Tenant Rental Ledger free printable template

Fill out, sign, and share forms from a single PDF platform

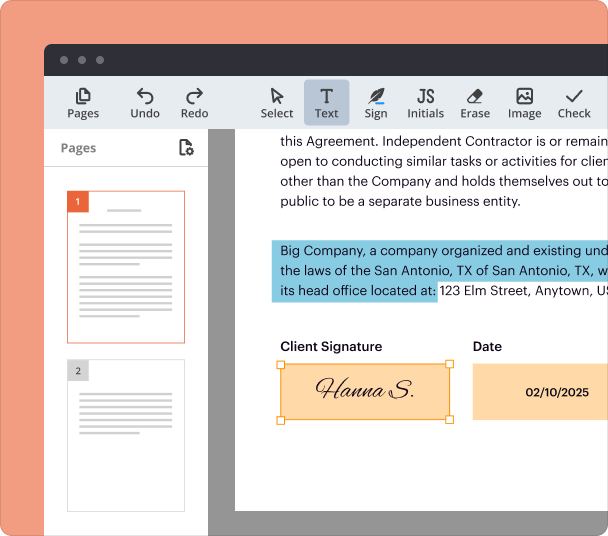

Edit and sign in one place

Create professional forms

Simplify data collection

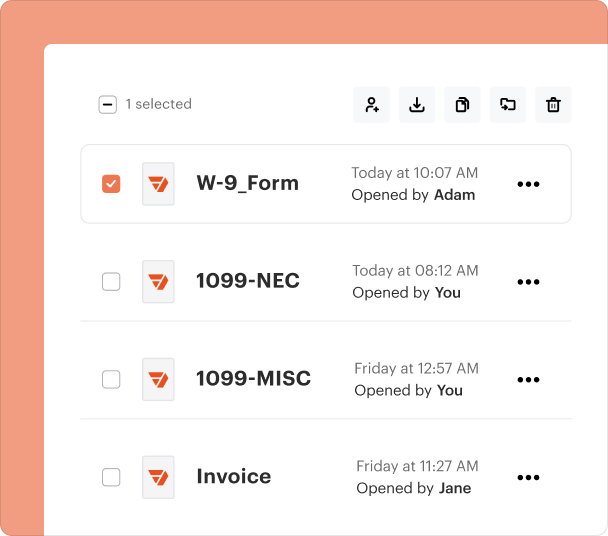

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

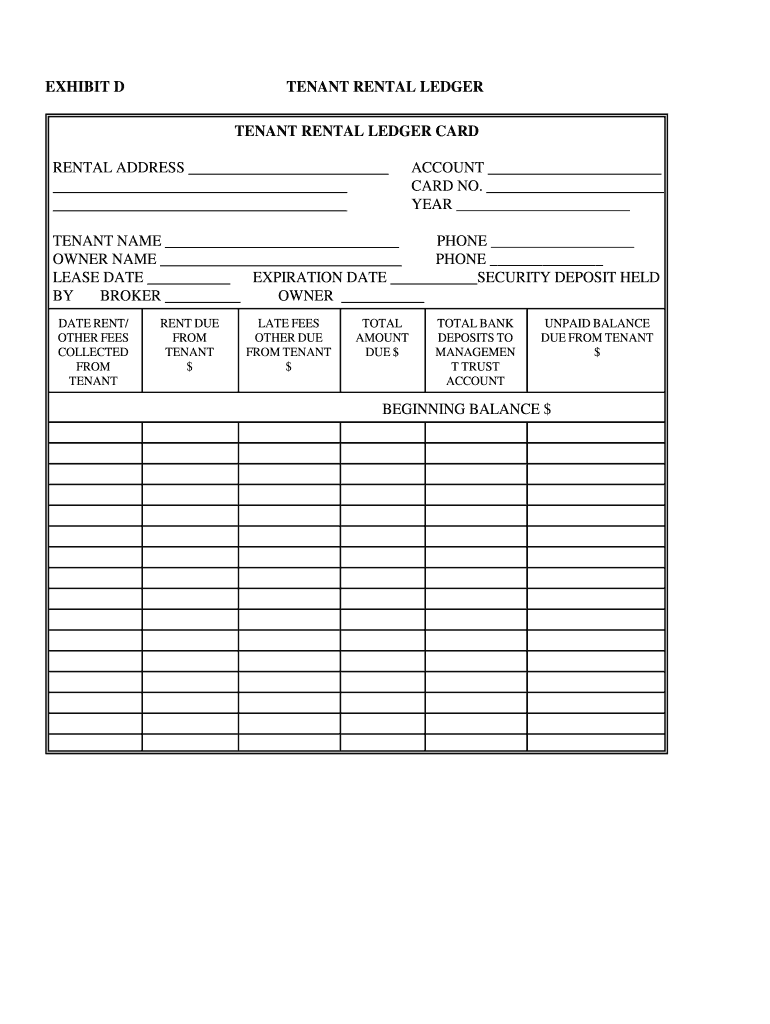

Understanding the Tenant Rental Ledger Printable Form

What is the tenant rental ledger printable form?

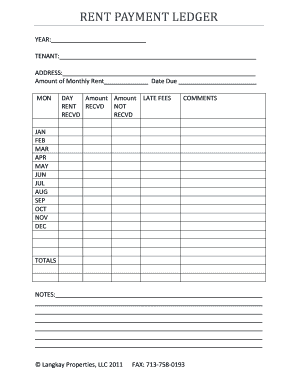

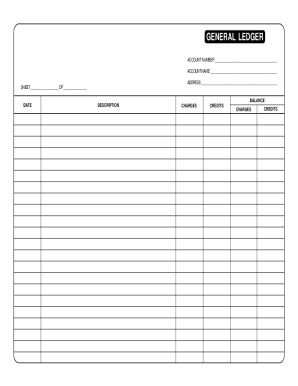

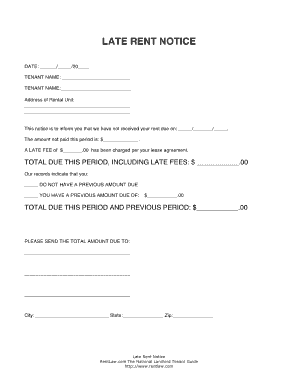

The tenant rental ledger printable form is a document used by property owners and managers to track rental payments and other financial transactions related to a lease agreement. This form serves as a detailed record of the payments made by tenants, including rent, late fees, and any additional charges. It is essential for maintaining accurate financial records and ensuring transparency in rental agreements.

Key features of the tenant rental ledger printable form

This form typically includes essential fields such as the tenant's name, rental address, and owner's name. It captures detailed data for each transaction, including the date of payment, the amount due, amounts paid, and any unpaid balances. The ledger also often features sections for late fees and security deposits, providing a comprehensive view of the tenant's financial standing.

When to use the tenant rental ledger printable form

This form should be used at the start of a lease and updated regularly to reflect any transactions. It is particularly useful during rent collection and for resolving any disputes regarding payment records. Landlords and property managers can refer to this ledger during tax season to report income accurately or when reviewing a tenant’s financial history for future rental agreements.

How to fill the tenant rental ledger printable form

Filling out the tenant rental ledger involves entering basic information at the top, such as the tenant's name and rental address. For every payment, detail the date it was received, the amount paid, and any fees applied. Ensure to update the ledger regularly, particularly with new transactions or changes in the tenant’s financial obligations. Consistent updates help in tracking unpaid balances and overall financial health.

Best practices for accurate completion

To maintain an accurate tenant rental ledger, it is important to record payments as soon as they are received. Use clear and legible handwriting or digital tools to avoid misunderstandings. Regularly review the entries for discrepancies and reconcile with the tenant’s statements to ensure both parties have consistent financial records.

Security and compliance for the tenant rental ledger printable form

Maintaining the security of the tenant rental ledger is crucial, especially when handling sensitive financial information. Ensure that the ledger is kept in a secure location, whether digitally or physically. Adhering to applicable state and federal laws regarding tenant information privacy is essential to avoid legal issues.

Frequently Asked Questions about rental ledger from private landlord form

What should I do if I encounter a mistake on the ledger?

If you find a mistake, it is important to correct it promptly. Cross out the error with a single line and write the correct information next to it. Ensure both the landlord and tenant initial the correction to maintain transparency.

Can I use a digital version of the tenant rental ledger?

Yes, using a digital version of the ledger can streamline the process, especially for calculations and record-keeping. Ensure that your digital tool complies with security requirements to protect sensitive tenant information.

pdfFiller scores top ratings on review platforms