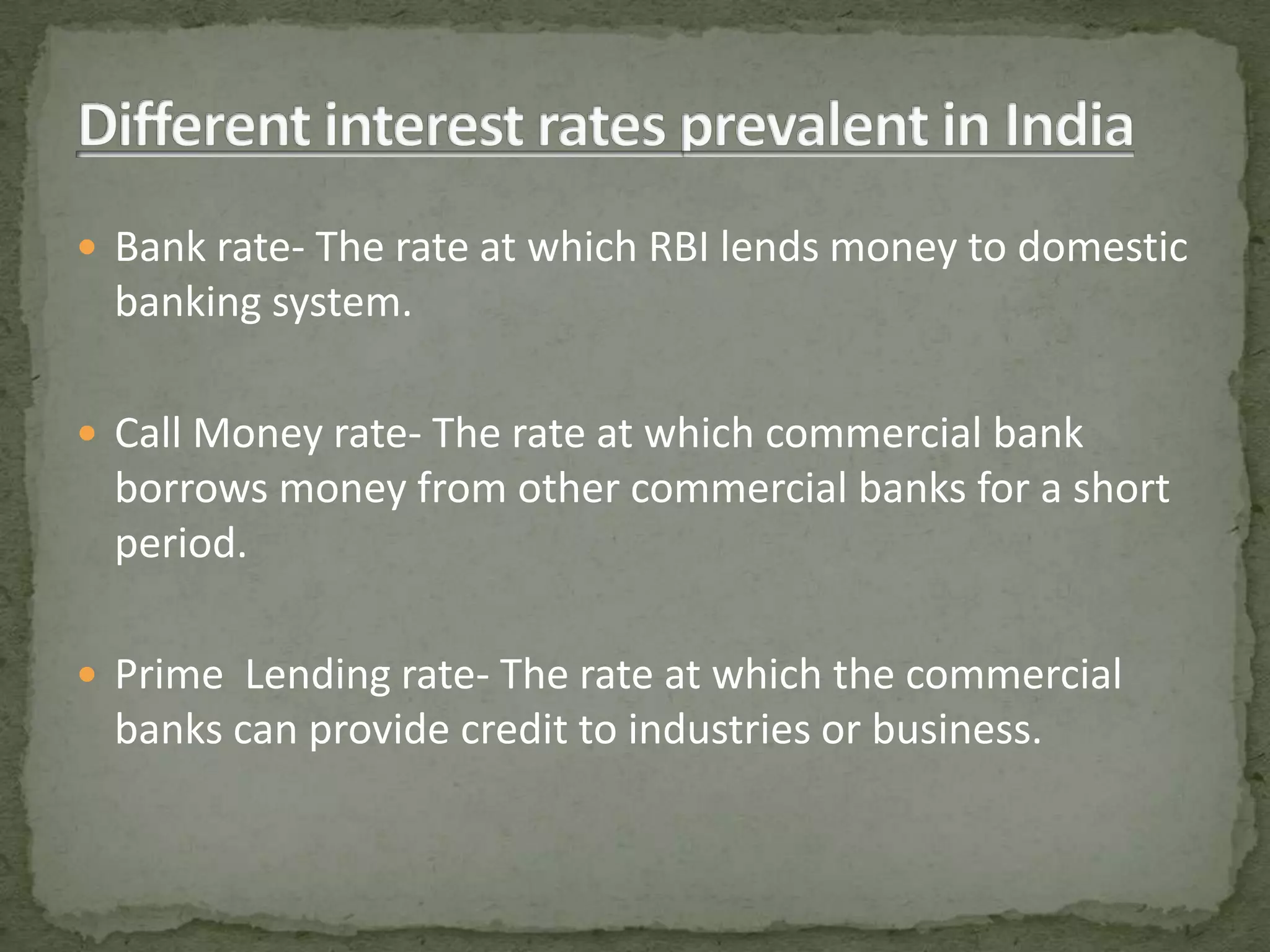

The document summarizes India's monetary policy. It discusses the goals of monetary policy as achieving low and stable inflation while promoting economic growth. It outlines the various interest rates set by the Reserve Bank of India and tools used to regulate money supply such as cash reserve ratio and statutory liquidity ratio. While monetary policy can help reduce inflation and stabilize the economy, it has limitations in predicting inflationary pressures and ensuring long-term growth. The document concludes by emphasizing the need for monetary policy to support agricultural growth, infrastructure development, and other priorities to ensure inclusive development.