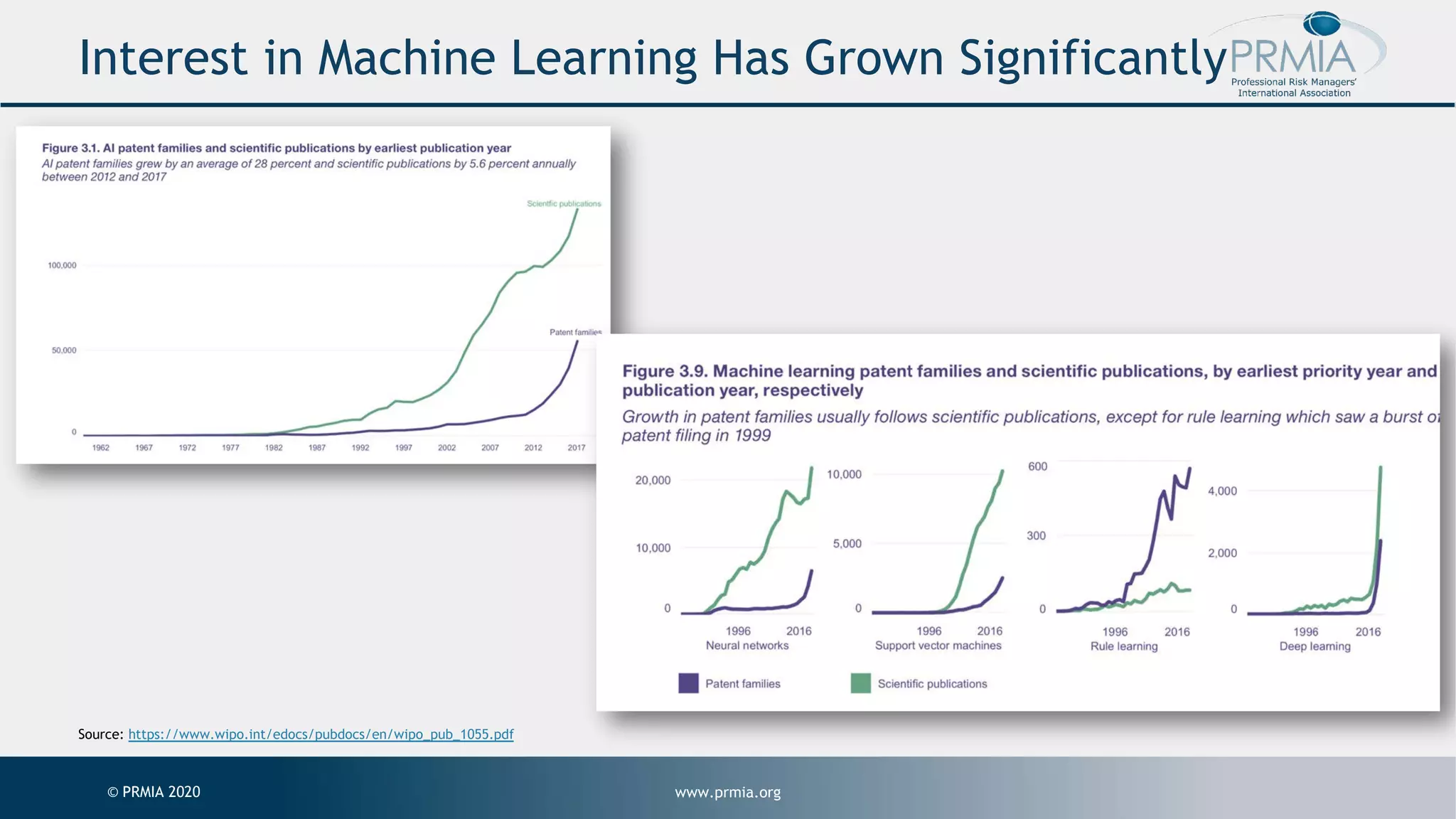

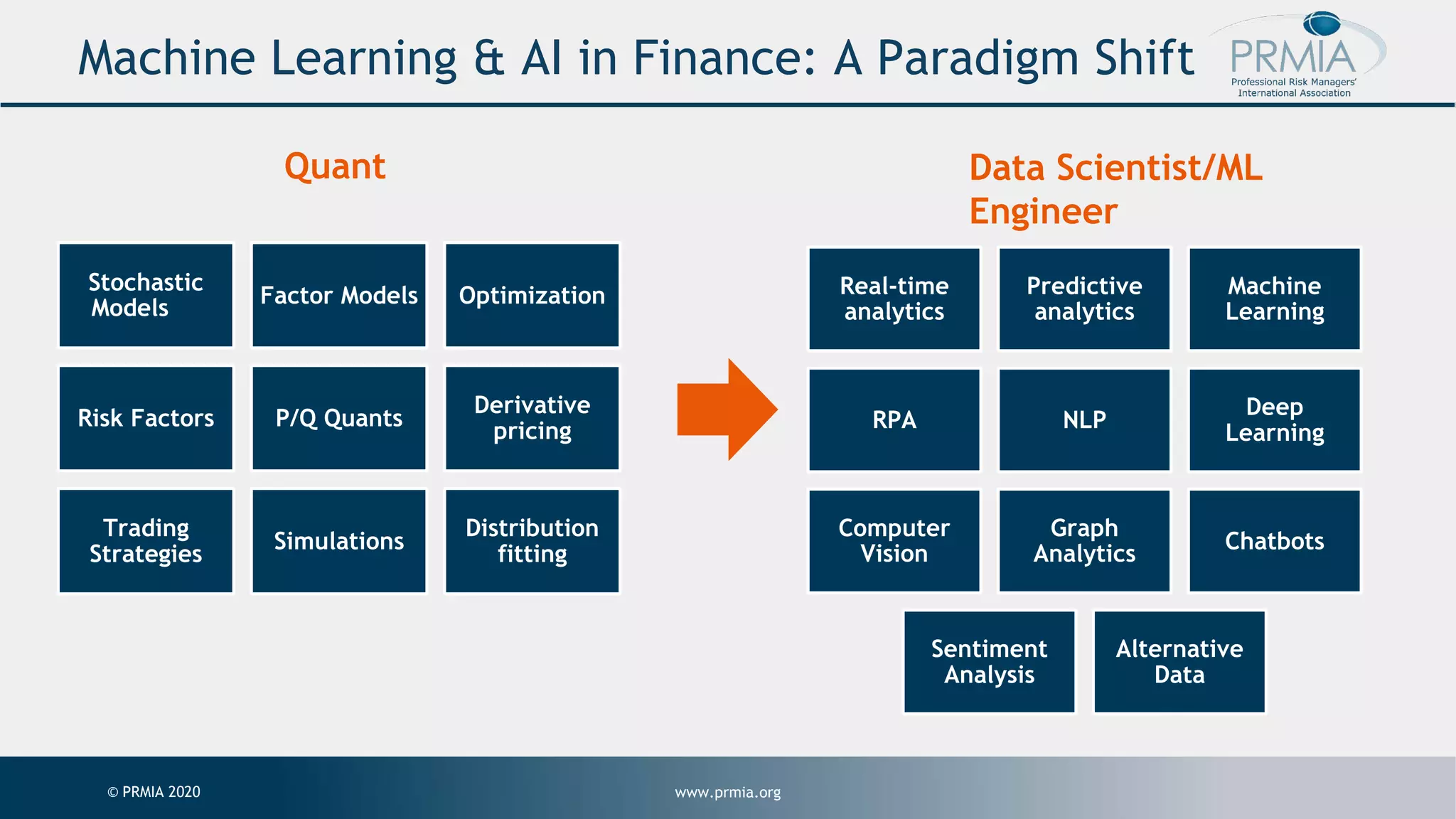

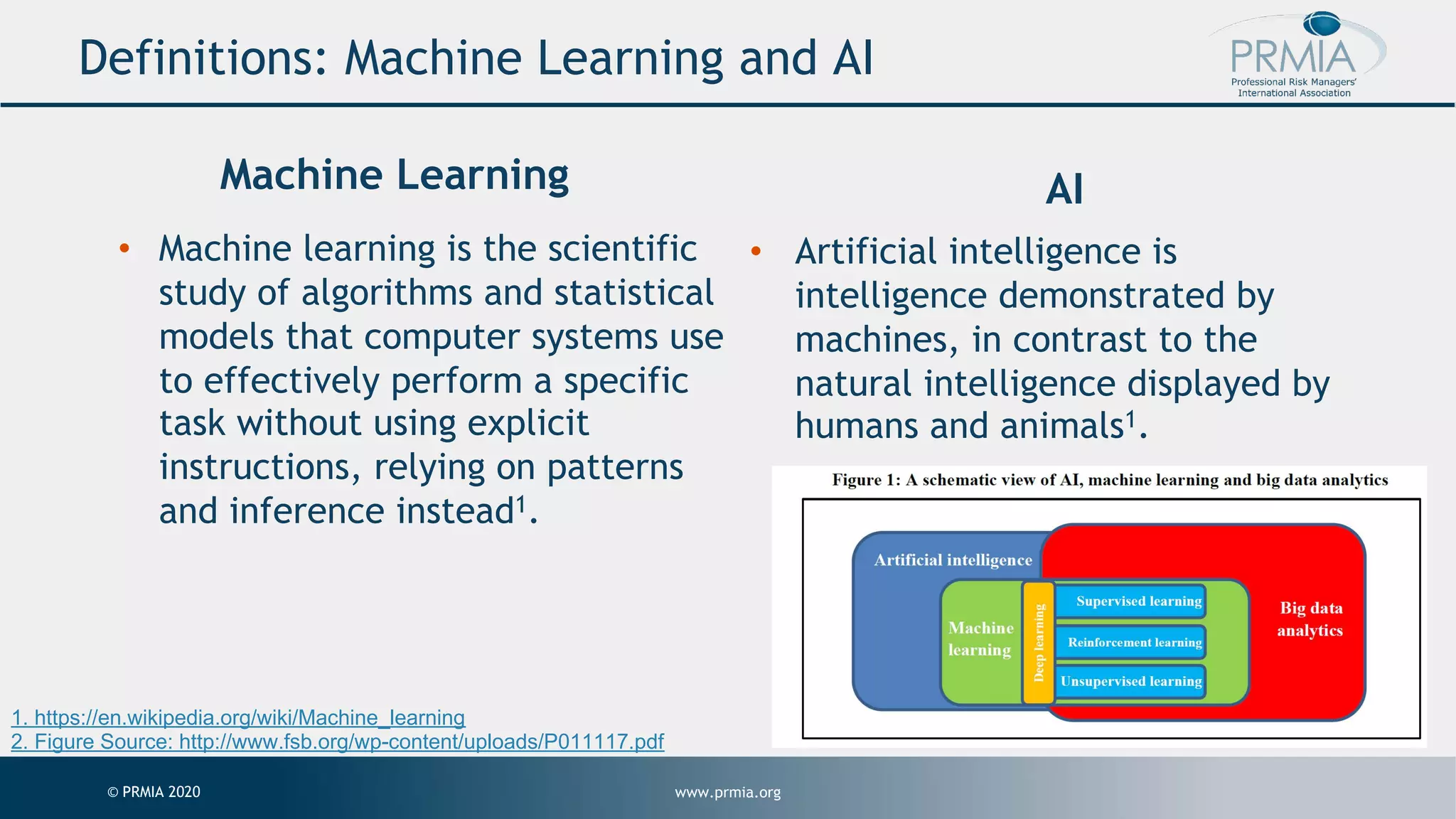

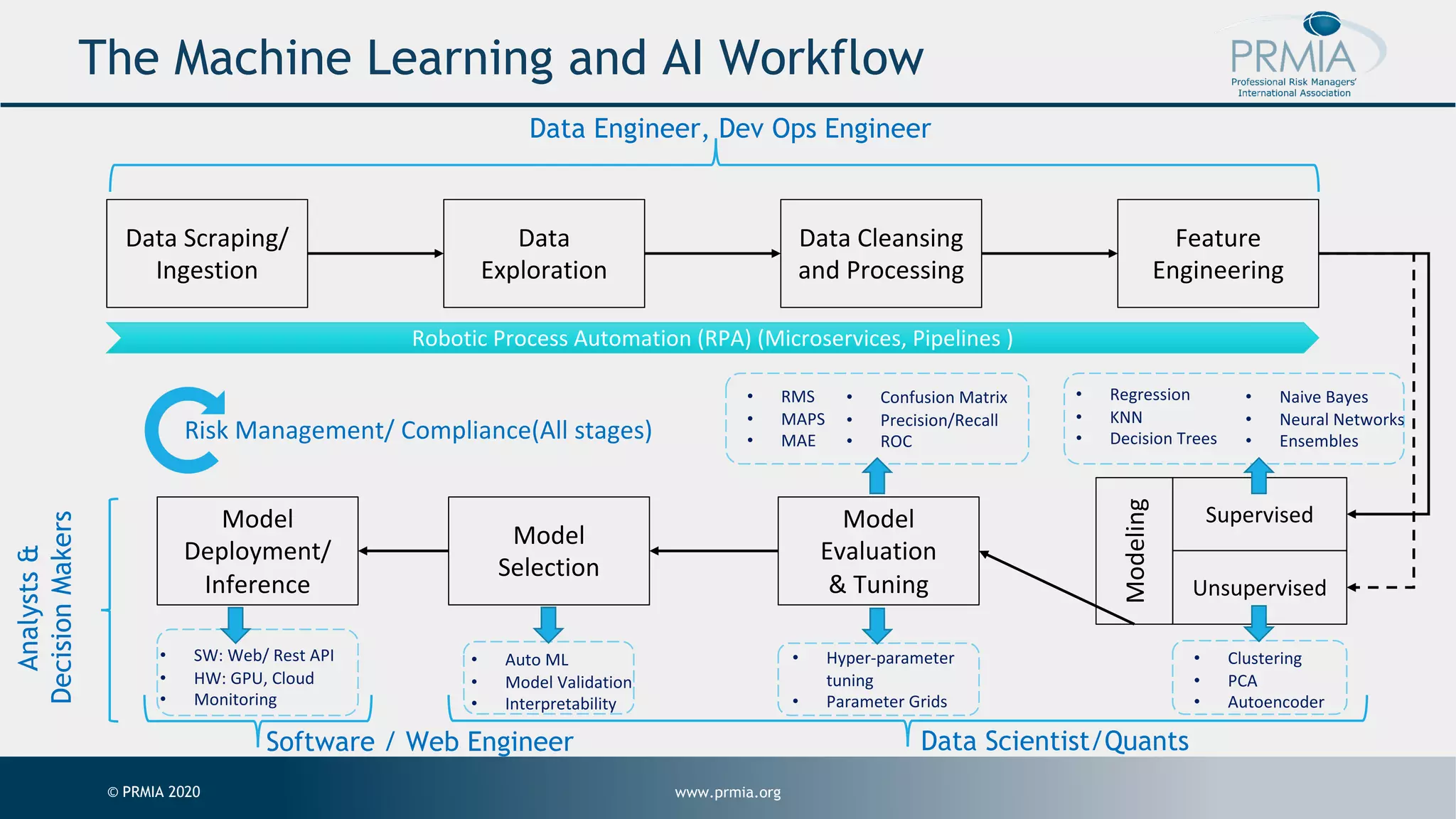

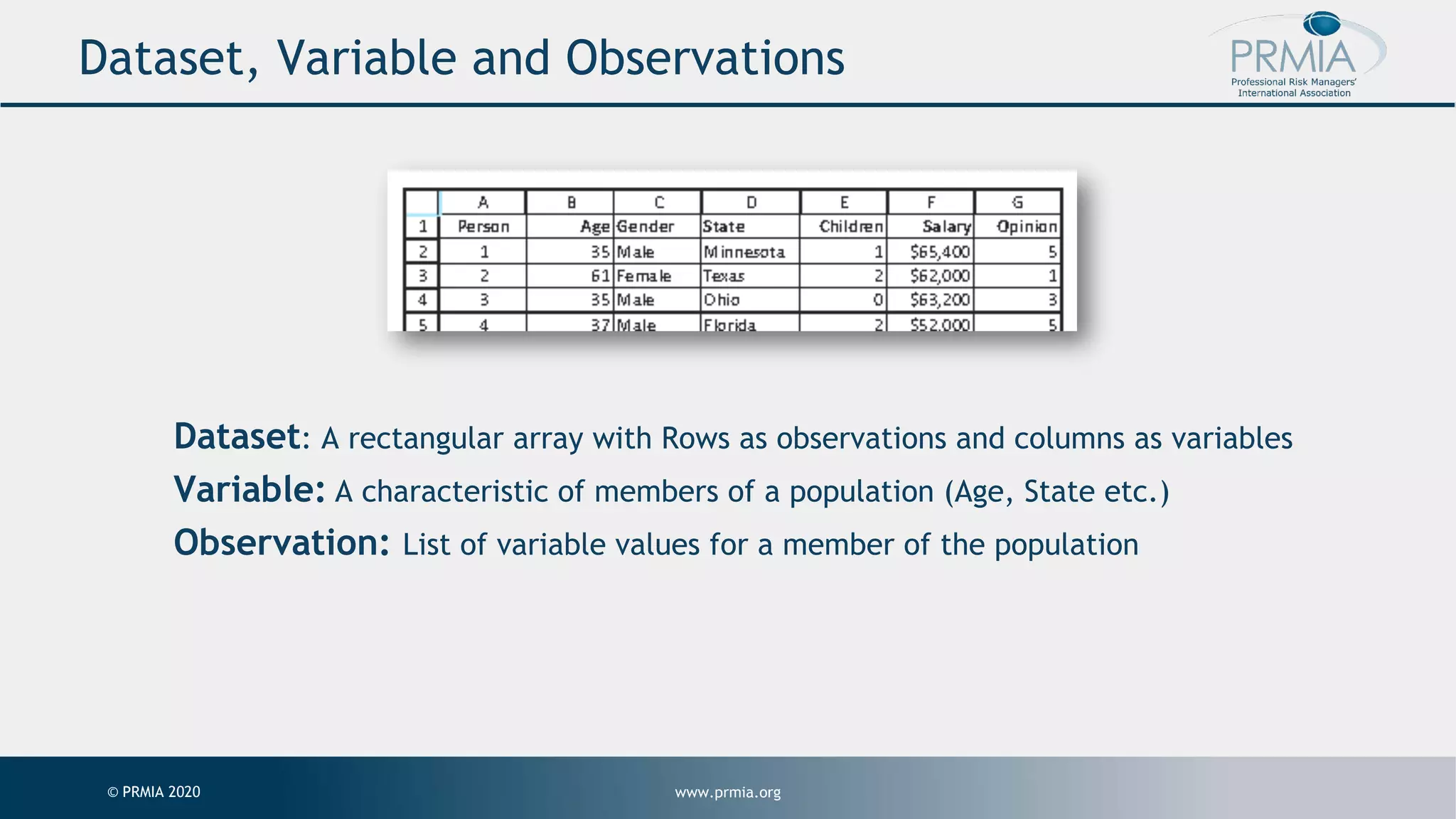

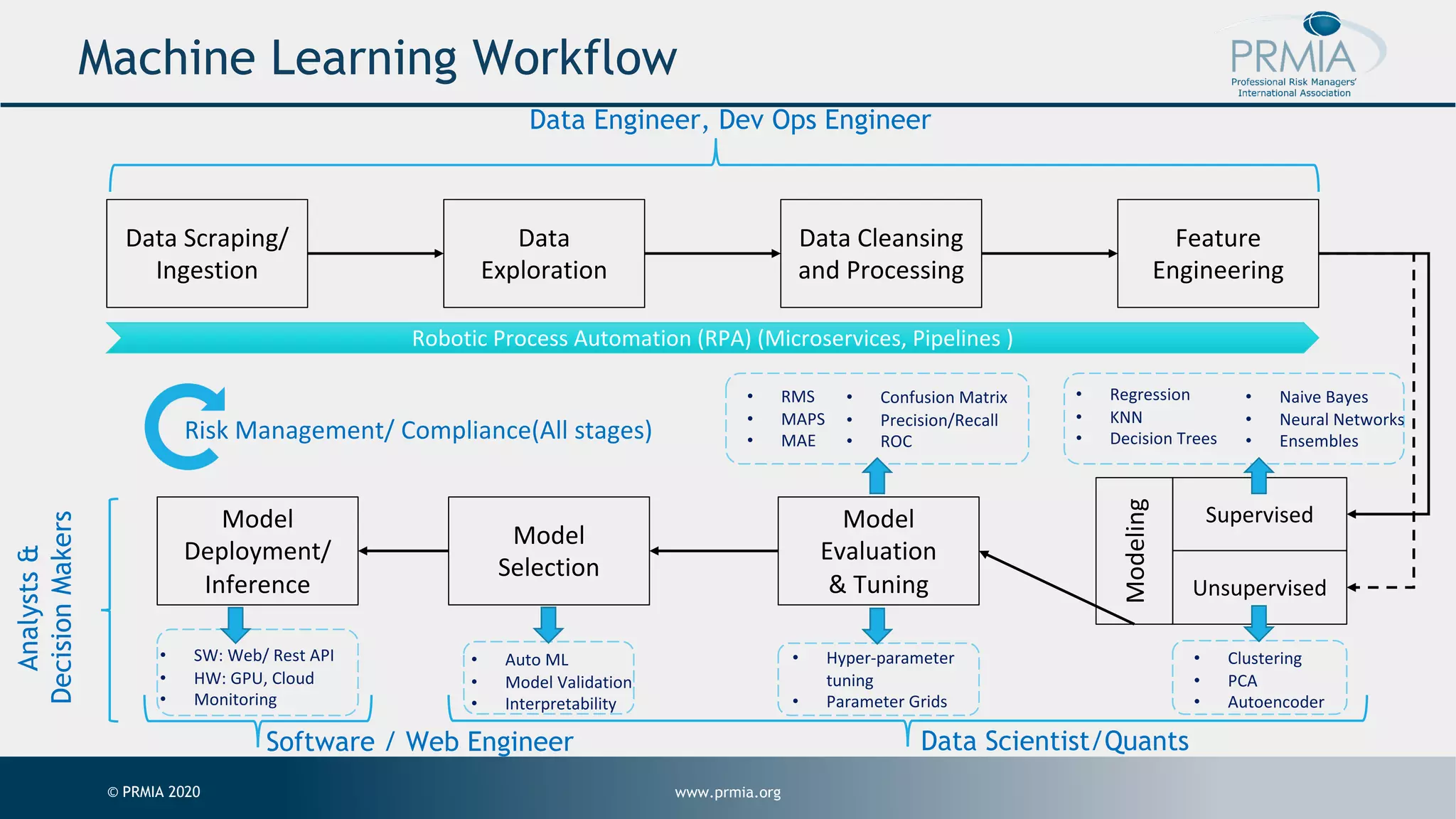

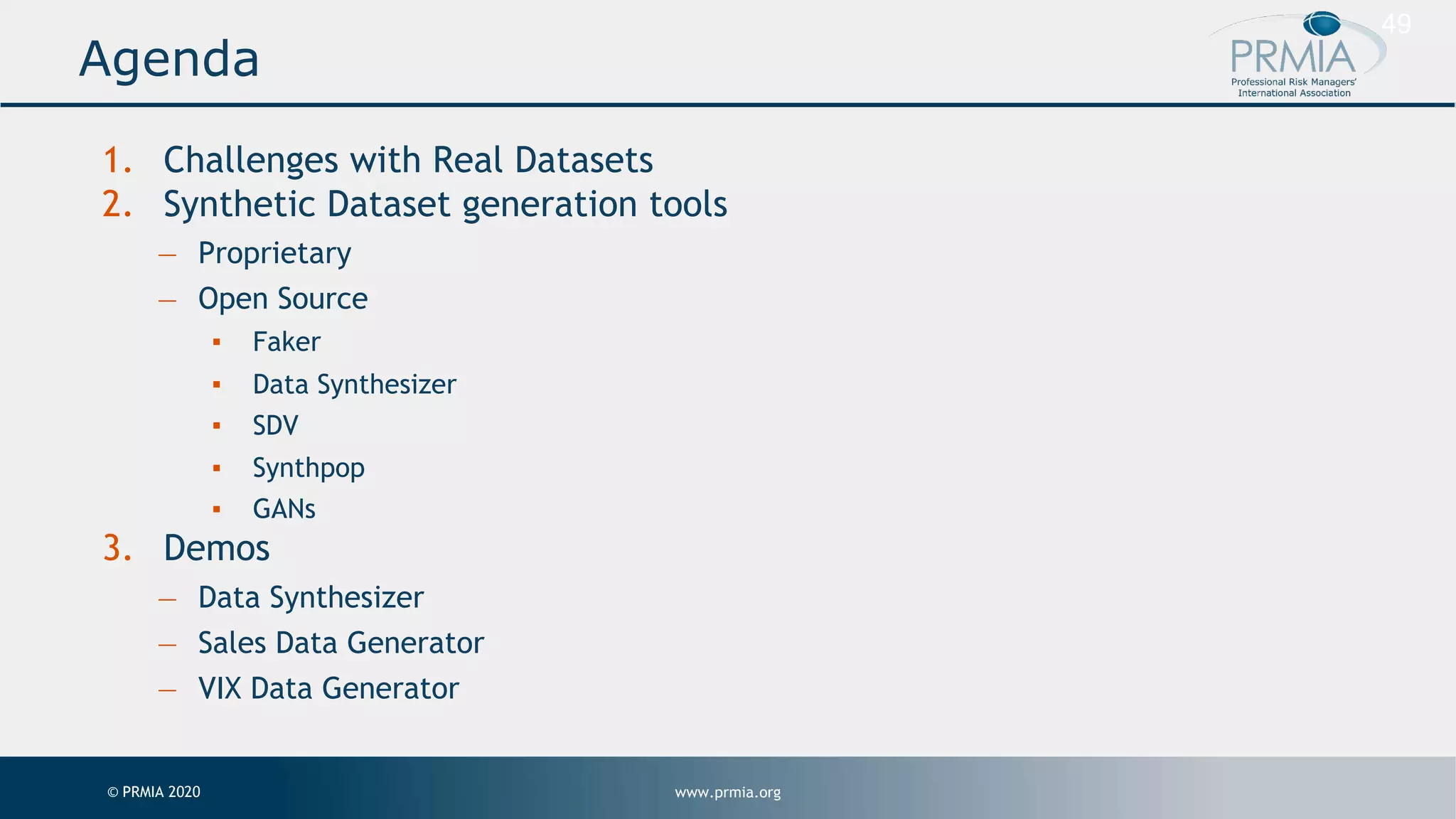

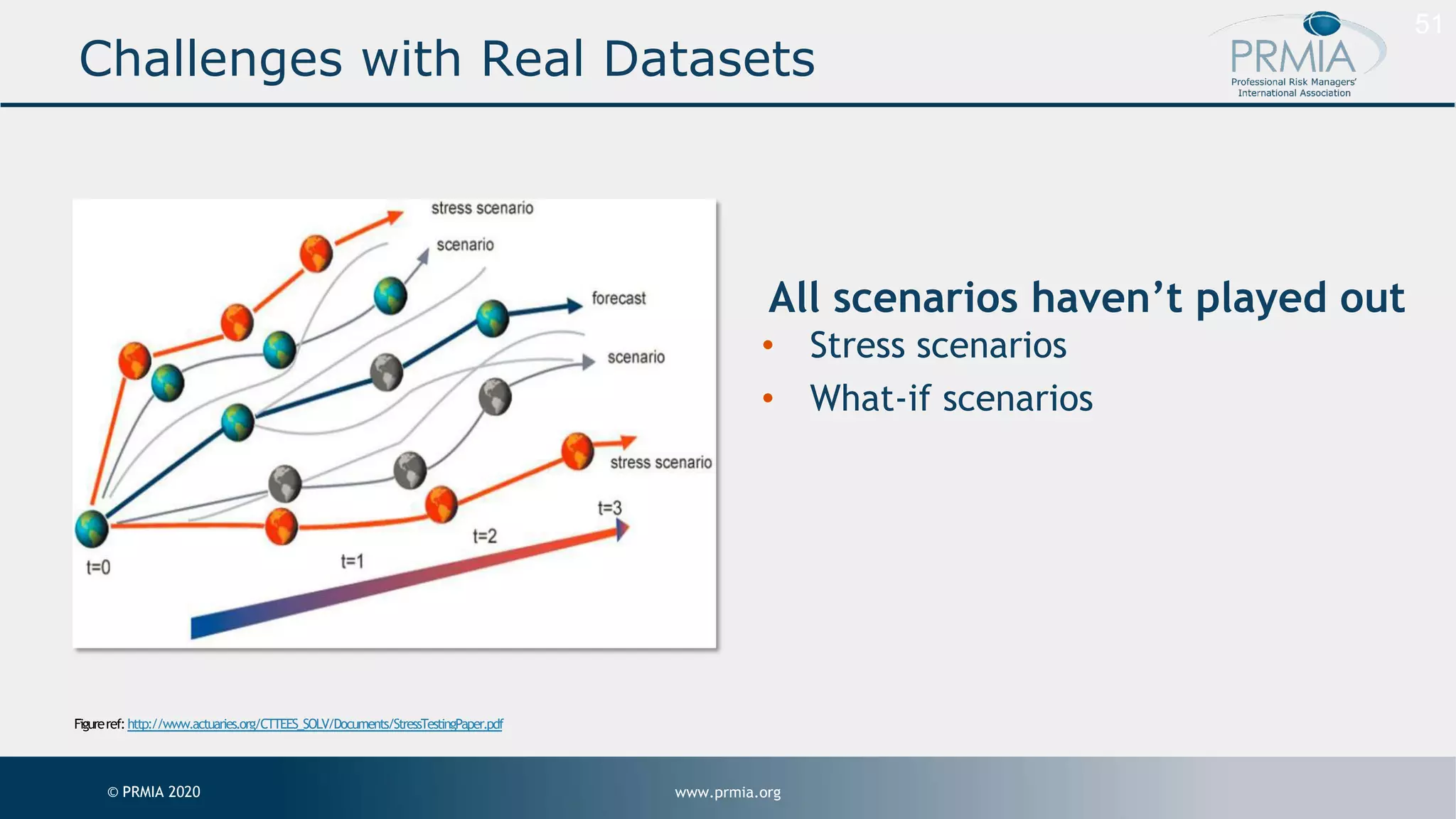

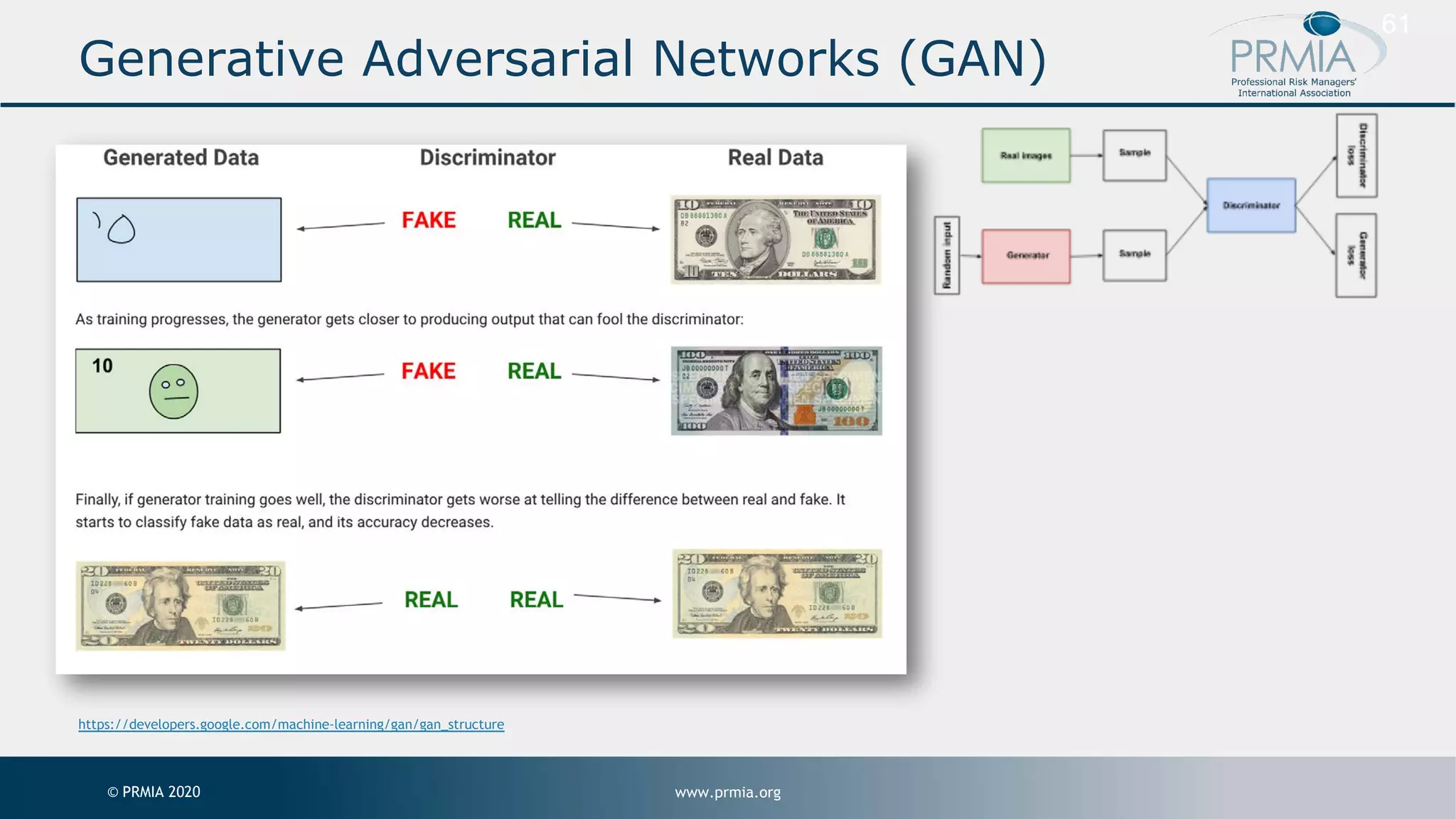

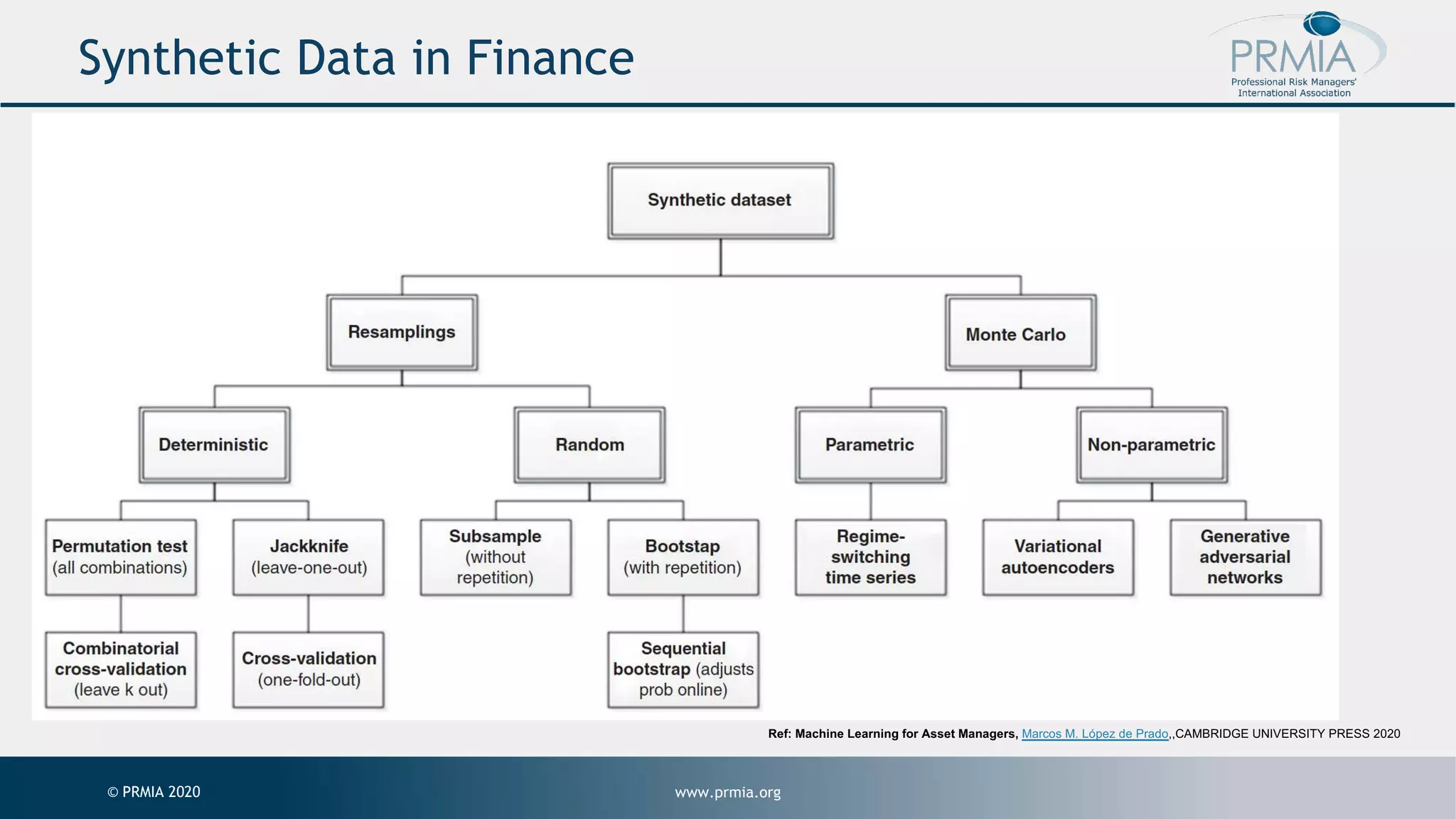

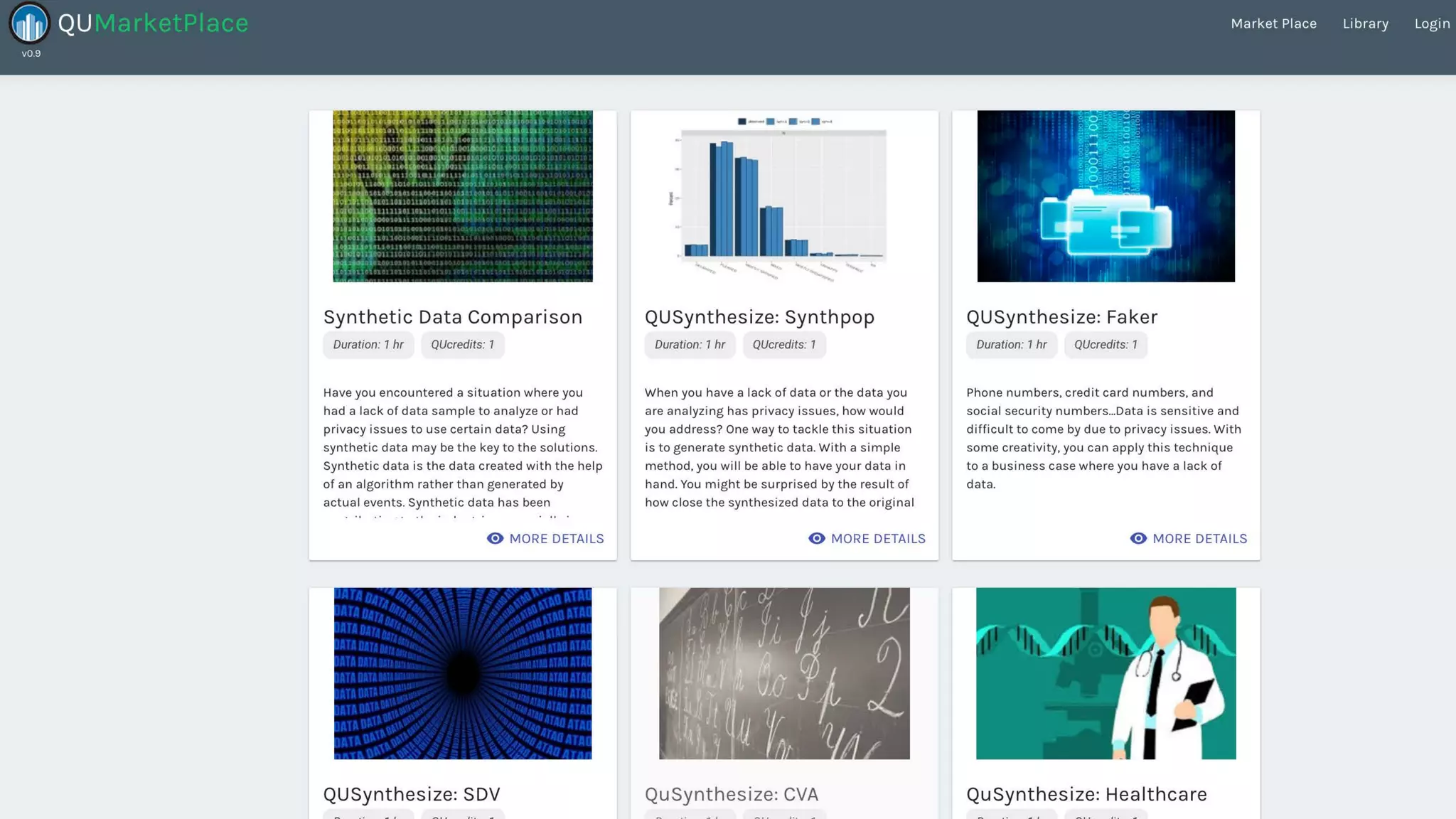

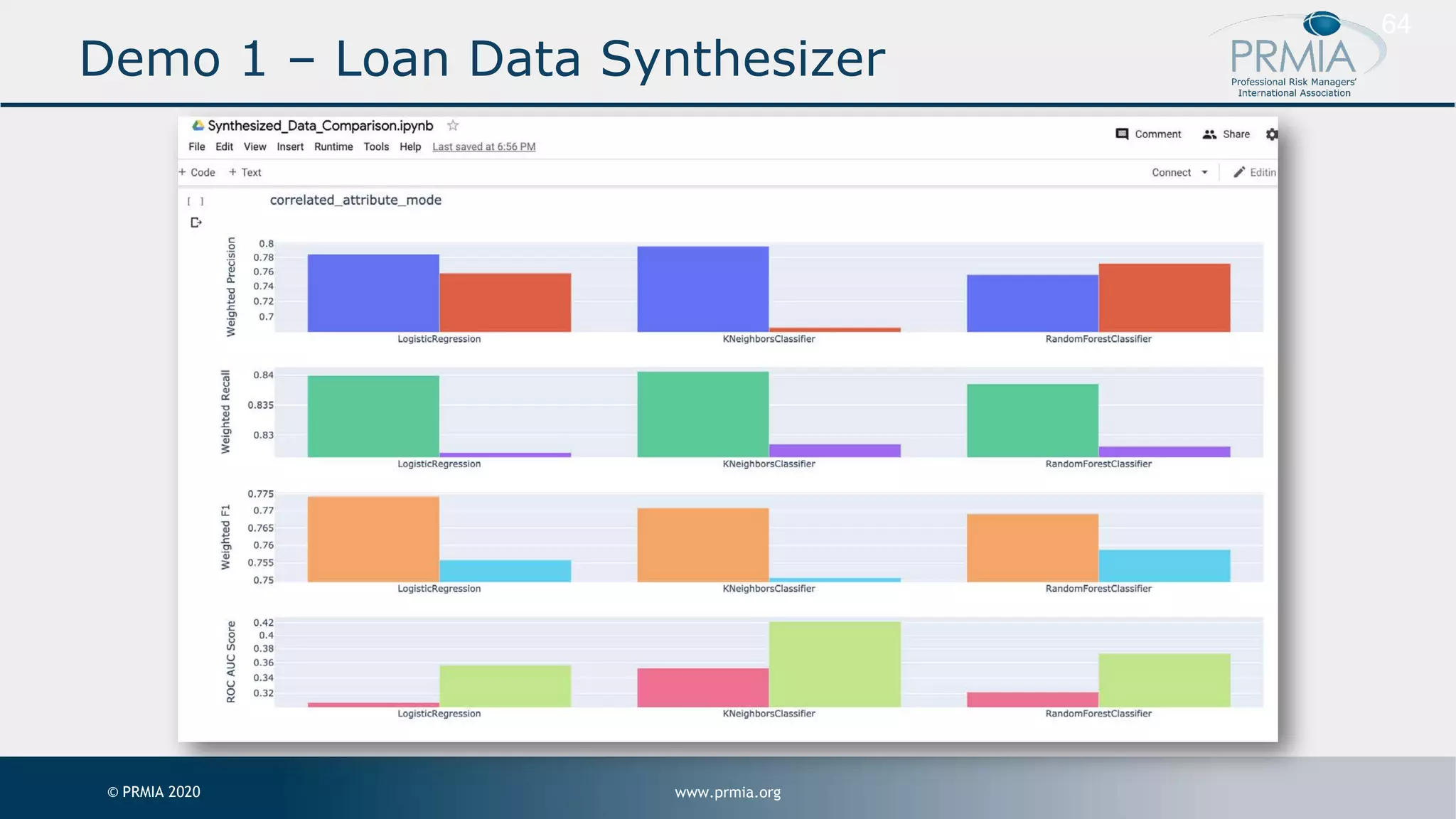

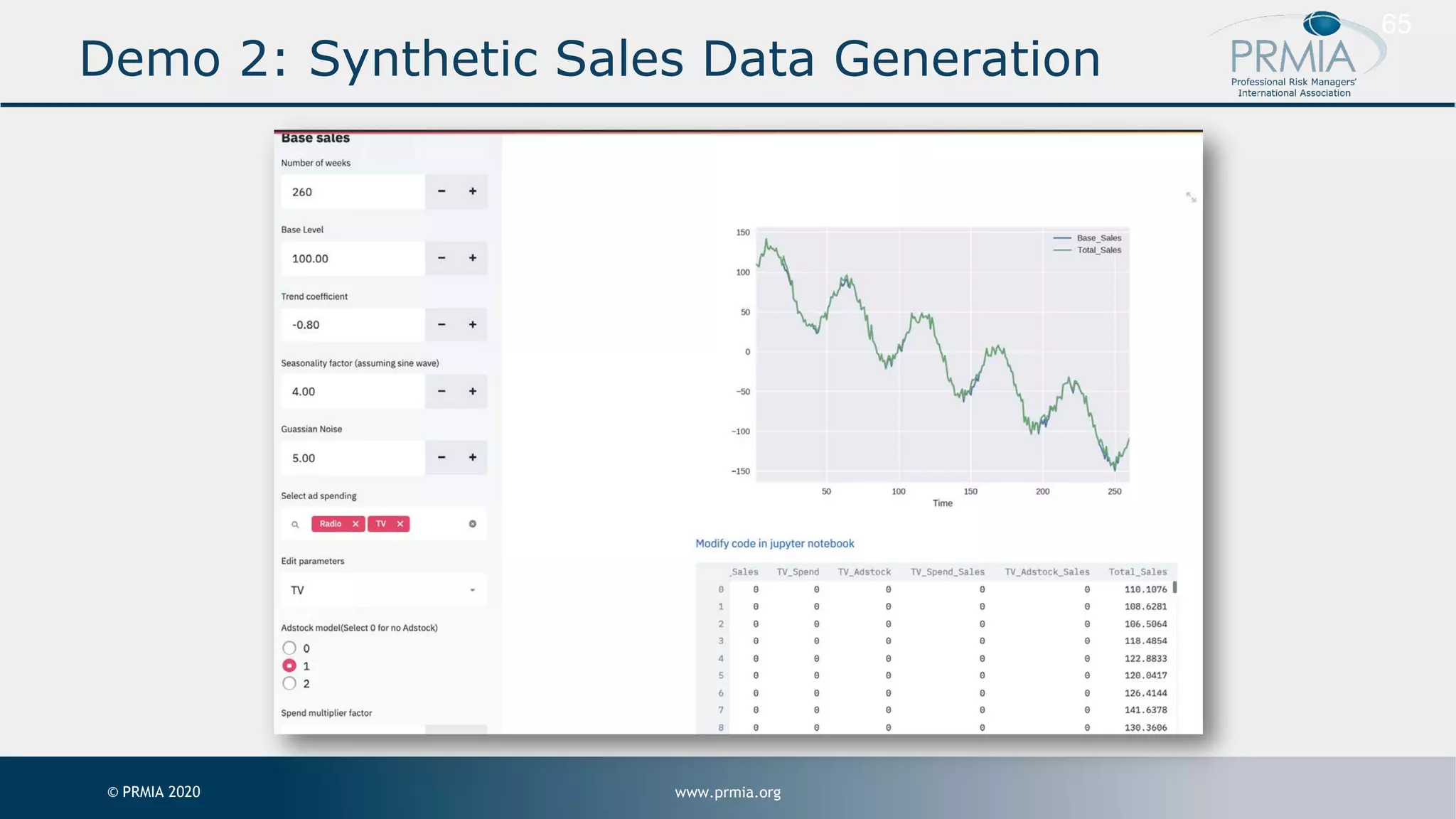

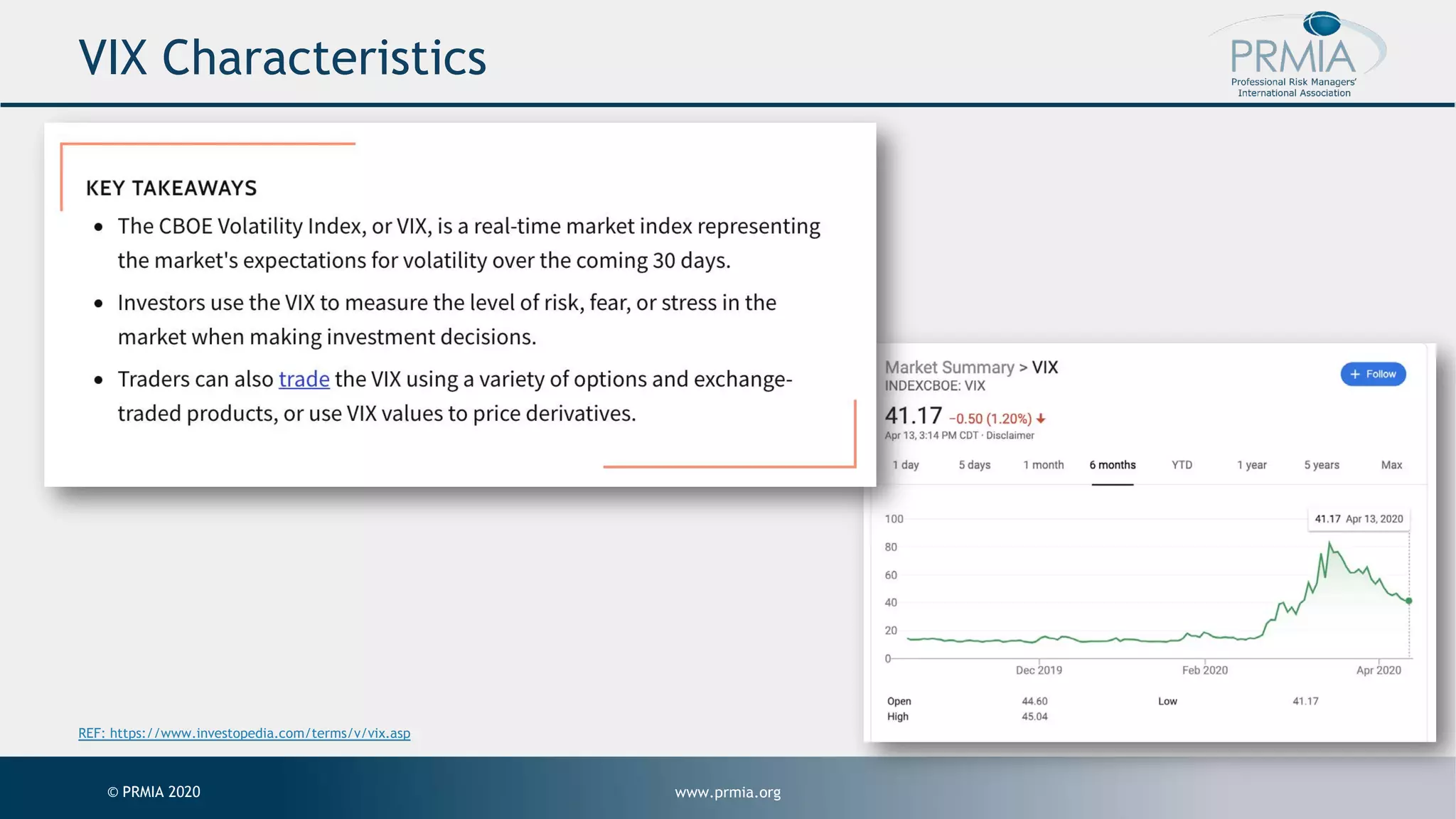

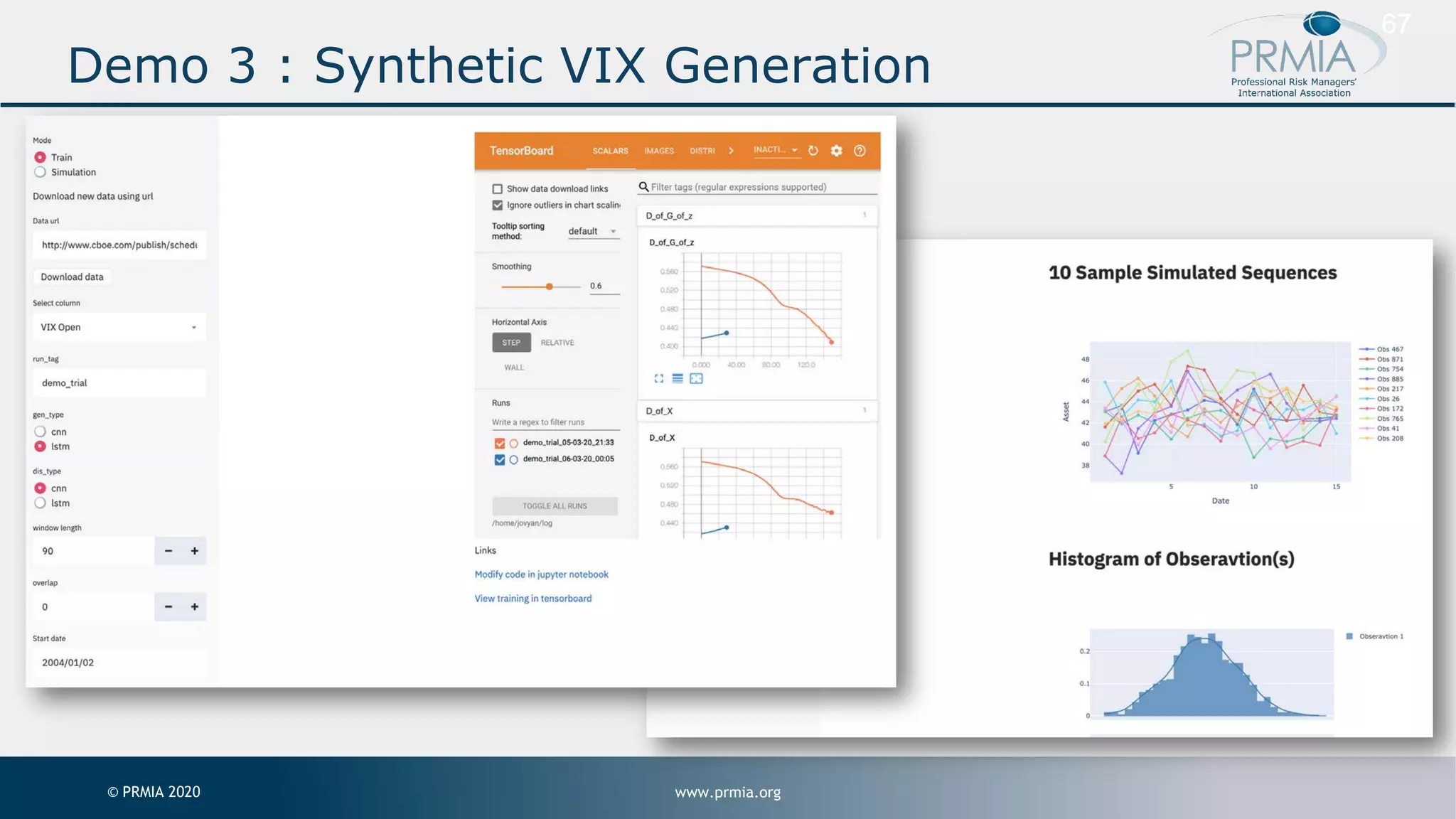

This document presents a comprehensive overview of synthetic VIX data generation using machine learning techniques, led by Sri Krishnamurthy, CFA. It discusses the importance of machine learning in finance, challenges with real datasets, and various tools for synthetic data generation, including demos related to loan and sales data. Additionally, it outlines the educational foundation courses intended for financial professionals to understand machine learning and AI applications in finance.