IRS 1099-MISC 2024-2025 free printable template

Show details

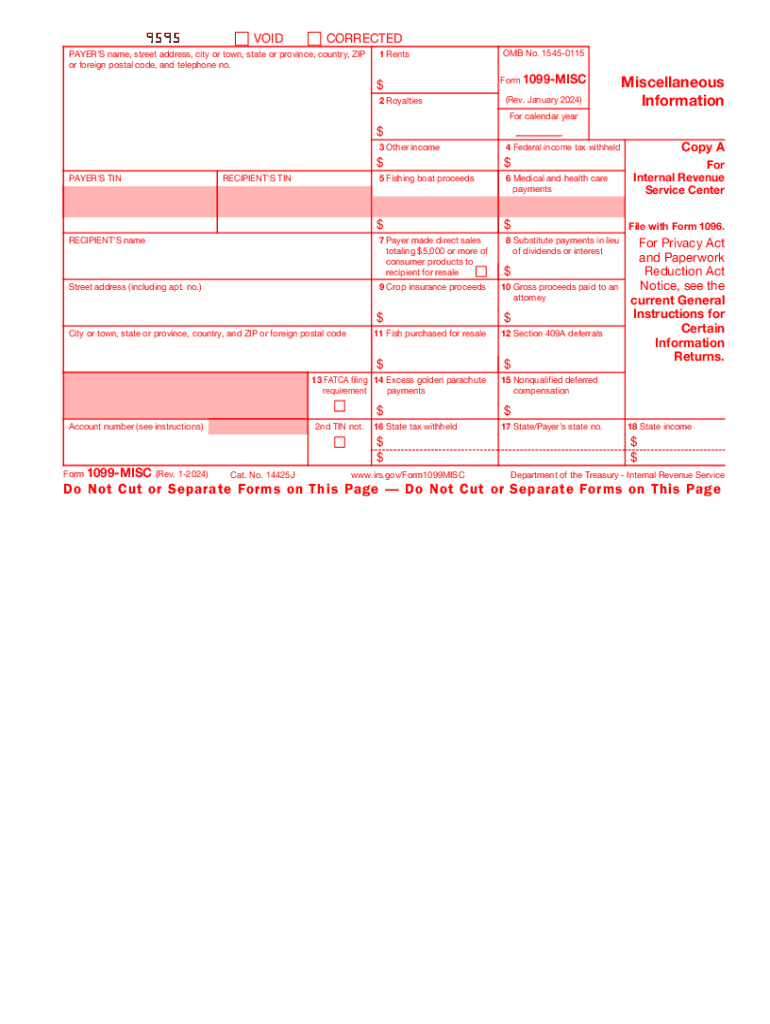

Attention: Copy A of this form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. The official printed version of Copy A of this IRS form is scannable,

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1099-MISC

How to edit IRS 1099-MISC

How to fill out IRS 1099-MISC

Instructions and Help about IRS 1099-MISC

How to edit IRS 1099-MISC

To edit IRS 1099-MISC, first download the PDF version of the form. You can open the file in a PDF editor, such as pdfFiller, which allows you to make necessary changes to the fields. Ensure that the information you provide is accurate to avoid penalties. After editing, save the updated form before submission.

How to fill out IRS 1099-MISC

To fill out IRS 1099-MISC, follow these steps:

01

Obtain the correct form from the IRS website or a tax professional.

02

Enter your business name, address, and taxpayer identification number (TIN) at the top of the form.

03

Provide the recipient's name, address, and TIN in the appropriate sections.

04

Report the payments made to the recipient in the correct boxes based on their nature.

05

Provide your contact information and any other required details at the bottom of the form.

Ensure all entries are legible and accurate to meet IRS standards and avoid any complications.

Latest updates to IRS 1099-MISC

Latest updates to IRS 1099-MISC

The IRS frequently updates forms and requirements. Always check the IRS website for the most recent updates to the IRS 1099-MISC before filing.

All You Need to Know About IRS 1099-MISC

What is IRS 1099-MISC?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About IRS 1099-MISC

What is IRS 1099-MISC?

IRS 1099-MISC is a tax form used to report miscellaneous income other than wages, salaries, and tips. This form is crucial for businesses and tax filers who pay non-employee compensation, rents, royalties, and other specified payments. It helps the IRS track these payments and ensures compliance with tax regulations.

What is the purpose of this form?

The purpose of the IRS 1099-MISC is to report various types of payments made to non-employees. This includes rents, services, awards, or other forms of income that do not fit into the standard wage category. By reporting these payments, you help ensure that recipients accurately report their income on their tax returns.

Who needs the form?

Any business that has paid $600 or more to a non-employee for services must file IRS 1099-MISC. This applies to freelancers, independent contractors, and vendors, among others. Furthermore, other payments, like rent or royalties, also require using this form regardless of the amount.

When am I exempt from filling out this form?

You may be exempt from filing IRS 1099-MISC if the payments made are to corporations, including S corporations and C corporations, unless the payments are for specific services such as medical or legal services. Additionally, you are exempt if the payments do not meet the minimum threshold of $600.

Components of the form

IRS 1099-MISC consists of several key components: the payer's information, recipient’s information, the amount and type of payment made, and additional boxes for specific types of payments. Each box has a label indicating its purpose, such as non-employee compensation, rent, or royalties. It is vital to correctly fill each component to ensure compliance.

Due date

The due date for filing IRS 1099-MISC with the IRS is typically January 31 of the year following the payment. If you are filing electronically, the deadline may vary slightly. Be sure to check the IRS guidelines to avoid late filing penalties.

What payments and purchases are reported?

IRS 1099-MISC is used to report payments for various services not classified under wages or salaries. This includes payments for non-employee services, rents, prizes, and awards. Additionally, it includes any royalties paid over $10 and payments for medical services. Understanding what constitutes reportable payments is essential for accurate reporting.

How many copies of the form should I complete?

You must complete multiple copies of IRS 1099-MISC: one for the IRS, one for the state tax authority if applicable, and one for the recipient. Each copy must be accurately filled with the same information for reporting purposes. Ensure that the recipient receives their copy by the due date.

What are the penalties for not issuing the form?

Failure to issue IRS 1099-MISC can result in significant penalties from the IRS. Penalties vary depending on how late the form is filed, with higher fines for forms filed after the due date. Deliberate disregard of filing requirements can lead to even steeper penalties, so it is essential to fulfill this obligation timely.

What information do you need when you file the form?

When filing IRS 1099-MISC, you will need to gather the following information: the payer's name, address, and TIN; the recipient's name, address, and TIN; and details about the payments made, including the amounts and the purpose of each payment. Ensuring the accuracy of this information is critical to avoid issues with the IRS.

Is the form accompanied by other forms?

IRS 1099-MISC may need to be accompanied by other forms depending on the nature of the payments reported. For example, if you are declaring non-employee compensation, you may need to complete Schedule C to report income from self-employment. Always check specific instructions provided by the IRS to determine if additional forms are necessary.

Where do I send the form?

IRS 1099-MISC should be sent to the IRS at the specific address listed in the filing instructions for the form, based on whether you are filing electronically or by mail. If filing by mail, ensure that you send it to the correct address to prevent delays or issues with processing.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Loved this Was definitely what I needed.

No comment No comment at this time.

See what our users say