National Economic University

Chapter 3

Panel Data Regression

Dr. Phung Minh Duc

Contents

1. Introduction

2. Panel data

3. Regression models with Panel data

4. Estimation model selection Tests

5. Some defects of the panel model

6. Commands on Stata

7. Practice

Introduction

Endogeneity Problem

𝑌 = 𝛽0 + 𝛽1 𝑋 + 𝑢

❖ Endogeneity problem is when the independent variable is correlated with the

error term:

𝑐𝑜𝑣(𝑋, 𝑢) ≠ 0

❖ If the model contains endogenous variables => The coefficients estimated by

the OLS method are biased and unstable: 𝐸(𝛽 1 ) ≠ 𝛽1

❖ Endogeneity is a frequent problem in economic and econometrics.

Introduction

Sources of endogeneity

❖ Omitted variable: Independent variables are not observed and end up in

the error term, so the error term is correlated with the independent

variables used in the model

❖ Measurement: Measurement error can cause correlation between the

mismeasured variable and the error term

❖ Simultaneity: The independent variable and the dependent variable are

related at the same time

Introduction

Solutions for endogeneity

❖ Find and include a proxy variable in the model

❖ Using instrumental variable method (IV)

❖ Using econometric models with panel data

Panel Data

❖ Panel data is a set of data collected on the same set of individuals

(household, enterprise, province, etc…) along time at equally spaced time

points..

❖ Panel data contains two directions:

▪ The horizontal information between objects at the same time

(characteristic of cross-sectional data)

▪ The vertical information of each object along time(characteristic of

time series data).

Panel Data

❖ Panel data structure

Individual Time Depvar (Y) Indepvar (X)

1 1 𝑦11 𝑥11

1 2 𝑦12 𝑥12

1 3 𝑦13 𝑥13

… … … …

N 1 𝑦𝑁1 𝑥𝑁1

N 2 𝑦𝑁2 𝑥𝑁2

N 3 𝑦𝑁3 𝑥𝑁3

Panel Data

❖ Note:

The variables in the panel dataset can include the following groups:

▪ Group 1: Variables that change in both directions, such as: the output of

a enterprises, personal consumption, etc.

▪ Group 2: Variables that change horizontally but not vertically, such as:

the gender of household head, religion, etc.

▪ Group 3: Variables that change vertically but not horizontally. such as:

exchange rate, basic interest rate, general macroeconomic environment

So, panel data provides more dimensional information than other data

types and are very useful in applied research.

Panel Data

❖ Balance panel data is a data set with full individual information at all

times of observation

❖ Unbalance panel data is a data set with missing information of some

individuals at some time of observation

❖ Sources of unbalance:

▪ Self-selection (enterprise bankruptcy, province merged, individual

death, etc.)

▪ Random factors (data entry errors, data at a certain time cannot be

collected)

Panel Data

❖ The size of the dataset

Suppose the data set contains information about N individuals at T of the

observation period, then there are the following cases:

▪ N >> and T <<: The traditional panel data format

▪ N << and T >>: Take care of the autocorrelation problem

▪ N << and T<<: The data format is rarely used

▪ N >> and T>>: Being interested in research (Big data)

Panel Data

❖ Advantages of panel data

▪ Rich information: Horizontal (observations) and vertical (time)

▪ Solve the problem of endogeneity due to the lack of unobserved variables

(individual characteristic variables)

If intra-individual variation is considered, the impact of unobserved factors

can be excluded (individual characteristics do not change over time).

Panel Data

❖ Advantages of panel data

▪ Achieve vivid and refined analytics:

For example, in poverty reduction research, the panel data not only shows

the number of poor households, but also provides information on which

households are chronically poor, temporary poor or falling back into poverty.

Panel Data

❖ Advantages of panel data

▪ Reducing multicollinearity in the problem with distributed lag

▪ Increasing degrees of freedom, increasing the accuracy of statistical

inferences

▪ Suitable for datasets collected in developing countries

Panel Data

❖ Some typical panel datasets in Vietnam

▪ Vietnam Household Living Standard Survey (VHLSS)

▪ General Enterprise Survey (GES)

▪ Small and Medium Enterprise Survey (SMES)

▪ Provincial Competitiveness Index (PCI)

▪ …

Panel Data

❖ Practice on Stata

▪ Create an panel data file from annual data files

▪ Using the commands:

➢ merge

➢ reshape long, i(id) j(time)

➢ xtset id time

Regression models with Panel data

❖ General Panel Regression Model

𝑌𝑖𝑡 = 𝛽0 + 𝛽1 𝑋1𝑖𝑡 + ⋯ + 𝛽𝑘 𝑋𝑘𝑖𝑡 + 𝑐𝑖 + 𝑢𝑖𝑡 (1)

In which:

• 𝑖 is the individual index, 𝑗 is the time index;

• 𝑐𝑖 represents an unobserved factor (individual characteristic), which does

not change over time, that has an impact on 𝑌.

Note: Since 𝑐𝑖 represents the difference between individuals in the set of

observations, and this difference does not depend on time, the model (1) is

also called individual effect models.

Regression models with Panel data

Depending on the nature of 𝑐𝑖 , we have three models with different estimation

methods as follows:

▪ Pooled Estimation Model: There is no (or omitted) 𝑐𝑖 in the model

▪ Random Effects Estimation: There exists 𝑐𝑖 but 𝑐𝑖 is not correlated with

any independent variable 𝑋𝑘 in the model

▪ Fixed Effects Estimation: There exist 𝑐𝑖 and 𝑐𝑖 are correlated with at

least one independent variable 𝑋𝑘 in the model

Regression models with Panel data

❖ Pooled Estimation Model (POLS)

𝑌𝑖𝑡 = 𝛽0 + 𝛽1 𝑋1𝑖𝑡 + ⋯ + 𝛽𝑘 𝑋𝑘𝑖𝑡 + 𝑐𝑖 + 𝑢𝑖𝑡 (1)

▪ If 𝑐𝑖 really does not exist, then OLS is the best estimator for (1), with the

following assumptions:

➢ POLS1: 𝐸 𝑢𝑖𝑡 𝑋 = 0, ∀𝑖, 𝑡

➢ POLS2: Random error _𝑖𝑡 not autocorrelated

➢ POLS3: 𝑣𝑎𝑟 𝑢𝑖𝑡 𝑋 = 𝜎 2 , ∀𝑖, 𝑡

▪ If 𝑐𝑖 exists (which is quite common), then OLS obtains a biased estimator

▪ Command on Stata: reg Y X1 … Xk

Regression models with Panel data

❖ Random Effects Estimation (RE)

𝑌𝑖𝑡 = 𝛽0 + 𝛽1 𝑋1𝑖𝑡 + ⋯ + 𝛽𝑘 𝑋𝑘𝑖𝑡 + 𝑐𝑖 + 𝑢𝑖𝑡 (1)

▪ If 𝑐𝑖 exists, but 𝑐𝑖 is not correlated with 𝑋𝑖𝑡 , then there is no

endogenous variable problem. However, since c is included in the

random error, then the new random errors 𝑣𝑖𝑡 = 𝑐𝑖 + 𝑢𝑖𝑡 is

autocorrelated.

▪ The random effect estimation method focuses on solving the

autocorrelation problem of 𝑣𝑖𝑡

Regression models with Panel data

❖ Random Effects Estimation (RE)

𝑌𝑖𝑡 = 𝛽0 + 𝛽1 𝑋1𝑖𝑡 + ⋯ + 𝛽𝑘 𝑋𝑘𝑖𝑡 + 𝑐𝑖 + 𝑢𝑖𝑡 (1)

The assumptions of the RE estimation method are as follows

❖ RE1: 𝐸 𝑢𝑖𝑡 𝑋, 𝑐 = 0, ; 𝐸 𝑐𝑖 , 𝑋 = 0, ∀𝑖, 𝑡

❖ RE2: The random error 𝑢𝑖𝑡 not autocorrelated

❖ RE3: v𝑎𝑟 𝑐𝑖 𝑋 = 𝜎𝑐2 ; 𝑣𝑎𝑟 𝑢𝑖𝑡 𝑋, 𝑐 = 𝜎𝑢2 , ∀𝑖, 𝑡

Regression models with Panel data

❖ Random Effects Estimation (RE)

𝑌𝑖𝑡 = 𝛽0 + 𝛽1 𝑋1𝑖𝑡 + ⋯ + 𝛽𝑘 𝑋𝑘𝑖𝑡 + 𝑐𝑖 + 𝑢𝑖𝑡 (1)

Estimation methods for RE model:

❖ Generalized Least Squares (GLS) Estimator

❖ Maximum Likelihood Estimation (MLE)

Command on Stata (for GLS estimator method):

xtreg Y X1 … Xk, re

Regression models with Panel data

❖ Fixed Effects Estimation (FE)

𝑌𝑖𝑡 = 𝛽0 + 𝛽1 𝑋1𝑖𝑡 + ⋯ + 𝛽𝑘 𝑋𝑘𝑖𝑡 + 𝑐𝑖 + 𝑢𝑖𝑡 (1)

▪ If 𝑐𝑖 exists, and 𝑐𝑖 is correlated with 𝑋𝑖𝑡 , then there is endogenous

variable problem.

▪ The assumptions of the FE estimation method are as follows:

❖ FE1: 𝐸 𝑢𝑖𝑡 𝑋𝑖 , 𝑐𝑖 = 0, ∀𝑡, that mean:

𝑐𝑜𝑣 𝑢𝑖𝑡 , 𝑋𝑖 = 0 and 𝑐𝑜𝑣 𝑢𝑖𝑡 , 𝑐𝑖 = 0

❖ FE2: 𝑟𝑎𝑛𝑘 𝐸 𝑋 ′ 𝑋 = 𝑘

❖ RE3: v𝑎𝑟 𝑢𝑖𝑡 𝑋𝑖𝑡 = 𝜎𝑢2 ; 𝑐𝑜𝑣(𝑢𝑖 , 𝑢𝑗 ) = 0, ∀𝑖 ≠ 𝑗

Regression models with Panel data

❖ The within estimator with FE model

𝑌𝑖𝑡 = 𝛽0 + 𝛽1 𝑋𝑖𝑡 + 𝑐𝑖 + 𝑢𝑖𝑡 (1)

▪ For each 𝑖, average the equation (1) over time, we get:

1 1 1

σ 𝑌 = 𝛽0 + 𝛽1 . 𝑇 σ𝑡 𝑋𝑖𝑡 + 𝑐𝑖 + 𝑇 . σ𝑡 𝑢𝑖𝑡

𝑇 𝑡 𝑖𝑡

or 𝑌𝑖 = 𝛽0 + 𝛽1 𝑋𝑖 + 𝑐𝑖 + 𝑢𝑖 (2)

▪ From (1) and (2), because 𝑐𝑖 is fixed over time, we have:

ሷ = 𝛽1 𝑋ሷ 𝑖𝑡 + 𝑢ሷ 𝑖𝑡

𝑌𝑖𝑡 − 𝑌𝑖 = 𝛽1 (𝑋𝑖𝑡 − 𝑋𝑖 ) + (𝑢𝑖𝑡 − 𝑢𝑖 ) or 𝑌𝑖𝑡 (3)

A pooled OLS estimator that is based on the time-demeaned variables is called the fixed

effects estimator or the within estimator.

Command on Stata: xtreg Y X, fe

Estimation model selection Tests

Breusch – Pagan Test

❖ Hypothesis testing:

𝐻0 : 𝑣𝑎𝑟 𝑐𝑖 = 0

ቊ

𝐻1 : 𝑣𝑎𝑟(𝑐𝑖 ) ≠ 0

❖ Test statistics

σ𝑛𝑖=1(σ𝑇𝑡=1 𝑣𝑖𝑡 )2

1− 𝑛

(𝑛𝑇)2 σ𝑖=1 σ𝑇𝑡=1 𝑣 2 𝑖𝑡

𝜆𝐿𝑀 =

2 𝑛𝑇 2 − 𝑛𝑇

If 𝐻0 is true, then 𝜆𝐿𝑀 obeys the law of Chi-squared with one degree of freedom

Command on Stata: xttest0

Estimation model selection Tests

Hausman Test

❖ Hypothesis testing:

𝐻0 : 𝑐𝑜𝑣 𝑐𝑖 , 𝑢𝑖𝑡 = 0

ቊ

𝐻1 : 𝑐𝑜𝑣 (𝑐𝑖 , 𝑢𝑖𝑡 ) ≠ 0

❖ Test statistics

𝜒 2 𝑞𝑠 = (𝛽መ𝐹𝐸 − 𝛽መ𝑅𝐸 )′(𝑉𝐹𝐸 − 𝑉𝑅𝐸 )−1 (𝛽መ𝐹𝐸 − 𝛽መ𝑅𝐸 )

If 𝐻0 is true, then 𝜆𝐿𝑀 obeys the law of Chi-squared with one degree of

freedom

Command on Stata: hausman fe re

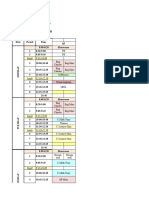

Estimation model selection Tests

𝑐𝑖 = 0

RE POLS

(xttest0; P>>)

𝑐𝑖 ≠ 0, P<<

FE or RE 𝑃≫

(Hausman) RE

𝑃≪

FE

Estimation model selection Tests

Practice on Stata

❖ Step 1: Model selection between POLS and RE

xtreg Y X1…Xk, re

Xttest0 => If P-value >> then POLS is the best model

❖ Step 2: Model selection between FE and RE

xtreg Y X1…Xk, fe

est store fe

xtreg Y X1…Xk, re

est store re

hausman fe re => If P-value << then FE is the best model

If P-value >> then RE is the best model

Some defects of the panel model

❖ In FE model

▪ Autocorrelation

xtserial Y X If P-value << then the model has autocorrelation

=> xtregar Y, X, fe

▪ Contemporaneous correlations

xttest2

If P-value << then the model has contemporaneous correlations

=> xtscc Y X, fe

▪ Heteroskedasticity

xttest3 If P-value << then the model has heteroskedasticity

=> xtreg Y X, fe robust

Some defects of the panel model

❖ In RE model

▪ Autocorrelation

xttest1 If P-value >> then the model has autocorrelation

=> xtregar Y, X, fe

▪ Heteroskedasticity

xtreg Y X, re

predict res1, ue

robvar res1, by (id)

If P-value << then the model has heteroskedasticity

=> xtreg Y X, re robust

Practice