在 MetaTrader 5 中应用费歇尔变换和逆费歇尔变换进行市场分析

简介

本文介绍了在金融市场中运用的费歇尔变换和逆费歇尔变换。

2010 年 10 月期的 "Stocks and Commodities"(股票与商品)杂志发表了平滑 RSI 逆费歇尔变换指标的 MQL5 版的实施,意味着费歇尔变换理论投入实践。通过使用基于费歇尔指标的信号的 EA 交易回测了指标盈利能力。

本文以在互联网上找到的 J.F.Ehlers 著作与文章为基础。本文的末尾列出了所有参考资文献。

1. 高斯概率密度函数与市场周期的关系

价格具有正态概率密度函数是一个常见的假定。

这意味着价格与平均值的背离可描述为著名的高斯钟:

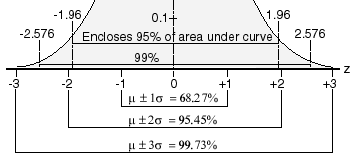

图 1. 高斯钟

我提到了正态概率密度函数。为了充分理解,让我们介绍几种想法和数学公式,希望大多数读者都能理解它们。

查阅 Merriam-Webster(韦伯)字典,probability(概率) 的定义如下

- The ratio of the number of outcomes in an exhaustive set of equally likely outcomes that produce a given event to the total number of possible outcomes or(在一组无遗漏的机会均等的结果中产生指定事件的结果的数量与可能的结果的总数量之比,或者)

- The chance that a given event will occur(发生指定事件的机会)。

随机变量 指其值来自某类随机过程的测量的变量。在我们的案例中,随机变量是资产的价格。

最后,PDF 是 Probability Density Function(概率密度函数)的缩写 - 该函数描述一个随机变量 X(再一次指出,在我们的案例中为价格)的值为某个可能值范围中的值的概率。产生于高斯分布或正态分布 的随机变量值是一种经常用于描述现实世界中趋向于围绕单个平均值聚集的随机变量的概率分布。

从数学上来讲,随机变量 X 在区间 [a,b] 内取值的概率定义为一个积分:

![]()

这表示曲线 f(x) 下方从 a 到 b 的面积。概率以从 0 到 100% 或从 0 至 1.00 的方式表示,因此有一个限制,即曲线 f(x) 下的总面积必须等于 1(概率的总和):

![]()

现在,让我们回到图 1 的下半部分:

图 2. 高斯钟标准方差

在这里,您可以看到在平均值 +/- 1-3 标准方差(西格马)下的值占有的百分比。在高斯概率分布函数中,68.27% 的发生情况落在平均值 +/- 一倍标准方差的范围内,95.45% 落在平均值 +/- 两倍标准方差的范围内,99.73% 落在平均值 +/- 三倍标准方差的范围内。

您认为实际市场数据会是这种情况吗?完成不是。当我们观察市场价格时,我们可以假定图表看起来像一个方波 - 当突破阻力位或支撑位后,大的订单会形成上升或下降到下一支撑/阻力位的价格趋势。这是为什么可以通过方波或正弦波对市场进行建模,并且有极好的近似性的原因。

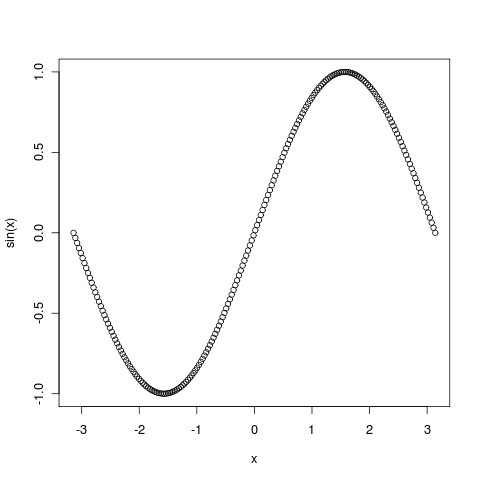

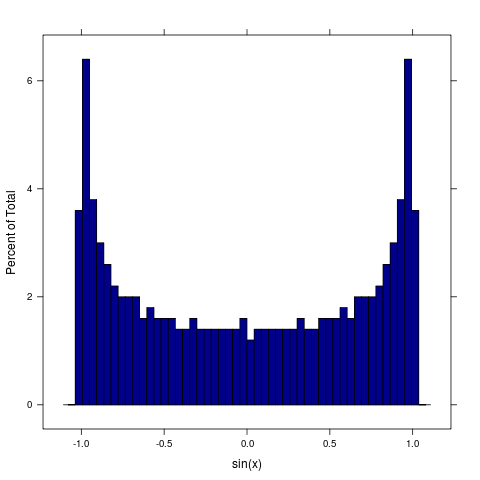

请观察下面的正弦图:

图 3. 正弦图

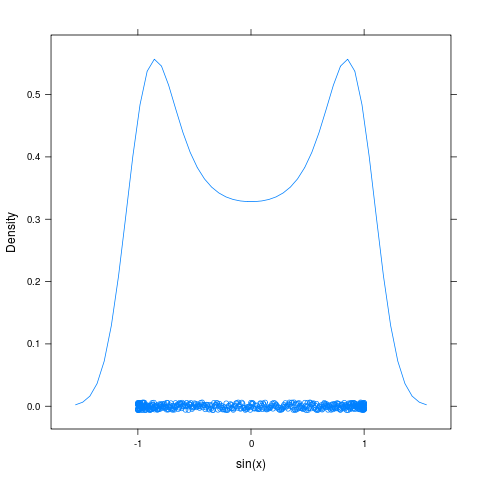

您应注意到,在现实世界中,大多数交易是在接近支撑位和阻力位的地方进行的,这看起来相当自然。现在,我将绘制一个正弦波密度图。您可以想像我们将图 3 向右旋转 90 度,让构成图形的所有圆圈掉落在地上:

图 4. 正弦曲线密度图

您可能注意到,最大密度出现在最左侧和最右侧。这似乎与先前的陈述一致,即大多数交易是在非常靠近阻力位和支撑位的地方进行的。让我们通过绘制一个直方图来查看发生情况的百分比:

图 5. 正弦曲线密度直方图

它看起来像高斯钟吗?不是非常像。前三根和后三根柱似乎有最大的出现可能性。

J.F. Ehlers 在其 "Сybernetic analysis for stocks and futures"(股票与期货控制分析)一书中描述了一个实验,在其中他分析了 15 年里的美国国债。他应用了标准化的 10 柱通道,测量了 100 个区间里的价格位置,统计价格落在每个区间中的次数。此概率分布的结果和正弦波非常类似。

2. 费歇尔变换及其在时间序列中的应用

因为我们知道一个市场周期的概率密度函数并不会让我们想到高斯分布,而是一种正弦波的概率密度函数,并且大多数指标假定市场周期的概率密度函数为高斯分布,我们需要一种方式来“纠正”。解决方法是使用费歇尔变换。费歇尔变换将任何波形的概率密度函数转换为近似的高斯分布。

费歇尔变换的等式为:

![]() ,

,

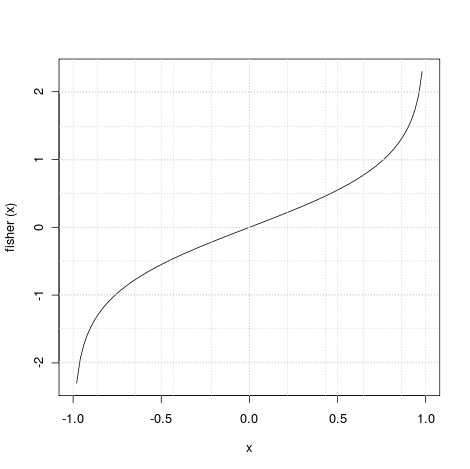

图 6. 费歇尔变换

我说过费歇尔变换的输出是近似的高斯概率密度函数。为了对其进行解释,值得看一看图 6。

当输入数据接近其平均值时,增益接近 1(参见 |X<0.5| 的图)。在另一方面,当标准化后的输入接近任何一个极限时,输出被大大放大(参见 0.5<|x|<1 的图)。在实际中,您可能想在出现最多背离时增大“相似高斯”的尾部 - 这是变换后的概率密度函数确实出现的情况。

我们如何在交易中应用费歇尔变换?首先,由于 |x|<1 的约束,价格必须标准化到这个范围。当标准化后的价格经过费歇尔变换处理之后,极端价格变动变得相对罕见。这意味着费歇尔变换捕捉到这些极端价格变动,并且允许我们依据这些极值进行交易。

3. 用 MQL5 编写的费歇尔变换

在 Ehlers 的 "Cybernetic Analysis for Stocks and Futures"(股票与期货控制分析)一书中描述了费歇尔变换指标的源代码。

已经用 MQL4 实施了该指标,我将其转换为 MQL5。指标使用中间价 (H+L)/2,我使用 iMA() 函数从历史记录中提取中间价。

首先,价格被标准化到 10 根柱内,并且将标准化后的价格进行费歇尔变换处理。

//+------------------------------------------------------------------+ //| FisherTransform.mq5 | //| Copyright 2011, Investeo.pl | //| http://www.investeo.pl | //+------------------------------------------------------------------+ #property copyright "Copyright 2011, Investeo.pl" #property link "http://www.investeo.pl" #property version "1.00" #property indicator_separate_window #property description "MQL5 version of Fisher Transform indicator" #property indicator_buffers 4 #property indicator_level1 0 #property indicator_levelcolor Silver #property indicator_plots 2 #property indicator_type1 DRAW_LINE #property indicator_color1 Red #property indicator_width1 1 #property indicator_type2 DRAW_LINE #property indicator_color2 Blue #property indicator_width2 1 double Value1[]; double Fisher[]; double Trigger[]; input int Len=10; double medianbuff[]; int hMedian; //+------------------------------------------------------------------+ //| Custom indicator initialization function | //+------------------------------------------------------------------+ int OnInit() { //--- indicator buffers mapping SetIndexBuffer(0,Fisher,INDICATOR_DATA); SetIndexBuffer(1,Trigger,INDICATOR_DATA); SetIndexBuffer(2,Value1,INDICATOR_CALCULATIONS); SetIndexBuffer(3,medianbuff,INDICATOR_CALCULATIONS); ArraySetAsSeries(Fisher,true); ArraySetAsSeries(Trigger,true); ArraySetAsSeries(Value1,true); ArraySetAsSeries(medianbuff,true); hMedian = iMA(_Symbol,PERIOD_CURRENT,1,0,MODE_SMA,PRICE_MEDIAN); if(hMedian==INVALID_HANDLE) { //--- tell about the failure and output the error code PrintFormat("Failed to create handle of the iMA indicator for the symbol %s/%s, error code %d", _Symbol, EnumToString(PERIOD_CURRENT), GetLastError()); //--- the indicator is stopped early, if the returned value is negative return(-1); } //--- return(0); } //+------------------------------------------------------------------+ //| Custom indicator iteration function | //+------------------------------------------------------------------+ int OnCalculate(const int rates_total, const int prev_calculated, const datetime &time[], const double &open[], const double &high[], const double &low[], const double &close[], const long &tick_volume[], const long &volume[], const int &spread[]) { //--- int nLimit=MathMin(rates_total-Len-1,rates_total-prev_calculated); int copied = CopyBuffer(hMedian,0,0,nLimit,medianbuff); if (copied!=nLimit) return (-1); nLimit--; for(int i=nLimit; i>=0; i--) { double price=medianbuff[i]; double MaxH = price; double MinL = price; for(int j=0; j<Len; j++) { double nprice=medianbuff[i+j]; if (nprice > MaxH) MaxH = nprice; if (nprice < MinL) MinL = nprice; } Value1[i]=0.5*2.0 *((price-MinL)/(MaxH-MinL)-0.5)+0.5*Value1[i+1]; if(Value1[i]>0.9999) Value1[i]=0.9999; if(Value1[i]<-0.9999) Value1[i]=-0.9999; Fisher[i]=0.25*MathLog((1+Value1[i])/(1-Value1[i]))+0.5*Fisher[i+1]; Trigger[i]=Fisher[i+1]; } //--- return value of prev_calculated for next call return(rates_total); } //+------------------------------------------------------------------+

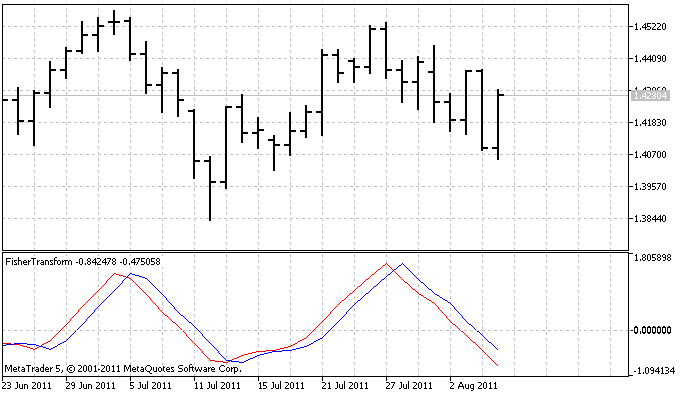

请注意,生成了尖锐的信号。

信号线是经过简单费歇尔变换处理的价格,延迟一根柱。

图 7. 费歇尔变换指标

4. 逆费歇尔变换及其在周期指标中的应用

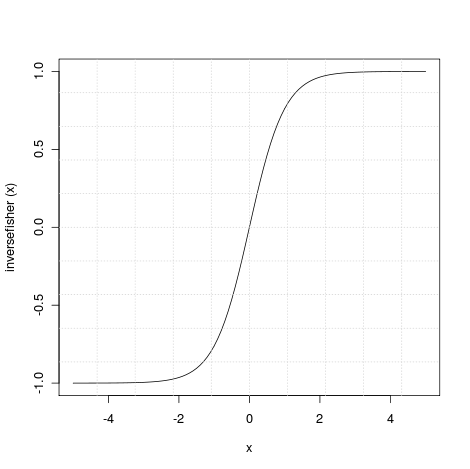

通过解费歇尔变换等式,用 y 求 x 获得逆费歇尔变换等式:

![]() ,

,

图 8. 逆费歇尔变换

与此函数相对应的变换是费歇尔变换的逆转。

对于 |x|>2,输入被压缩到不大于 1(负数为 -1,正数为 +1),对于 |x|<1,它几乎是线性关系,意味着输出与输入几乎有相同的特性。

结果,在将逆费歇尔变换应用到妥为准备的输入数据时,输出有很大的可能性为 -1 或 +1。这使逆费歇尔变换特别适合振荡指标。逆费歇尔变换可以通过提供清晰的买入或卖出信号来改进它们。

5. 用 MQL5 编写的逆费歇尔变换的例子

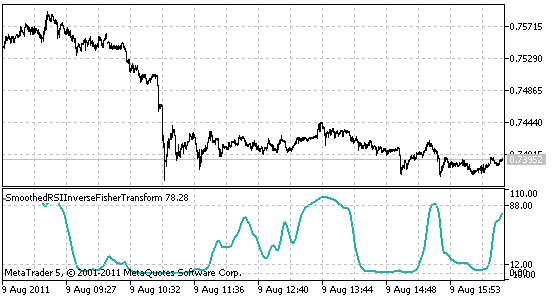

为了验证逆费歇尔变换,我实施了 Sylvain's Vervoort 于 2010 年 10 月期的 "Stocks and Commodities" (股票与商品)杂志上发表的平滑 RSI 逆费歇尔变换指标的 MQL5 版,并依据该指标建立了一个交易信号模块和 EA 交易程序。

很多交易平台已经实施了逆费歇尔变换指标,可在 traders.com 网站和 MQL5.com 代码库中获得其源代码。

因为在 MQL5 中没有 iRSIOnArray 函数,我在指标代码中添加了该函数。与原始指标的唯一不同之处在于默认的 RSIPeriod 设置为 21,而 EMAPeriod 设置为 34,因为对于我们的设置 (EURUSD 1H),它的运行更好。您可以将其改为默认的 RSIPeriod 4 和 EMAPeriod 4。

//+------------------------------------------------------------------+ //| SmoothedRSIInverseFisherTransform.mq5 | //| Copyright 2011, Investeo.pl | //| http://www.investeo.pl | //+------------------------------------------------------------------+ #property copyright "Copyright 2011, Investeo.pl" #property link "http://www.investeo.pl" #property version "1.00" #property indicator_separate_window #include <MovingAverages.mqh> #property description "MQL5 version of Silvain Vervoort's Inverse RSI" #property indicator_minimum -10 #property indicator_maximum 110 #property indicator_buffers 16 #property indicator_level1 12 #property indicator_level2 88 #property indicator_levelcolor Silver #property indicator_plots 1 #property indicator_type1 DRAW_LINE #property indicator_color1 LightSeaGreen #property indicator_width1 2 int ma_period=10; // period of ma int ma_shift=0; // shift ENUM_MA_METHOD ma_method=MODE_LWMA; // type of smoothing ENUM_APPLIED_PRICE applied_price=PRICE_CLOSE; // type of price double wma0[]; double wma1[]; double wma2[]; double wma3[]; double wma4[]; double wma5[]; double wma6[]; double wma7[]; double wma8[]; double wma9[]; double ema0[]; double ema1[]; double rainbow[]; double rsi[]; double bufneg[]; double bufpos[]; double srsi[]; double fish[]; int hwma0; int wma1weightsum; int wma2weightsum; int wma3weightsum; int wma4weightsum; int wma5weightsum; int wma6weightsum; int wma7weightsum; int wma8weightsum; int wma9weightsum; extern int RSIPeriod=21; extern int EMAPeriod=34; //+------------------------------------------------------------------+ //| Custom indicator initialization function | //+------------------------------------------------------------------+ int OnInit() { SetIndexBuffer(0,fish,INDICATOR_DATA); SetIndexBuffer(1,wma0,INDICATOR_CALCULATIONS); SetIndexBuffer(2,wma1,INDICATOR_CALCULATIONS); SetIndexBuffer(3,wma2,INDICATOR_CALCULATIONS); SetIndexBuffer(4,wma3,INDICATOR_CALCULATIONS); SetIndexBuffer(5,wma4,INDICATOR_CALCULATIONS); SetIndexBuffer(6,wma5,INDICATOR_CALCULATIONS); SetIndexBuffer(7,wma6,INDICATOR_CALCULATIONS); SetIndexBuffer(8,wma7,INDICATOR_CALCULATIONS); SetIndexBuffer(9,wma8,INDICATOR_CALCULATIONS); SetIndexBuffer(10,wma9,INDICATOR_CALCULATIONS); SetIndexBuffer(11,rsi,INDICATOR_CALCULATIONS); SetIndexBuffer(12,ema0,INDICATOR_CALCULATIONS); SetIndexBuffer(13,srsi,INDICATOR_CALCULATIONS); SetIndexBuffer(14,ema1,INDICATOR_CALCULATIONS); SetIndexBuffer(15,rainbow,INDICATOR_CALCULATIONS); ArraySetAsSeries(fish,true); ArraySetAsSeries(wma0,true); ArraySetAsSeries(wma1,true); ArraySetAsSeries(wma2,true); ArraySetAsSeries(wma3,true); ArraySetAsSeries(wma4,true); ArraySetAsSeries(wma5,true); ArraySetAsSeries(wma6,true); ArraySetAsSeries(wma7,true); ArraySetAsSeries(wma8,true); ArraySetAsSeries(wma9,true); ArraySetAsSeries(ema0,true); ArraySetAsSeries(ema1,true); ArraySetAsSeries(rsi,true); ArraySetAsSeries(srsi,true); ArraySetAsSeries(rainbow,true); PlotIndexSetDouble(0,PLOT_EMPTY_VALUE,0.0); PlotIndexSetInteger(0,PLOT_DRAW_BEGIN,0); //--- sets drawing line empty value PlotIndexSetDouble(0,PLOT_EMPTY_VALUE,0.0); //--- digits IndicatorSetInteger(INDICATOR_DIGITS,2); hwma0=iMA(_Symbol,PERIOD_CURRENT,2,ma_shift,ma_method,applied_price); if(hwma0==INVALID_HANDLE) { //--- tell about the failure and output the error code PrintFormat("Failed to create handle of the iMA indicator for the symbol %s/%s, error code %d", _Symbol, EnumToString(PERIOD_CURRENT), GetLastError()); //--- the indicator is stopped early, if the returned value is negative return(-1); } return(0); } //+------------------------------------------------------------------+ //| Custom indicator iteration function | //+------------------------------------------------------------------+ int OnCalculate(const int rates_total, const int prev_calculated, const datetime &time[], const double &open[], const double &high[], const double &low[], const double &close[], const long &tick_volume[], const long &volume[], const int &spread[]) { //--- int nLimit; if(rates_total!=prev_calculated) { CopyBuffer(hwma0,0,0,rates_total-prev_calculated+1,wma0); LinearWeightedMAOnBuffer(rates_total,prev_calculated,0,2,wma0,wma1,wma1weightsum); LinearWeightedMAOnBuffer(rates_total,prev_calculated,0,2,wma1,wma2,wma2weightsum); LinearWeightedMAOnBuffer(rates_total,prev_calculated,0,2,wma2,wma3,wma3weightsum); LinearWeightedMAOnBuffer(rates_total,prev_calculated,0,2,wma3,wma4,wma4weightsum); LinearWeightedMAOnBuffer(rates_total,prev_calculated,0,2,wma4,wma5,wma5weightsum); LinearWeightedMAOnBuffer(rates_total,prev_calculated,0,2,wma5,wma6,wma6weightsum); LinearWeightedMAOnBuffer(rates_total,prev_calculated,0,2,wma6,wma7,wma7weightsum); LinearWeightedMAOnBuffer(rates_total,prev_calculated,0,2,wma7,wma8,wma8weightsum); LinearWeightedMAOnBuffer(rates_total,prev_calculated,0,2,wma8,wma9,wma9weightsum); if(prev_calculated==0) nLimit=rates_total-1; else nLimit=rates_total-prev_calculated+1; for(int i=nLimit; i>=0; i--) rainbow[i]=(5*wma0[i]+4*wma1[i]+3*wma2[i]+2*wma3[i]+wma4[i]+wma5[i]+wma6[i]+wma7[i]+wma8[i]+wma9[i])/20.0; iRSIOnArray(rates_total,prev_calculated,11,RSIPeriod,rainbow,rsi,bufpos,bufneg); ExponentialMAOnBuffer(rates_total,prev_calculated,12,EMAPeriod,rsi,ema0); ExponentialMAOnBuffer(rates_total,prev_calculated,13,EMAPeriod,ema0,ema1); for(int i=nLimit; i>=0; i--) srsi[i]=ema0[i]+(ema0[i]-ema1[i]); for(int i=nLimit; i>=0; i--) fish[i]=((MathExp(2*srsi[i])-1)/(MathExp(2*srsi[i])+1)+1)*50; } //--- return value of prev_calculated for next call return(rates_total); } //+------------------------------------------------------------------+ //+------------------------------------------------------------------+ /// Calculating RSI //+------------------------------------------------------------------+ int iRSIOnArray(const int rates_total,const int prev_calculated,const int begin, const int period,const double &price[],double &buffer[],double &bpos[],double &bneg[]) { int i; //--- check for data ArrayResize(bneg,rates_total); ArrayResize(bpos,rates_total); if(period<=1 || rates_total-begin<period) return(0); //--- save as_series flags bool as_series_price=ArrayGetAsSeries(price); bool as_series_buffer=ArrayGetAsSeries(buffer); if(as_series_price) ArraySetAsSeries(price,false); if(as_series_buffer) ArraySetAsSeries(buffer,false); double diff=0.0; //--- check for rates count if(rates_total<=period) return(0); //--- preliminary calculations int ppos=prev_calculated-1; if(ppos<=begin+period) { //--- first RSIPeriod values of the indicator are not calculated for (i=0; i<begin; i++) { buffer[i]=0.0; bpos[i]=0.0; bneg[i]=0.0; } double SumP=0.0; double SumN=0.0; for(i=begin;i<=begin+period;i++) { buffer[i]=0.0; bpos[i]=0.0; bneg[i]=0.0; //PrintFormat("%f %f\n", price[i], price[i-1]); diff=price[i]-price[i-1]; SumP+=(diff>0?diff:0); SumN+=(diff<0?-diff:0); } //--- calculate first visible value bpos[begin+period]=SumP/period; bneg[begin+period]=SumN/period; if (bneg[begin+period]>0.0000001) buffer[begin+period]=0.1*((100.0-100.0/(1+bpos[begin+period]/bneg[begin+period]))-50); //--- prepare the position value for main calculation ppos=begin+period+1; } //--- the main loop of calculations for(i=ppos;i<rates_total && !IsStopped();i++) { diff=price[i]-price[i-1]; bpos[i]=(bpos[i-1]*(period-1)+((diff>0.0)?(diff):0.0))/period; bneg[i]=(bneg[i-1]*(period-1)+((diff<0.0)?(-diff):0.0))/period; if (bneg[i]>0.0000001) buffer[i]=0.1*((100.0-100.0/(1+bpos[i]/bneg[i]))-50); //Print(buffer[i]); } //--- restore as_series flags if(as_series_price) ArraySetAsSeries(price,true); if(as_series_buffer) ArraySetAsSeries(buffer,true); return(rates_total); } //+------------------------------------------------------------------+

图 9. 逆费歇尔变换指标

因为我仅仅表示了变换等式,您可能对费歇尔变换和逆费歇尔变换的来源有些疑惑。

当我为撰写本文而收集资料时,我对费歇尔如何得到这两个变换产生兴趣,但没有在互联网上找到任何信息。

但是当我观察费歇尔变换和逆费歇尔变换时,两个图都让我想到某些三角或双曲线函数(您能看出任何相似性吗?)。因为这些函数可以从欧拉公式推导出来,并且以欧拉数 'e' 来表示,我查阅了有关微积分学的书籍,并且反复确认:

![]() ,

,

![]() ,

,

并且因为我们知道可以通过以下等式获得双曲正切函数 tanh(x):

![]() ,

,

和...

![]()

是的,这些都是我在前面提供的相同等式。除去费歇尔变换的神秘面纱了!费歇尔变换是简单的反双曲正切函数 arctanh(x),而逆费歇尔变换是其反转,双曲正切函数 tanh(x)!

6. 交易信号模块

为了验证逆费歇尔变换,我依据逆费歇尔变换指标建立了一个交易信号模块。

您可以发现,可以将其用于查看以自定义指标为基础的交易模块。我使用 CiCustom 类的实例来保存逆费歇尔指标,并重写 CExpertSignal 类的四个虚拟方法:CheckOpenLong() 和 CheckOpenShort() 负责在没有未平仓位时生成信号,CheckReverseLong() 和 CheckReverseShort() 负责反向持仓。

//+------------------------------------------------------------------+ //| InverseFisherRSISmoothedSignal.mqh | //| Copyright © 2011, Investeo.pl | //| http://Investeo.pl | //| Version v01 | //+------------------------------------------------------------------+ #property tester_indicator "SmoothedRSIInverseFisherTransform.ex5" //+------------------------------------------------------------------+ //| include files | //+------------------------------------------------------------------+ #include <Expert\ExpertSignal.mqh> //+------------------------------------------------------------------+ //| Class CSignalInverseFisherRSISmoothed. | //| Description: Class generating InverseFisherRSISmoothed signals | //| Derived from CExpertSignal. | //+------------------------------------------------------------------+ // wizard description start //+------------------------------------------------------------------+ //| Description of the class | //| Title=Signal on the Inverse Fisher RSI Smoothed Indicator | //| Type=SignalAdvanced | //| Name=InverseFisherRSISmoothed | //| Class=CSignalInverseFisherRSISmoothed | //| Page= | //+------------------------------------------------------------------+ // wizard description end //+------------------------------------------------------------------+ //+------------------------------------------------------------------+ //| CSignalInverseFisherRSISmoothed class | //| Purpose: A class of a module of trade signals, | //| on InverseFisherRSISmoothed | //+------------------------------------------------------------------+ class CSignalInverseFisherRSISmoothed : public CExpertSignal { protected: CiCustom m_invfish; double m_stop_loss; public: CSignalInverseFisherRSISmoothed(); //--- methods initialize protected data virtual bool InitIndicators(CIndicators *indicators); virtual bool ValidationSettings(); //--- virtual bool CheckOpenLong(double &price,double &sl,double &tp,datetime &expiration); virtual bool CheckReverseLong(double &price,double &sl,double &tp,datetime &expiration); virtual bool CheckOpenShort(double &price,double &sl,double &tp,datetime &expiration); virtual bool CheckReverseShort(double &price,double &sl,double &tp,datetime &expiration); protected: bool InitInvFisher(CIndicators *indicators); double InvFish(int ind) { return(m_invfish.GetData(0,ind)); } }; //+------------------------------------------------------------------+ //| Constructor CSignalInverseFisherRSISmoothed. | //| INPUT: no. | //| OUTPUT: no. | //| REMARK: no. | //+------------------------------------------------------------------+ void CSignalInverseFisherRSISmoothed::CSignalInverseFisherRSISmoothed() { //--- initialize protected data } //+------------------------------------------------------------------+ //| Validation settings protected data. | //| INPUT: no. | //| OUTPUT: true-if settings are correct, false otherwise. | //| REMARK: no. | //+------------------------------------------------------------------+ bool CSignalInverseFisherRSISmoothed::ValidationSettings() { //--- initial data checks if(!CExpertSignal::ValidationSettings()) return(false); //--- ok return(true); } //+------------------------------------------------------------------+ //| Create Inverse Fisher custom indicator. | //| INPUT: indicators -pointer of indicator collection. | //| OUTPUT: true-if successful, false otherwise. | //| REMARK: no. | //+------------------------------------------------------------------+ bool CSignalInverseFisherRSISmoothed::InitInvFisher(CIndicators *indicators) { //--- check pointer printf(__FUNCTION__+": initializing Inverse Fisher Indicator"); if(indicators==NULL) return(false); //--- add object to collection if(!indicators.Add(GetPointer(m_invfish))) { printf(__FUNCTION__+": error adding object"); return(false); } MqlParam invfish_params[]; ArrayResize(invfish_params,2); invfish_params[0].type=TYPE_STRING; invfish_params[0].string_value="SmoothedRSIInverseFisherTransform"; //--- applied price invfish_params[1].type=TYPE_INT; invfish_params[1].integer_value=PRICE_CLOSE; //--- initialize object if(!m_invfish.Create(m_symbol.Name(),m_period,IND_CUSTOM,2,invfish_params)) { printf(__FUNCTION__+": error initializing object"); return(false); } m_invfish.NumBuffers(18); //--- ok return(true); } //+------------------------------------------------------------------+ //| Create indicators. | //| INPUT: indicators -pointer of indicator collection. | //| OUTPUT: true-if successful, false otherwise. | //| REMARK: no. | //+------------------------------------------------------------------+ bool CSignalInverseFisherRSISmoothed::InitIndicators(CIndicators *indicators) { //--- check pointer if(indicators==NULL) return(false); //--- initialization of indicators and timeseries of additional filters if(!CExpertSignal::InitIndicators(indicators)) return(false); //--- create and initialize SAR indicator if(!InitInvFisher(indicators)) return(false); m_stop_loss = 0.0010; //--- ok printf(__FUNCTION__+": all inidicators properly initialized."); return(true); } //+------------------------------------------------------------------+ //| Check conditions for long position open. | //| INPUT: price - reference for price, | //| sl - reference for stop loss, | //| tp - reference for take profit, | //| expiration - reference for expiration. | //| OUTPUT: true-if condition performed, false otherwise. | //| REMARK: no. | //+------------------------------------------------------------------+ bool CSignalInverseFisherRSISmoothed::CheckOpenLong(double &price,double &sl,double &tp,datetime &expiration) { printf(__FUNCTION__+" checking signal"); int idx=StartIndex(); //--- price=0.0; tp =0.0; //--- if(InvFish(idx+2)<12.0 && InvFish(idx+1)>12.0) { printf(__FUNCTION__ + " BUY SIGNAL"); return true; } else printf(__FUNCTION__ + " NO SIGNAL"); //--- return false; } //+------------------------------------------------------------------+ //| Check conditions for long position close. | //| INPUT: price - refernce for price. | //| OUTPUT: true-if condition performed, false otherwise. | //| REMARK: no. | //+------------------------------------------------------------------+ bool CSignalInverseFisherRSISmoothed::CheckReverseLong(double &price,double &sl,double &tp,datetime &expiration) { long tickCnt[1]; int ticks=CopyTickVolume(Symbol(), 0, 0, 1, tickCnt); if (ticks!=1 || tickCnt[0]!=1) return false; int idx=StartIndex(); price=0.0; // sl =m_symbol.NormalizePrice(m_symbol.Bid()+20*m_stop_level); //--- if((InvFish(idx+1)>88.0 && InvFish(idx)<88.0) || (InvFish(idx+2)>88.0 && InvFish(idx+1)<88.0) || (InvFish(idx+2)>12.0 && InvFish(idx+1)<12.0)) { printf(__FUNCTION__ + " REVERSE LONG SIGNAL"); return true; } else printf(__FUNCTION__ + " NO SIGNAL"); return false; } //+------------------------------------------------------------------+ //| Check conditions for short position open. | //| INPUT: price - refernce for price, | //| sl - refernce for stop loss, | //| tp - refernce for take profit, | //| expiration - refernce for expiration. | //| OUTPUT: true-if condition performed, false otherwise. | //| REMARK: no. | //+------------------------------------------------------------------+ bool CSignalInverseFisherRSISmoothed::CheckOpenShort(double &price,double &sl,double &tp,datetime &expiration) { printf(__FUNCTION__+" checking signal"); int idx=StartIndex(); //--- price=0.0; sl = 0.0; //--- if(InvFish(idx+2)>88.0 && InvFish(idx+1)<88.0) {printf(__FUNCTION__ + " SELL SIGNAL"); return true;} else printf(__FUNCTION__ + " NO SIGNAL"); //--- return false; } //+------------------------------------------------------------------+ //| Check conditions for short position close. | //| INPUT: price - refernce for price. | //| OUTPUT: true-if condition performed, false otherwise. | //| REMARK: no. | //+------------------------------------------------------------------+ bool CSignalInverseFisherRSISmoothed::CheckReverseShort(double &price,double &sl,double &tp,datetime &expiration) { long tickCnt[1]; int ticks=CopyTickVolume(Symbol(), 0, 0, 1, tickCnt); if (ticks!=1 || tickCnt[0]!=1) return false; int idx=StartIndex(); price=0.0; //--- if((InvFish(idx+1)<12.0 && InvFish(idx)>12.0) || (InvFish(idx+2)<12.0 && InvFish(idx+1)>12.0) || (InvFish(idx+2)<88.0 && InvFish(idx+1)>88.0)) { printf(__FUNCTION__ + " REVERSE SHORT SIGNAL"); return true; } else printf(__FUNCTION__ + " NO SIGNAL"); return false; }

7. EA 交易

为了验证逆费歇尔变换,我建立了一个使用前述交易信号模块的标准 EA 交易。

我还添加了来自《MQL5 向导:如何创建未平仓位的追踪模块》一文的跟踪止损模块。

//+------------------------------------------------------------------+ //| InvRSIFishEA.mq5 | //| Copyright 2011, MetaQuotes Software Corp. | //| https://www.mql5.com | //+------------------------------------------------------------------+ #property copyright "Copyright 2011, MetaQuotes Software Corp." #property link "https://www.mql5.com" #property version "1.00" //+------------------------------------------------------------------+ //| Include | //+------------------------------------------------------------------+ #include <Expert\Expert.mqh> //--- available signals #include <Expert\Signal\MySignal\InverseFisherRSISmoothedSignal.mqh> //--- available trailing #include <Expert\Trailing\SampleTrailing.mqh> //--- available money management #include <Expert\Money\MoneyFixedLot.mqh> //+------------------------------------------------------------------+ //| Inputs | //+------------------------------------------------------------------+ //--- inputs for expert input string Expert_Title ="InvRSIFishEA"; // Document name ulong Expert_MagicNumber =7016; // bool Expert_EveryTick =true; // //--- inputs for main signal input int Signal_ThresholdOpen =10; // Signal threshold value to open [0...100] input int Signal_ThresholdClose=10; // Signal threshold value to close [0...100] input double Signal_PriceLevel =0.0; // Price level to execute a deal input double Signal_StopLevel =0.0; // Stop Loss level (in points) input double Signal_TakeLevel =0.0; // Take Profit level (in points) input int Signal_Expiration =0; // Expiration of pending orders (in bars) input double Signal__Weight =1.0; // InverseFisherRSISmoothed Weight [0...1.0] //--- inputs for money input double Money_FixLot_Percent =10.0; // Percent input double Money_FixLot_Lots =0.2; // Fixed volume //+------------------------------------------------------------------+ //| Global expert object | //+------------------------------------------------------------------+ CExpert ExtExpert; //+------------------------------------------------------------------+ //| Initialization function of the expert | //+------------------------------------------------------------------+ int OnInit() { //--- Initializing expert if(!ExtExpert.Init(Symbol(),Period(),Expert_EveryTick,Expert_MagicNumber)) { //--- failed printf(__FUNCTION__+": error initializing expert"); ExtExpert.Deinit(); return(-1); } //--- Creating signal CSignalInverseFisherRSISmoothed *signal=new CSignalInverseFisherRSISmoothed; if(signal==NULL) { //--- failed printf(__FUNCTION__+": error creating signal"); ExtExpert.Deinit(); return(-2); } //--- ExtExpert.InitSignal(signal); signal.ThresholdOpen(Signal_ThresholdOpen); signal.ThresholdClose(Signal_ThresholdClose); signal.PriceLevel(Signal_PriceLevel); signal.StopLevel(Signal_StopLevel); signal.TakeLevel(Signal_TakeLevel); signal.Expiration(Signal_Expiration); //--- Creation of trailing object CSampleTrailing *trailing=new CSampleTrailing; trailing.StopLevel(0); trailing.Profit(20); if(trailing==NULL) { //--- failed printf(__FUNCTION__+": error creating trailing"); ExtExpert.Deinit(); return(-4); } //--- Add trailing to expert (will be deleted automatically)) if(!ExtExpert.InitTrailing(trailing)) { //--- failed printf(__FUNCTION__+": error initializing trailing"); ExtExpert.Deinit(); return(-5); } //--- Set trailing parameters //--- Creation of money object CMoneyFixedLot *money=new CMoneyFixedLot; if(money==NULL) { //--- failed printf(__FUNCTION__+": error creating money"); ExtExpert.Deinit(); return(-6); } //--- Add money to expert (will be deleted automatically)) if(!ExtExpert.InitMoney(money)) { //--- failed printf(__FUNCTION__+": error initializing money"); ExtExpert.Deinit(); return(-7); } //--- Set money parameters money.Percent(Money_FixLot_Percent); money.Lots(Money_FixLot_Lots); //--- Check all trading objects parameters if(!ExtExpert.ValidationSettings()) { //--- failed ExtExpert.Deinit(); return(-8); } //--- Tuning of all necessary indicators if(!ExtExpert.InitIndicators()) { //--- failed printf(__FUNCTION__+": error initializing indicators"); ExtExpert.Deinit(); return(-9); } //--- ok return(0); } //+------------------------------------------------------------------+ //| Deinitialization function of the expert | //+------------------------------------------------------------------+ void OnDeinit(const int reason) { ExtExpert.Deinit(); } //+------------------------------------------------------------------+ //| "Tick" event handler function | //+------------------------------------------------------------------+ void OnTick() { ExtExpert.OnTick(); } //+------------------------------------------------------------------+ //| "Trade" event handler function | //+------------------------------------------------------------------+ void OnTrade() { ExtExpert.OnTrade(); } //+------------------------------------------------------------------+ //| "Timer" event handler function | //+------------------------------------------------------------------+ void OnTimer() { ExtExpert.OnTimer(); } //+------------------------------------------------------------------+

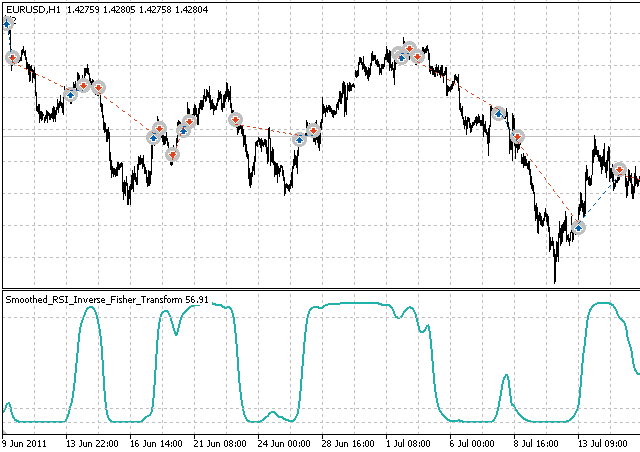

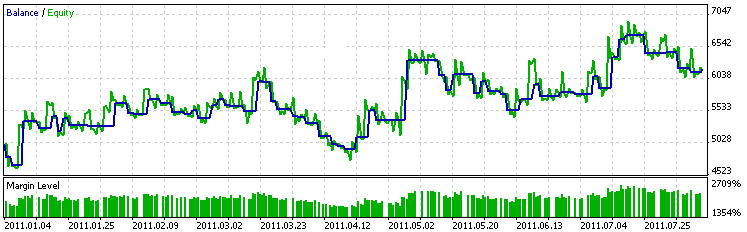

我必须承认,该 EA 交易并不是对每项资产、每个时间框架都是盈利的,但是我对其进行调整,使其对 EURUSD,在 1H 时间框架上具有很好的结果。

我鼓励读者尝试更改信号模块和指标设置,除了本文介绍的以外,您还可以找出更多能够盈利的 EA。

图 10. 逆费歇尔变换 EA

图 11. 逆费歇尔变换 EA 余额图

总结

我希望本文很好地介绍了费歇尔变换和逆费歇尔变换,并且给出了一种依据自定义指标建立信号交易模块的方法。

我使用了 Sylvain's Vervoort 平滑 RSI 逆费歇尔变换指标,但是事实上,您可以轻松地将逆费歇尔变换应用到任何振荡指标并依据本文建立 EA。

我也鼓励读者调整设置,从而依据我介绍的 EA 开发出一个盈利的 EA。我还在下面列出更多参考文献的外部链接。

参考文献

- 费歇尔变换

- 使用费歇尔变换

- 逆费歇尔变换

- 平滑 RSI 逆费歇尔变换