, skew_sell_threshold, GetPositionStatus(), GetCurrentLotSize(), GetCurrentProfit(), GetPositionDuration(), "None"); //--- Update dashboard with no signal return; //--- Exit function } double htf_mean, htf_variance, htf_skewness, htf_kurtosis; //--- Declare HTF stats if (!MathMoments(htf_prices, htf_mean, htf_variance, htf_skewness, htf_kurtosis, 0, InpPeriod)) { //--- Calculate HTF moments Print("Error calculating HTF moments: ", GetLastError()); //--- Log error UpdateDashboard(mean, lower_ci, upper_ci, skewness, jb_stat, kurtosis, skew_buy_threshold, skew_sell_threshold, GetPositionStatus(), GetCurrentLotSize(), GetCurrentProfit(), GetPositionDuration(), "None"); //--- Update dashboard with no signal return; //--- Exit function } htf_valid = (current_price <= htf_mean && skewness <= 0) || (current_price >= htf_mean && skewness >= 0); //--- Check HTF validity Print("HTF Check: Price=", DoubleToString(current_price, _Digits), ", HTF Mean=", DoubleToString(htf_mean, _Digits), ", Valid=", htf_valid); //--- Log HTF check } // Generate signals bool buy_signal = htf_valid && (current_price < lower_ci) && (skewness < skew_buy_threshold) && (jb_stat > InpJBThreshold); //--- Check buy signal conditions bool sell_signal = htf_valid && (current_price > upper_ci) && (skewness > skew_sell_threshold) && (jb_stat > InpJBThreshold); //--- Check sell signal conditions // Fallback signal if (!buy_signal && !sell_signal) { //--- Check no primary signal buy_signal = htf_valid && (current_price < mean - 0.3 * std_dev); //--- Check fallback buy sell_signal = htf_valid && (current_price > mean + 0.3 * std_dev); //--- Check fallback sell Print("Fallback Signal: Buy=", buy_signal, ", Sell=", sell_signal); //--- Log fallback signals } // Log signal status Print("Signal Check: Buy=", buy_signal, ", Sell=", sell_signal, ", Price=", DoubleToString(current_price, _Digits), ", LowerCI=", DoubleToString(lower_ci, _Digits), ", UpperCI=", DoubleToString(upper_ci, _Digits), ", Skew=", DoubleToString(skewness, 4), ", BuyThresh=", DoubleToString(skew_buy_threshold, 4), ", SellThresh=", DoubleToString(skew_sell_threshold, 4), ", JB=", DoubleToString(jb_stat, 2)); //--- Log signal details }

In the OnTick event handler, we first verify if a new bar has formed by comparing the current bar time from iTime with _Symbol, _Period, and shift 0 against "g_lastBarTime"; if not, we refresh the dashboard with placeholder zeros for stats, current position details from helpers like "GetPositionStatus", and "None" signal via "GetSignalStatus" passing false flags, then exit early. We update "g_lastBarTime" to the current time and ensure market data availability by checking SymbolInfoDouble for both SYMBOL_BID and "SYMBOL_ASK"; if missing, log an error, update the dashboard similarly, and return. We declare a "prices" array, set it as a series with ArraySetAsSeries, and populate it using CopyClose from shift 1 for "InpPeriod" bars; if the copied count doesn't match, log the issue with GetLastError, update the dashboard, and exit.

To compute stats, we declare variables for "mean", "variance", "skewness", and "kurtosis", invoking MathMoments on the prices array from index 0 to "InpPeriod"; on failure, log error, update dashboard, and return. We calculate the Jarque-Bera statistic as sample size "n" times (skewness squared over 6 plus kurtosis squared over 24), then log the values rounded for readability. Adaptive thresholds are set: "skew_buy_threshold" as -0.3 minus 0.05 times kurtosis for buys, and "skew_sell_threshold" as 0.3 plus 0.05 times kurtosis for sells. If kurtosis exceeds "InpKurtosisThreshold", we log a skip message, update the dashboard with current stats and "None", and exit to avoid high-tail-risk scenarios.

We derive "std_dev" from MathSqrt of variance, validate "confidenceLevel" within bounds (defaulting to 0.95 if not), compute "z_score" using "NormalInverse" on half plus half confidence, then "ci_mult" as z over square root of n, yielding "upper_ci" and "lower_ci" as mean plus/minus ci_mult times std_dev. Current price is fetched via iClose at shift 0. For higher timeframe confirmation if "InpHigherTF" is set, we copy HTF prices similarly, calculate its moments, and set "htf_valid" true if price aligns with mean relative to skewness sign (below mean with negative skew or above with positive), logging the check; default to true if disabled.

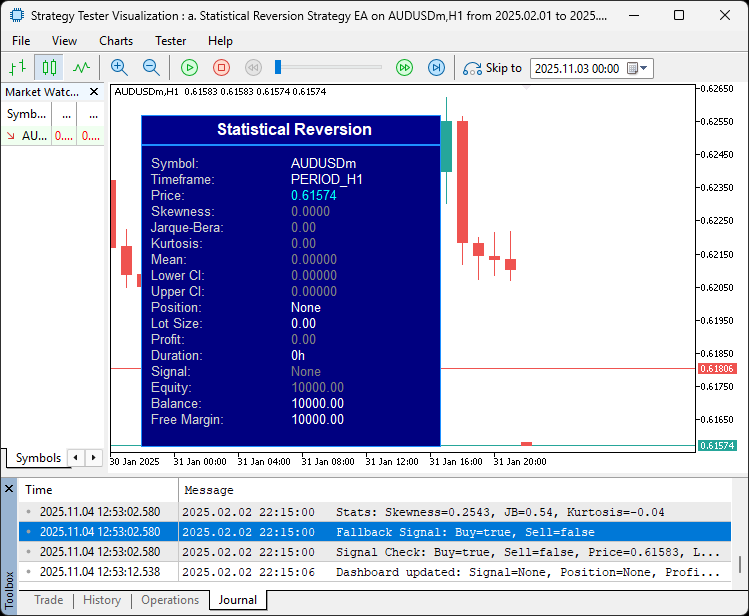

Signals are generated: "buy_signal" if HTF valid, price below lower CI, skewness under buy threshold, and JB above "InpJBThreshold"; "sell_signal" mirrored for upper CI and sell threshold. If no primary signal, fallback to HTF-valid price breaches of mean minus/plus 0.3 std_dev for buy/sell, logging these. We conclude the segment by logging detailed signal conditions, including price, CIs, skewness with thresholds, and JB. Upon compilation, we get the following outcome.

From the image, we can see that we can do the computations and determine the signal threshold. Now that's done. We need to act on the signals. We want to close the existing positions, though, when we have new signals. Here is the logic we use to achieve that in a function.

//+------------------------------------------------------------------+ //| Close All Positions of Type | //+------------------------------------------------------------------+ void CloseAllPositions(ENUM_POSITION_TYPE pos_type) { for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Iterate through positions if (PositionGetSymbol(i) == _Symbol && PositionGetInteger(POSITION_MAGIC) == InpMagicNumber && PositionGetInteger(POSITION_TYPE) == pos_type) { //--- Check details ulong ticket = PositionGetInteger(POSITION_TICKET); //--- Get ticket double profit = PositionGetDouble(POSITION_PROFIT); //--- Get profit trade.PositionClose(ticket); //--- Close position } } }

We define the "CloseAllPositions" function to shut down all open positions of a specified "ENUM_POSITION_TYPE", like buy or sell, ensuring we clear opposite trades before new signals. We loop backward from "PositionsTotal" minus 1 to zero for safe iteration without index issues during closures. For each, if "PositionGetSymbol" matches "_Symbol", "PositionGetInteger" with "POSITION_MAGIC" equals "InpMagicNumber", and type via "POSITION_TYPE" aligns with "pos_type", we retrieve the "ticket" using "PositionGetInteger" on "POSITION_TICKET" and profit from "PositionGetDouble" with "POSITION_PROFIT" (just in case you want to log and see the profit), then execute "trade.PositionClose" on the ticket to close it. We can now close the opposite trades and open new positions using the following logic.

// Position management: Close opposite positions if (HasPosition(POSITION_TYPE_BUY) && sell_signal) //--- Check buy position with sell signal CloseAllPositions(POSITION_TYPE_BUY); //--- Close all buys if (HasPosition(POSITION_TYPE_SELL) && buy_signal) //--- Check sell position with buy signal CloseAllPositions(POSITION_TYPE_SELL); //--- Close all sells // Calculate lot size double lot_size = InpFixedLots; //--- Set default lot size double riskPercent = InpRiskPercent; //--- Copy risk percent if (riskPercent > 0) { //--- Check if risk percent enabled double account_equity = AccountInfoDouble(ACCOUNT_EQUITY); //--- Get account equity double sl_points = InpBaseStopLossPips * g_pointMultiplier; //--- Calculate SL points double tick_value = SymbolInfoDouble(_Symbol, SYMBOL_TRADE_TICK_VALUE); //--- Get tick value if (tick_value == 0) { //--- Check invalid tick value Print("Error: Invalid tick value for ", _Symbol); //--- Log error return; //--- Exit function } lot_size = NormalizeDouble((account_equity * riskPercent / 100.0) / (sl_points * tick_value), 2); //--- Calculate risk-based lot size lot_size = MathMax(SymbolInfoDouble(_Symbol, SYMBOL_VOLUME_MIN), MathMin(lot_size, SymbolInfoDouble(_Symbol, SYMBOL_VOLUME_MAX))); //--- Clamp lot size Print("Lot Size: Equity=", account_equity, ", SL Points=", sl_points, ", Tick Value=", tick_value, ", Lot=", lot_size); //--- Log lot size calculation } // Open new positions if (!HasPosition() && buy_signal) { //--- Check no position and buy signal double sl = current_price - InpBaseStopLossPips * _Point * g_pointMultiplier; //--- Calculate SL double tp = current_price + InpBaseTakeProfitPips * _Point * g_pointMultiplier; //--- Calculate TP if (trade.Buy(lot_size, _Symbol, 0, sl, tp, "StatReversion Buy: Skew=" + DoubleToString(skewness, 4) + ", JB=" + DoubleToString(jb_stat, 2))) { //--- Open buy order Print("Buy order opened. Mean: ", DoubleToString(mean, 5), ", Current: ", DoubleToString(current_price, 5)); //--- Log buy open } else { //--- Handle buy open failure Print("Buy order failed: ", GetLastError()); //--- Log error } } else if (!HasPosition() && sell_signal) { //--- Check no position and sell signal double sl = current_price + InpBaseStopLossPips * _Point * g_pointMultiplier; //--- Calculate SL double tp = current_price - InpBaseTakeProfitPips * _Point * g_pointMultiplier; //--- Calculate TP if (trade.Sell(lot_size, _Symbol, 0, sl, tp, "StatReversion Sell: Skew=" + DoubleToString(skewness, 4) + ", JB=" + DoubleToString(jb_stat, 2))) { //--- Open sell order Print("Sell order opened. Mean: ", DoubleToString(mean, 5), ", Current: ", DoubleToString(current_price, 5)); //--- Log sell open } else { //--- Handle sell open failure Print("Sell order failed: ", GetLastError()); //--- Log error } } // Update dashboard UpdateDashboard(mean, lower_ci, upper_ci, skewness, jb_stat, kurtosis, skew_buy_threshold, skew_sell_threshold, GetPositionStatus(), lot_size, GetCurrentProfit(), GetPositionDuration(), GetSignalStatus(buy_signal, sell_signal)); //--- Update dashboard with signals

We manage positions by checking for opposites: if a buy is open and a sell signal emerges, we call "CloseAllPositions" with POSITION_TYPE_BUY to exit all longs; conversely for sells on a buy signal, ensuring no conflicting trades before new entries. For sizing, we default "lot_size" to "InpFixedLots", but if "InpRiskPercent" is positive, we compute it dynamically from account equity via AccountInfoDouble with ACCOUNT_EQUITY, SL distance adjusted by "g_pointMultiplier", and tick value from SymbolInfoDouble using SYMBOL_TRADE_TICK_VALUE—exiting with a log if invalid. The formula normalizes equity times risk percent over (SL points times tick value) to two decimals, then clamps between symbol's min and max volume with MathMax and MathMin, logging the details.

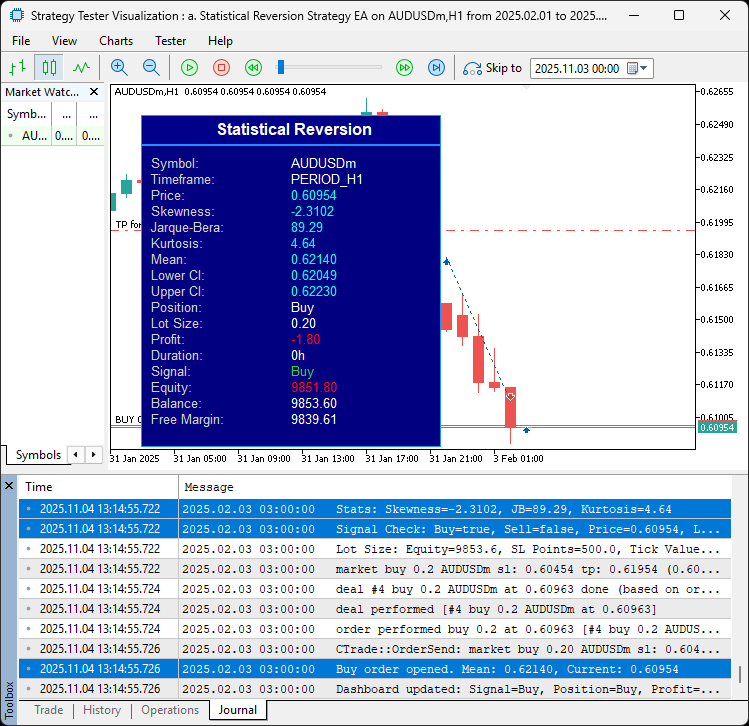

If no position exists and a buy signal is active, we derive SL below current price by base pips times _Point and multiplier, TP above similarly, then attempt "trade.Buy" with calculated lot, symbol, no price (market), SL, TP, and a comment including skewness and JB stats; log success with mean vs. current price or failure with the GetLastError function. Mirror this for sells, adjusting SL above and TP below. Finally, we refresh the dashboard by passing computed stats like mean, CIs, skewness, JB, kurtosis, thresholds, position status, lot, profit, duration, and signal to the "UpdateDashboard" function, which now should be complete with all the information. Upon compilation, we get the following outcome.

Now that we can open the positions, we need to manage them, specifically by trailing, taking partial closes, and closing them based on the time limit to prevent over-exposure. All these are just add-ons that you can skip through or condition whichever you don't want. Let us have them in functions.

//+------------------------------------------------------------------+ //| Manage Trailing Stop | //+------------------------------------------------------------------+ void ManageTrailingStop() { for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Iterate through positions if (PositionGetSymbol(i) != _Symbol || PositionGetInteger(POSITION_MAGIC) != InpMagicNumber) //--- Check symbol and magic continue; //--- Skip if not match ulong ticket = PositionGetInteger(POSITION_TICKET); //--- Get ticket double current_sl = PositionGetDouble(POSITION_SL); //--- Get current SL ENUM_POSITION_TYPE pos_type = (ENUM_POSITION_TYPE)PositionGetInteger(POSITION_TYPE); //--- Get position type double current_price = (pos_type == POSITION_TYPE_BUY) ? SymbolInfoDouble(_Symbol, SYMBOL_BID) : SymbolInfoDouble(_Symbol, SYMBOL_ASK); //--- Get current price double trail_distance = InpTrailingStopPips * _Point * g_pointMultiplier; //--- Calculate trail distance double trail_step = InpTrailingStepPips * _Point * g_pointMultiplier; //--- Calculate trail step if (pos_type == POSITION_TYPE_BUY) { //--- Check buy position double new_sl = current_price - trail_distance; //--- Calculate new SL if (new_sl > current_sl + trail_step || current_sl == 0) { //--- Check if update needed trade.PositionModify(ticket, new_sl, PositionGetDouble(POSITION_TP)); //--- Modify position } } else if (pos_type == POSITION_TYPE_SELL) { //--- Check sell position double new_sl = current_price + trail_distance; //--- Calculate new SL if (new_sl < current_sl - trail_step || current_sl == 0) { //--- Check if update needed trade.PositionModify(ticket, new_sl, PositionGetDouble(POSITION_TP)); //--- Modify position } } } } //+------------------------------------------------------------------+ //| Manage Partial Close | //+------------------------------------------------------------------+ void ManagePartialClose() { for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Iterate through positions if (PositionGetSymbol(i) != _Symbol || PositionGetInteger(POSITION_MAGIC) != InpMagicNumber) //--- Check symbol and magic continue; //--- Skip if not match ulong ticket = PositionGetInteger(POSITION_TICKET); //--- Get ticket double open_price = PositionGetDouble(POSITION_PRICE_OPEN); //--- Get open price double tp = PositionGetDouble(POSITION_TP); //--- Get TP double current_price = (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_BUY) ? SymbolInfoDouble(_Symbol, SYMBOL_BID) : SymbolInfoDouble(_Symbol, SYMBOL_ASK); //--- Get current price double volume = PositionGetDouble(POSITION_VOLUME); //--- Get position volume double half_tp_distance = MathAbs(tp - open_price) * 0.5; //--- Calculate half TP distance bool should_close = (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_BUY && current_price >= open_price + half_tp_distance) || (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_SELL && current_price <= open_price - half_tp_distance); //--- Check if at half TP if (should_close) { //--- Check if partial close needed double close_volume = NormalizeDouble(volume * InpPartialClosePercent, 2); //--- Calculate close volume if (close_volume >= SymbolInfoDouble(_Symbol, SYMBOL_VOLUME_MIN)) { //--- Check minimum volume trade.PositionClosePartial(ticket, close_volume); //--- Close partial position } } } } //+------------------------------------------------------------------+ //| Manage Time-Based Exit | //+------------------------------------------------------------------+ void ManageTimeBasedExit() { if (InpMaxTradeHours == 0) return; //--- Exit if no max duration for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Iterate through positions if (PositionGetSymbol(i) != _Symbol || PositionGetInteger(POSITION_MAGIC) != InpMagicNumber) //--- Check symbol and magic continue; //--- Skip if not match ulong ticket = PositionGetInteger(POSITION_TICKET); //--- Get ticket datetime open_time = (datetime)PositionGetInteger(POSITION_TIME); //--- Get open time datetime current_time = TimeCurrent(); //--- Get current time if ((current_time - open_time) / 3600 >= InpMaxTradeHours) { //--- Check if duration exceeded double profit = PositionGetDouble(POSITION_PROFIT); //--- Get profit trade.PositionClose(ticket); //--- Close position } } }

Here, we implement the "ManageTrailingStop" function to dynamically adjust stop losses on open positions as prices move favorably, looping backward through positions from PositionsTotal minus 1 to zero. For matches on symbol and magic, we retrieve the ticket, current stop loss, type as ENUM_POSITION_TYPE from PositionGetInteger on "POSITION_TYPE", and relevant price (bid for buys or ask for sells). We calculate trail distance and step using input pips times "_Point" and multiplier, then for buys, propose a new level below current price by distance, updating via "trade.PositionModify" if it's above current stop loss plus step or if unset; mirror for sells, moving stop loss above if below current minus step.

Next, the "ManagePartialClose" function handles profit-taking by closing a portion halfway to take profit (TP), iterating similarly to find qualifying positions. We get a ticket, open price with PositionGetDouble on POSITION_PRICE_OPEN, TP, current price based on type, and volume via "POSITION_VOLUME"; compute half TP distance as absolute TP minus open times 0.5, checking if price has reached it (above for buys, below for sells). If so, normalize a close volume as position size times "InpPartialClosePercent" to two decimals, and if at or above symbol min volume from SymbolInfoDouble with SYMBOL_VOLUME_MIN, execute "trade.PositionClosePartial" on the ticket and volume.

For "ManageTimeBasedExit", we return early if "InpMaxTradeHours" is zero, otherwise loop to identify matching positions, fetching ticket, open time as datetime from "PositionGetInteger" with "POSITION_TIME", and comparing against TimeCurrent to see if hours elapsed meet or exceed the limit. If yes, note profit, and close with "trade.PositionClose" on the ticket, enforcing duration caps. We can now call these functions to do the position management.

if (InpUseTrailingStop) //--- Check trailing stop enabled ManageTrailingStop(); //--- Manage trailing stop if (InpUsePartialClose) //--- Check partial close enabled ManagePartialClose(); //--- Manage partial close ManageTimeBasedExit(); //--- Manage time-based exit

When we compile, we get the following outcome.

We can see we modify and trail the favourable positions actively. Since we have achieved our objectives, the thing that remains is backtesting the program, and that is handled in the next section.

Backtesting

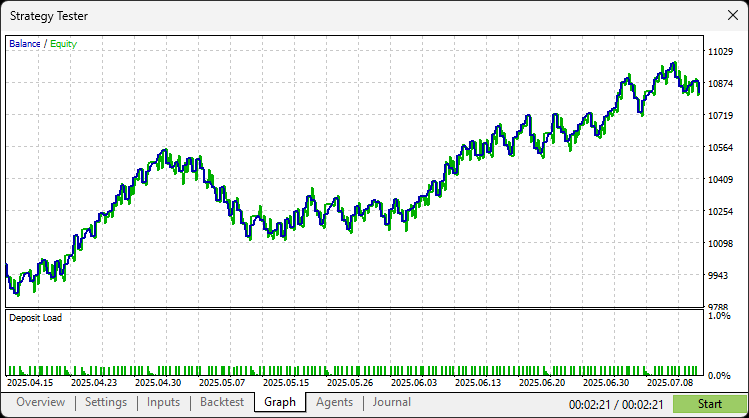

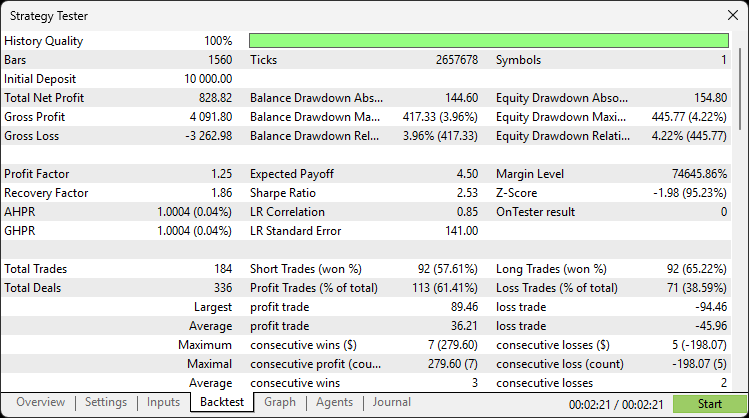

After thorough backtesting, we have the following results.

Backtest graph:

Backtest report:

Conclusion

In conclusion, we’ve developed a statistical mean reversion system in MQL5 that analyzes price data for moments like mean, variance, skewness, kurtosis, and Jarque-Bera statistics, generates signals based on confidence interval breaches with adaptive thresholds and optional higher timeframe confirmation, executes trades with equity-based or fixed sizing, and incorporates trailing stops, partial closures, and time-based exits for comprehensive risk control, all enhanced by a real-time on-chart dashboard.

Disclaimer: This article is for educational purposes only. Trading carries significant financial risks, and market volatility may result in losses. Thorough backtesting and careful risk management are crucial before deploying this program in live markets.

With this statistical mean reversion strategy, you’re equipped to capitalize on non-normal distribution opportunities, ready for further optimization in your trading journey. Happy trading!