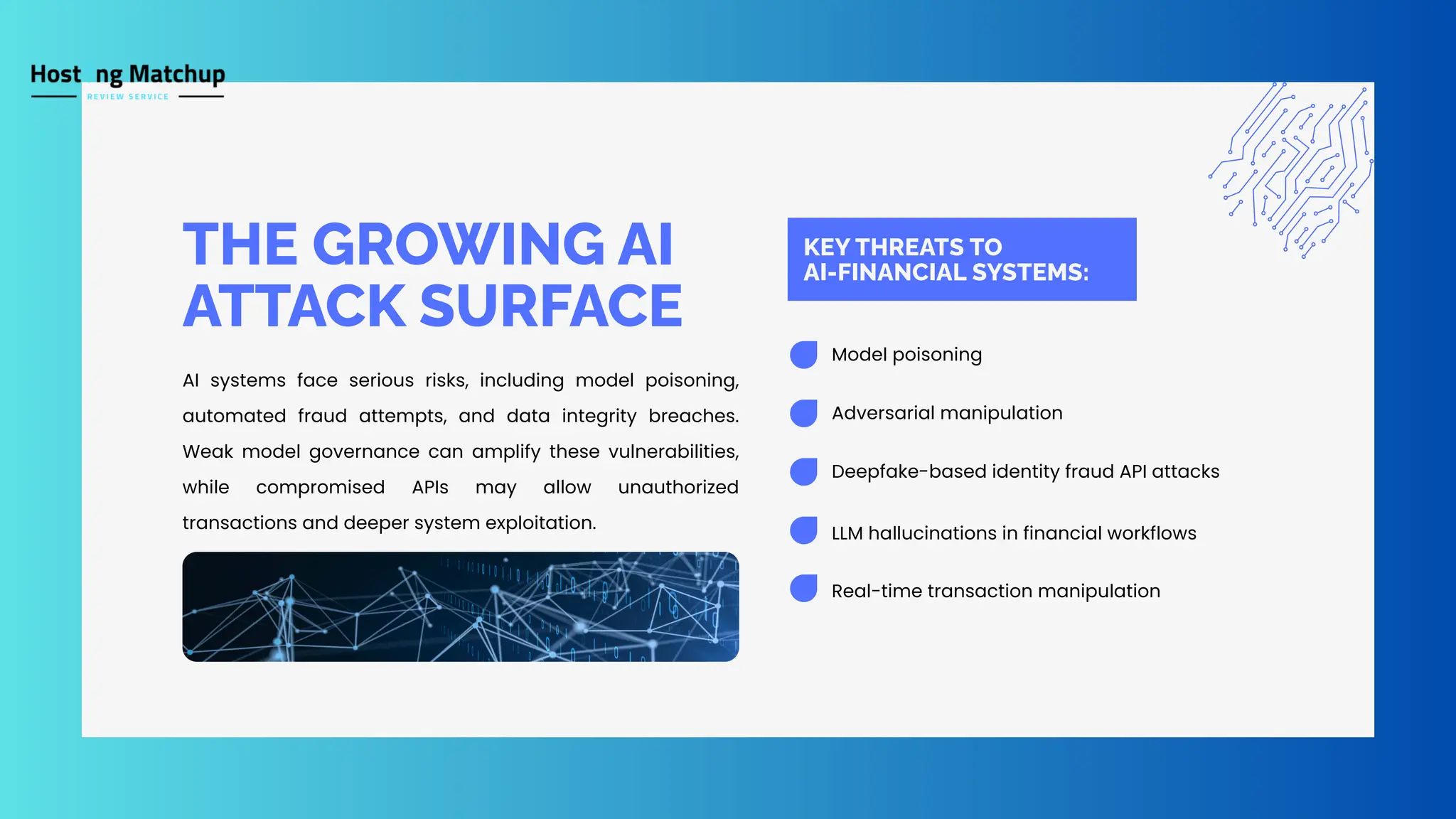

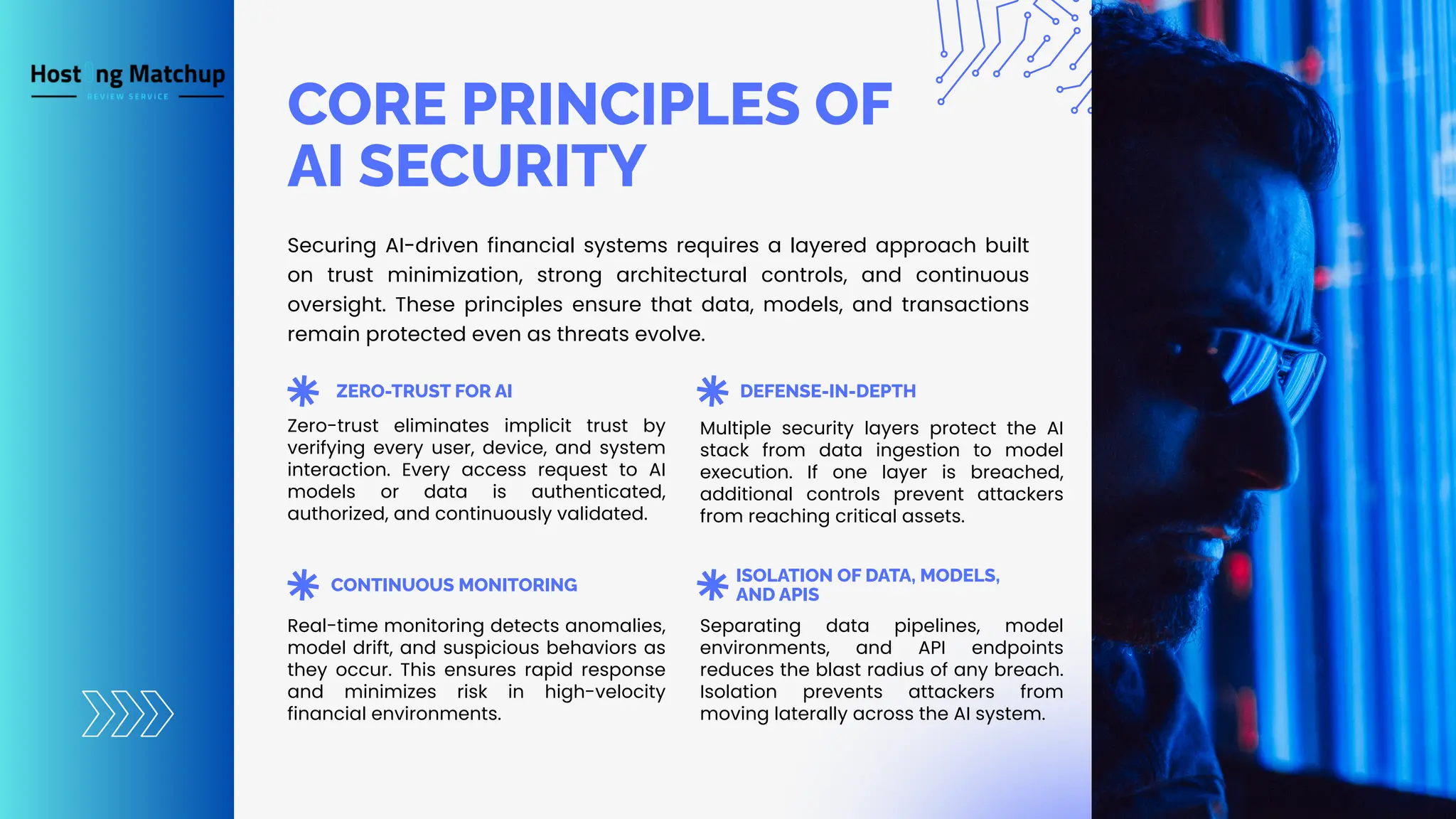

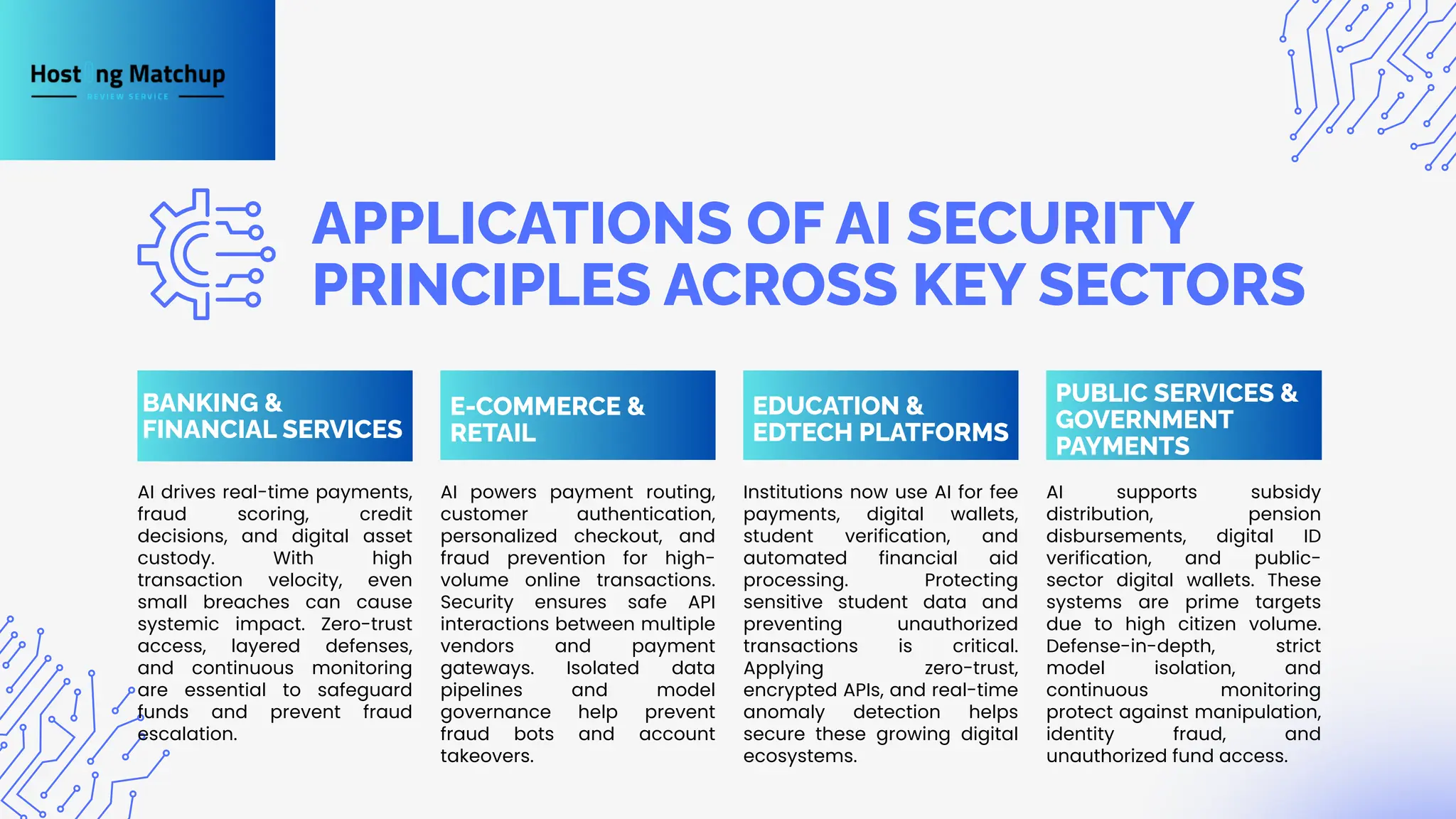

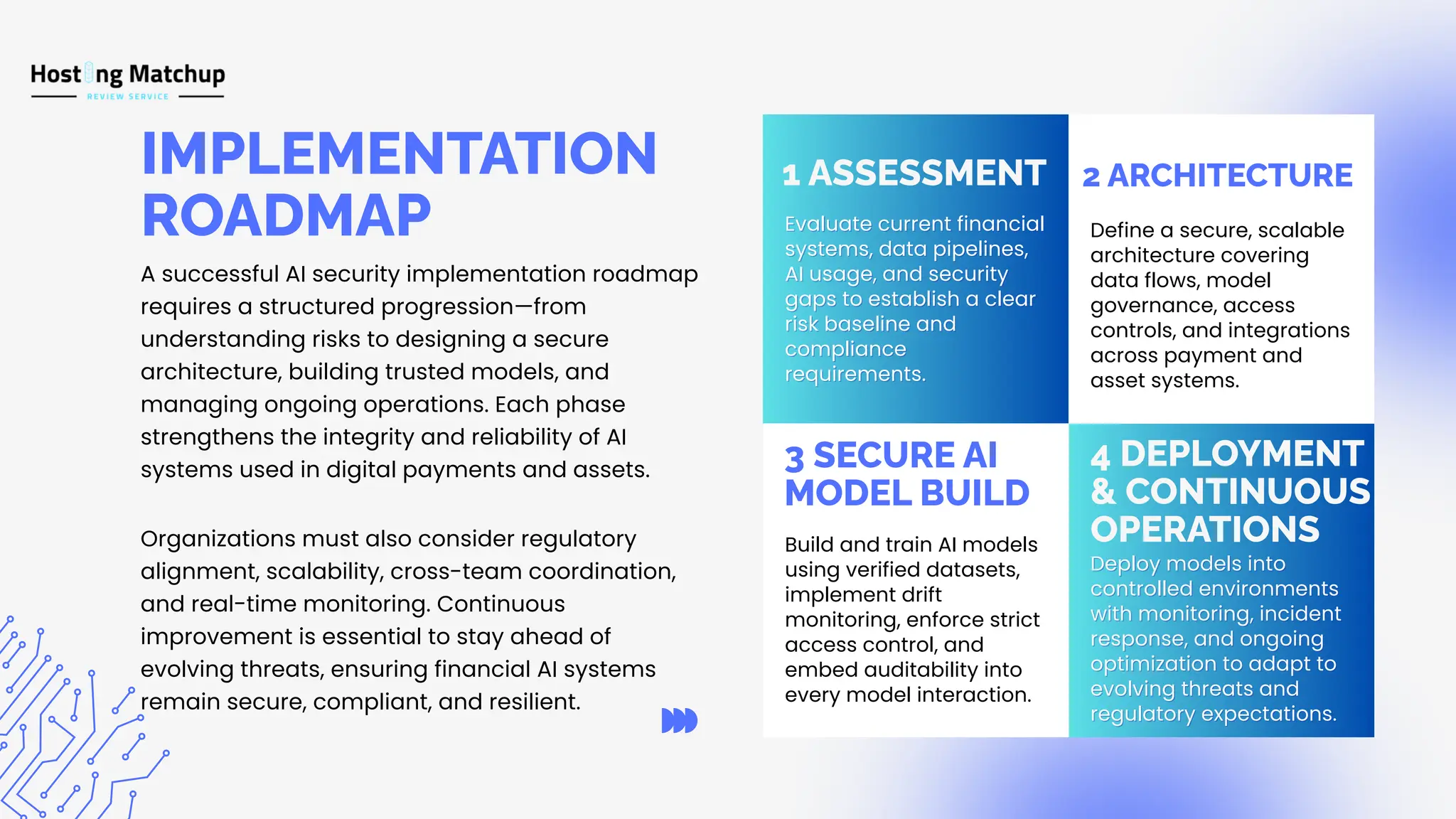

This presentation explores how to secure AI-driven financial infrastructure, including digital payments and digital assets. It explains key risks, security principles, and real-world applications across finance, e-commerce, public services, and education. Topics covered: – AI security fundamentals – Zero-trust architecture – Defense-in-depth model – Securing AI models and data pipelines – Protecting digital payment systems – Digital asset security – AIOps for continuous monitoring – Sector-wise use cases – Implementation roadmap – Key takeaways and case studies If you want to understand how AI, cybersecurity, and financial technology come together, this deck gives you a clear and practical overview.