Takaful Core Administration System: Complete Guide

Islamic financial markets operate under Sharia, where risk sharing, tabarru’, and strict fund segregation shape how protection is provided.

Off-the-shelf insurance platforms rarely fit: policy software must codify these rules – supporting PRF/PIF separation, surplus handling, and Sharia governance – without compromise.

In this guide, we unpack what makes a takaful core administration system different and outline the AMS features you’ll need to build a compliant, scalable operation.

Sharia Law and Insurance: The Need For a Custom Approach

Conventional insurance is built on risk transfer.

Takaful is built on risk sharing and mutual assistance (ta’awun). That single difference changes everything about system design.

A compliant takaful core administration system has to do more than process quotes, policies, and claims. It must embed Sharia governance into daily operations – automatically and unavoidably – so your business scales without compromising principles.

What are the Core Principles of Takaful?

Before focus on software, it’s worth grounding the discussion in the fundamentals.

Takaful replaces risk transfer with mutual risk sharing and is guided by a few Sharia-based principles that shape product design, accounting, and governance.

They determine how contributions are treated, how funds are segregated and used, and how decisions are overseen. The points below form the practical rulebook your core system and AMS must enforce day to day.

- Ta’awun (mutual assistance): Participants cooperate to protect each other against defined losses.

- Tabarru’ (donation): Part of each contribution is treated as a donation to the risk pool (PRF), enabling risk sharing rather than risk transfer.

- Participant Risk Fund (PRF) and Participant Investment Fund (PIF): The PRF holds tabarru’ donations and is used to pay claims and build reserves; the PIF (primarily in family takaful) holds the participant’s savings/investment portion. Both must be strictly segregated with separate ledgers, with operator fees, retakaful flows, and surplus handled without commingling.

- Risk sharing vs. risk transfer: Losses are indemnified from a collectively owned fund; the operator manages the pool and earns fees or a profit share per the selected model.

- Prohibition of riba, gharar, maysir: No interest, unjustified uncertainty, or gambling mechanics in contracts or investments.

- Sharia governance: A Sharia Supervisory Board oversees products, operations, and investments, issuing fatwas and audits.

- Surplus distribution: Net surplus (after claims, retakaful, and reserves) belongs to participants and is distributed or retained per the product’s rules.

What is the Takaful System?

We’ve established the rules of takaful insurance; in the simplest terms, takaful insurance system is the software that is built around them.

At its core, it orchestrates how contributions are split into tabarru’ for the PRF and, in family takaful, a savings or investment portion; how claims, fees, and retakaful flows move through separate ledgers; and how surplus is measured and returned.

Because operators often run multiple product lines under different takaful models, the platform must be model-aware at the product level.

A Wakala family product, a Hybrid motor product, and a Waqf microtakaful scheme can coexist, each with its own accounting schema, surplus logic, and retakaful rules.

Put simply, the takaful core administration system is the operational backbone. Everything above it—quoting, policy issuance, servicing, even straight through processing—relies on this engine to keep fund separation, Sharia intent, and regulatory compliance intact.

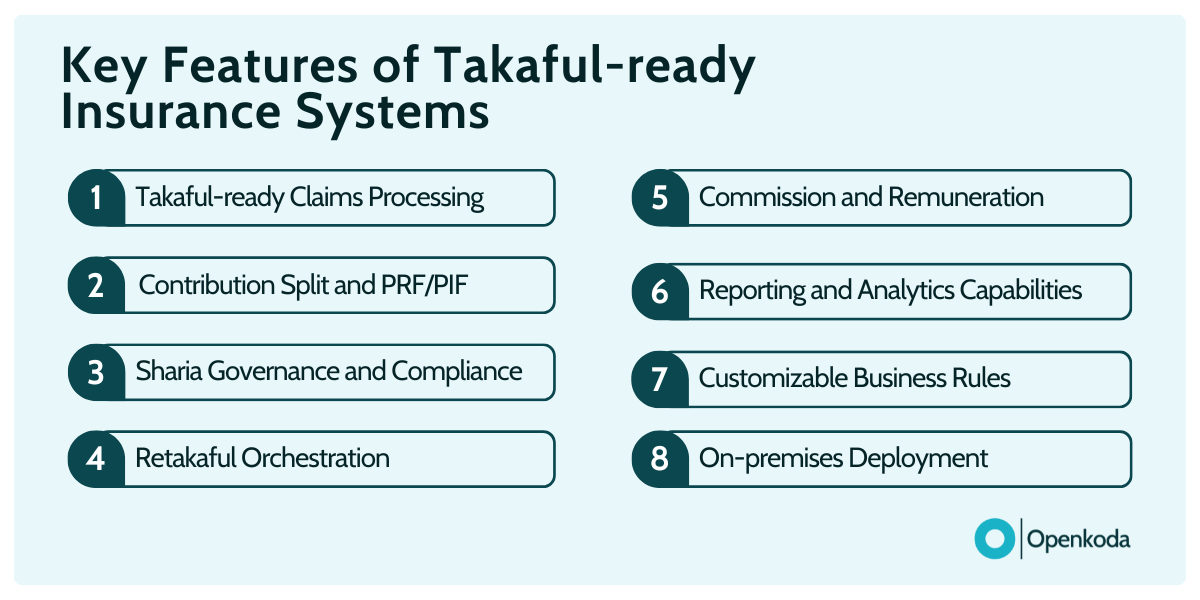

Key Features of Takaful-ready Agency Management Software (AMS)

Any takaful-ready system, but especially comprehensive solutions like, insurance agency management system are the user-facing layer that turns model choices into everyday workflows – quotes, policy issuance, endorsements, and servicing—while keeping Sharia and regulatory compliance non-negotiable.

Below are the capabilities a modern takaful AMS needs to support sustainable growth in the insurance industry.

Takaful-ready Claims Processing

FNOL from any channel, real-time validation of certificate, coverage, contribution status, and retakaful attachment. Routine claims flow through straight through processing; exceptions route to guided reviews with SSB checkpoints where needed.

Contribution Split and PRF/PIF Financial Accounting

A key aspect of takaful is the strict segregation of funds into the Participant Risk Fund (PRF) and the Participant Investment Fund (PIF).

Your AMS should let you configure both ledgers per product, enforce separation by design, and automate reconciliations and reporting – so teams can set up and manage these two accounts seamlessly, with full audit trails and regulatory compliance baked in.

Sharia Governance and Regulatory Compliance

SSB workflow for product changes, exception routing, and investment screening hooks.

Evidence vault for fatwas and approvals, maker-checker on sensitive actions, and configurable rule packs for local regulatory compliance.

Retakaful Orchestration

Treaty/FAC suggestions at quote time, automated cessions, bordereaux generation, and recovery tracking – fully separated from operator accounts and aligned with pool rules.

Commission and Remuneration Management

Transparent, model-consistent fee and commission structures that avoid maysir-like incentives.

Hierarchies for agents, brokers, bancatakaful, and digital partners.

Reporting and Analytics Capabilities

Operational dashboards (loss ratio, surplus emergence, qard hasan recovery), plus “ask-a-question” Reporting AI for fast, explainable insights.

Great for managerial decision making and SSB/regulatory audit prep.

Customizable Business Rules

Low-code forms, workflows, rating rules, and validations – within guardrails – so business teams can adapt journeys quickly. This is the AMS as business infrastructure, not just a UI.

On-premises Deployment and Data Residency Options

Cloud, private cloud, or on-premise deployment to satisfy Saudi Arabia data residency requirements. Local encryption, key management, and full audit trails.

API-first Connectivity

Clean, well-documented APIs for aggregators, MGAs, and embedded partners to quote and issue certificates, with throttling, observability, and sandbox environments.

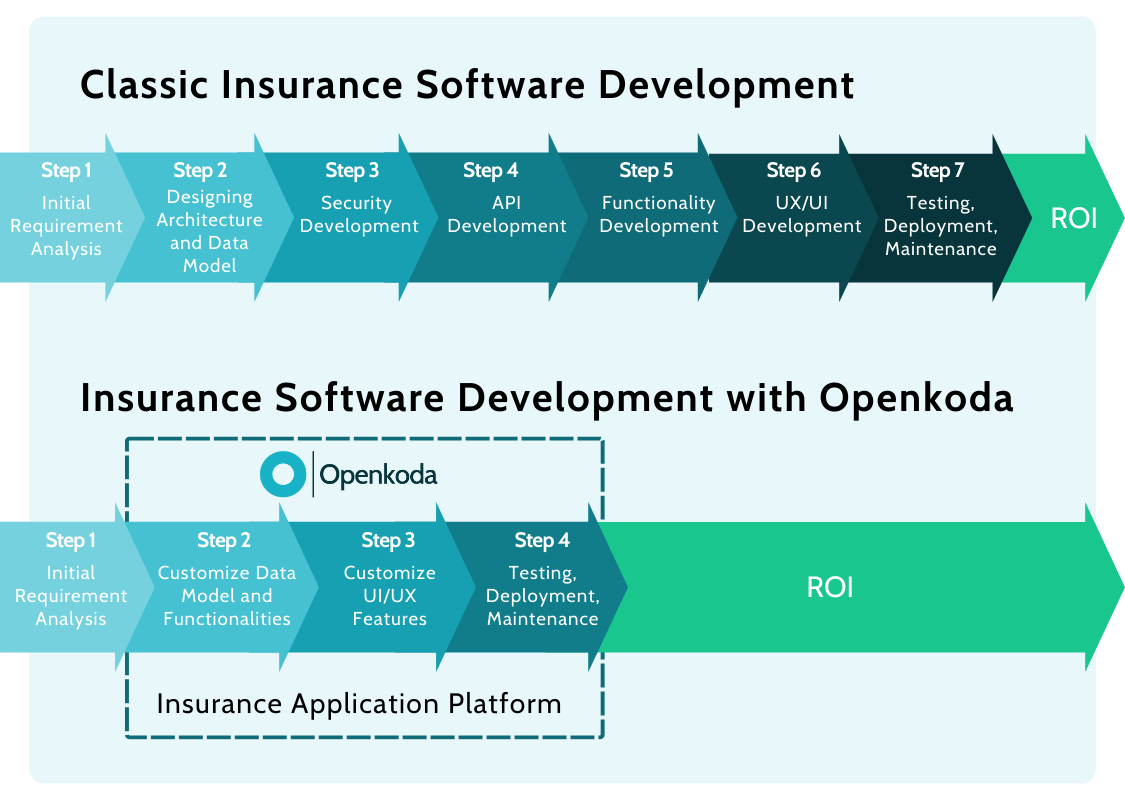

Openkoda: Takaful-Ready Software Development Platform

If you are looking to build your own takaful insurance platform, Openkoda might be the perfect solution for you.

Its flexible application core lets you customize products, workflows, and guardrails so your software aligns with Sharia requirements from day one.

At the heart of this flexibility is a customizable business-rule engine.

You can encode constraints that prohibit riba, gharar, and maysir; define surplus eligibility and distribution; and set precise underwriting and servicing rules for each product line.

Openkoda provides ready-to-adapt modules for the core operations you’ll need: policy management, claims management, and embedded insurance that greatly speed up development of innovative insurance products.

With Openkoda, you can easily configure how contributions are split into the Participant Risk Fund (PRF) and the Participant Investment Fund (PIF), define and maintain separate ledgers, and set up automated surplus and qard hasan workflows – without hard-coding or heavy rewrites.

These configurations plug directly into your quote-to-bind and policy issuance journeys, enabling safe straight through processing where your underwriting and Sharia rules allow, while strictly preserving fund separation.

Finally, Openkoda gives you freedom of deployment. Run in your cloud or fully on-premise, which makes it a strong fit for Islamic markets with strict data governance rules (including Saudi Arabia).