Export-Import Policy

Lalit Mohan Pant

Pal college of Technology & Management

Haldwani

Contents

Introduction

Why do we need export, brief history

Exim policy ,objectives

Export Promotion Measures

Import Control in India

Pre 90s Exim Policy of India

Post 90s Exim Policy of India

Why do we need export

Export means trade across the political boundaries of different nation. No

Nation is self sufficient and had all the goods that it needs. This happens

because of climatic variation & unequal distribution of natural resources.

As a result, countries all over the world have become interdependent, which

necessitated foreign trade. A developing country like India with its fast

growing agricultural production to keep pace with the population to keep

pace with the population growth and growing Industrial infrastructure

needs high-import and this can be sustained only with fast export growth.

To meet the oil import bill, export is unavoidable. Thus, it is evident that

export promotion continues to be a major thrust area for the government.

Several measures have been under taken in the past for improving export

performance of the country. In India, Govt. has come out from time to time

with various policies on foreign trade to promote export thereby increasing

the Foreign Exchange Reserve. These policies are termed as Exim

Policy

Brief history

Import export act was introduced by gov during second

world war and it lasted for around 45 yrs and in June

1992 this act was superceded by the Foreign Trade

(Development & Regulation Act), 1992. . The basic

objective of this new act was to give effect to the new

liberalized export and import policy of the Govt. till 1985

annual policies were made but from 1985-92, three yr

policy was made and then 5 yr policy was made

coinciding with 5 yr plans 1992-97, 1997-02, 2002-07.

What is Exim Policy?

It contains policies in the sphere of Foreign trade

i.e. with respect to import & export from the

country and more especially export promotion

measures, policies and procedure related there to.

Export means selling abroad and import as

bringing into India, any goods and services

Objective of Exim Policy

Accelerating the countrys transition to a globally oriented

vibrant economy with a view to derive maximum benefits

from expanding global market opportunities;

Stimulating sustained economic growth

Enhancing the technological strength and efficiency

Encouraging the attainment of internationally accepted

standards of quality

Providing consumers with good quality products and

services at reasonable prices.

General provisions regarding export import

Exports and Imports free unless regulated

Compliance with Laws

Interpretation of Policy

Procedure:

Exemption from Policy/ Procedure

Principles of Restriction

Restricted Goods

Terms and Conditions of a Licence

Importer-Exporter Code Number

Exemption from Bank Guarantee

Clearance of Goods from Customs

EXPORT PROMOTION MEASURES

Policy measures

Institutional set up.

Import Facilitation for Export Production.

Cash subsidies.

Fiscal Incentives.

Foreign Exchange Facilities.

Export incentives

Export production units

Import Facilitation for Export Production

Export Promotion Capital Goods Scheme

Special Import Licences

Duty Free Licences under Duty Exemption Scheme

Duty free licences are issued as :

(1) Advance licence

(2) Advance Intermediate licence.

(3) Special Imprest licence.

(4) Licence for jobbing, repairing etc. for re-export.

(5) Licence under export production programme.

(6) Advance Release Order.

(7) Back to Back Inland Letter of Credit.

Export Incentives

Duty Exemption

Duty Drawback Scheme

DFRC (Duty free replenishment certificate)

DEPB( Duty entitlement pass book)

Deemed Exports

Export Production Units

Export Oriented Unit (EOU)

Special Economic Zones (SEZ)

Software Technology Parks (STP)

Electronic Hardware Technology Parks (EHTP)

Cash subsidies

Marketing development assistance

Air freight subsidy

Spices export promotion scheme

Jute externel marketing assistance

Financial assistance scheme agriculture

&meat exports

Financial assistance to marine products

exports

Fiscal incentives

Exemption from payment of central excise duty &

simplified procedure for clearance.

Exemption from sales tax

Exemptions & deductions under income tax

act,1961.

Duty draw back Scheme (DDS)

Cash Compensatory Support ( CCS )

International Price Reimbursement Scheme

(IPRS)

Import control regime

1956-57, restrictions on imports started as lot of imports were there as such gov

even had to import food grains for self fulfillment

Imports were classified into

Banned items ,Canalized items ,Restricted items, OGL

In 1966 ruppee was devalued by 36.5% By devaluation gov expressed the hope that

the devaluation would lead to expansion in export earnings as Indian goods will

become cheaper in international market on the other hands import would decline as

price of imported goods would increase.

Because of a rigid itemization of permissible imports, an element of inflexibility in

the pattern of utilization of imports was introduced. The transferability of licenses

among same and different industries was not permissible. This gave rise to an

expanding black market in import licenses. Therefore, the import allocation system

was so designed as to eliminate the possibility of all competition, either domestic or

foreign. The Govt of India has liberalized the import regime from time to time. At

present, practically all controls on import have been lifted. Under the new EXIM

policy 2002-07.

Comparison of Pre 90s & Post 90s Exim Policy

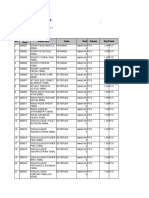

Year

Import Export

(Cr.)

(Cr.)

Trade

Bal.(Cr.)

1948-51

650

647

-3

Excess of Import due toPent-up demand of war.

Shortage of food & raw material due to

partition.

Import of capital goods due to starting

of hydro-electric & other projects.

1951-56

730

622

-108

Trade deficit was largely due to

programmes of industrialization which

gathered momentum and pushed up the

imports of capital goods.

No improvement in exports.

Year

Import Export

(Cr.)

(Cr.)

Trade

Bal.(Cr.)

1956-61

1080

613

-467

Excess of import due to setting of steel

plants,heavy expansion & renovation on

railways & modernization of many

industries.

Export lower than occur in second plan

which shows that export promotion drive

did not materialize.

1961-66

1224

747

-477

Excess of import due toRapid industrialization needs capital

goods as raw material.

Defence needs had increased due to

aggression by China & Pakistan.

Need of foodgrains due to failure of

crops in 1965-66.

Year

Import Export

(Cr.)

(Cr.)

Trade

Bal.(Cr.)

1966-69

(Annualplans)

5775

3708

-2067

Devaluation was resorted to essentiallyTo reduce volume of import.

To boost export.

Create favourable balance of trade and

balance of payment.

1969-74

1972

1810

-162

As a consequence of import restriction

policies with vigorous export promotion

measures ,during 1972-73 the country

had favourable balance of trade for first

time since independence.

But several international factors pushed

up

the

price

of

petroleum

product,steel,fertilizers etc.results low

magnitude of trade balance.

Year

(Cr.)

(Cr.)

Trade

Bal.(Cr.)

5540

4730

-810

Significant increase in export during

every year of this period.Export of

coffee,tea,cotton fabrics etc.recorded

substantial increase in this period.

But,Janta Government followed policy of

haphazard import liberalization results

decline trade balance from 1977-78.

1980-85 14,986 9051

-5935

Decline in POL imports was more than

by a big hike in non-POL imports as a

consequence of import liberalization.

1974-79

Import Export

Consequently, huge trade balance.

Year

Import Export

(Cr.)

(Cr.)

Trade

Bal.(Cr.)

1985-90

28,874 18,033 -10,841

Huge trade balance compelled the

government to approach the World

Bank/IMF for loan.

The government was also forced to

apply brakes on the licensing policy of

imports.

1990-92

45,522 38,300

In 1990-91,push was given to

export,but as a consequence of Gulf war

government failed to curb imports.

-7222

In1991-92, government introduced

number of measures in trade policy

allowing exim scripts,abolishing cash

compensatory support(CCS) schemes as

also a two-step devaluation of the

rupee,but fail to boost up export.

Year

Import Export

(Cr.)

1992-01

(Cr.)

Trade

Bal.(Cr.)

140740 118252 -22,488

In 1992-01,slow down in exports due toDepressed nature of world markets.

Saturation of developed countries market

for electronic goods which are dynamic

export sectors.

Increased protectionism by industrialised

countries in area of textile and clothing.

Increasing competition from China &

Taiwan.

India underestimated the impact SouthEast Asian crisis

Non-Tarrif barriers have been created by

developed counties to slow down Indian

exports.

In 2000-01 export was largely due to

rupee depreciation along with further

trade liberalization,more openness to

foreign investment in EOU sectors ike IT.

Year

Import Export

(US

$million)

2002 03 65422

2003-04

80177

(US

$million)

Trade

Bal.(US

$million)

52512 -12910

64723 -15454

Rise in imports in 2002-03 was broadly

based on oil imports,food &allied

products(edible oil),capital goods.

Exim policy 2003-04gave massive thrust

to exports by

Duty free import facility for service

sector upto earning 10lakh foreign

exchange.

Liberalization of Duty Exemption

scheme.

Besides,all these measures trade balance

in 2003-04 are high due to mainly on

imports of POL products more.Currently,

almost two-third of country crude oil

requirements

are

imported.Besides

import of POL, import of non POL items

shot up by 17% in2002-03 to 26.2%in

2003-04.

Trade - On an All time High

Economy is

more Open

than ever

before

Strong

Export

Growth

Strong

Service

Exports

Strong

Imports

growth

Source: Reserve Bank of India

Indias total external trade in goods and

services grew by 41.5% in H12005-06 to US $

153 billion. This is expected to go up to US $

310 billion by the end of this year. This was just

over US $ 74 billion in 1994.

The trade to GDP ratio, calculated at current

prices, has risen to 29.36% in 2004-05 from

18.28% in 1993-94.

Exports have grown to US $ 57.05 billion during

April-November 2005-2006. They are expected to

grow at 26% during the current year to US$ 100

billion.

Service Exports grew by 71% in 2004-05. India's

IT-ITES exports have shown robust growth and

are expected to grow by 32% this year to US $ 23

billion.

Non-oil imports grew at over 28% during April September 2005 led by demand for capital

goods.

Trade Trends ..

India's Foreign Trade

200

150

US$ million

US $ billion

India Exports - Goods and Services

100

50

0

9697

9798

9899

9900

0001

Goods

0102

0203

Services

0304

0405

0506

(A)

350

300

250

200

150

100

50

0

1984

Exports

2004-05

Imports

2005-06 (A)

Total Trade

India Capital Good Imports

140.00

120.00

US $ billion

US $ billion

Share of Asia

180

160

140

120

100

80

60

40

20

0

1994

100.00

80.00

60.00

40.00

20.00

0.00

96-97 97-98 98-99 99-00 00-01 01-02 02-03 03-04 04-05

Asia

Source: Reserve Bank of India

Non Asia

96-97

97-98

98-99

99-00

00-01

Capital Goods Imports

01-02

02-03

Total Imports

03-04

04-05