Top 5 Insurance Core Systems in 2025

With over 70% of insurers worldwide still relying on outdated legacy systems to some extent, there is a pressing need for innovation – a need that is being met by core platforms.

Today’s cloud‑native core platforms fuse policy, billing, claims, analytics, and open APIs into a single digital engine, giving carriers the agility to launch products faster, and automate at scale.

Let’s compare some of the key insurance core systems that are currently on the market to see which one’s works best.

What is a Core Insurance Platform?

A core insurance platform is the digital “backbone” of an insurer – the integrated suite that runs day‑to‑day business operations such as policy administration, underwriting, billing, claims, and often customer relationship management

By unifying these mission‑critical functions in one place, carriers gain a single source of truth for data, automate manual work, and embed compliance rules directly into workflows, reducing operational risk and cost.

Over the past few years, most core platforms have shifted to cloud‑native, API‑first architectures.

This modern design gives insurers on‑demand scalability, improved customer experience, continuous upgrades, and plug‑and‑play connections to emerging technologies – think generative AI for triaging claims, custom embedded insurance forms, or real‑time pricing engines.

McKinsey notes that cloud‑ready core systems are now the foundation for faster insurance product launches, real‑time analytics, and stronger ecosystem connectivity, making their modernization one of the industry’s top strategic priorities for 2025 in insurance industry.

Key Components of and Core Insurance System

While vendors differentiate themselves with niche modules and deployment models, every modern core platform is built around the same operational “bones.”

These shared components let carriers run the insurance value chain end‑to‑end without stitching together dozens of point solutions.

- Policy Management – Centralized administration of quotes, new business, renewals, endorsements, and cancellations across all product lines.

- Claims Processing – Intake, triage, adjudication, reserving, and settlement workflows—with rules engines to automate straightforward claims and surface exceptions for adjusters.

- Billing – Flexible invoicing, collections, disbursements, and payment‑plan management that supports multi‑currency and tax compliance.

- Custom Dashboards – Role‑based, real‑time views of operational KPIs (e.g., loss ratios, cycle times) that help underwriters, claims managers, and executives act on data quickly.

- API Integrations – Open, well‑documented interfaces that allow easy connections to digital distribution portals, rating engines, AI fraud detection, and partner ecosystems.

Core Platform vs Greenfield Build

Let’s start with greenfield.

Building a system from the ground up sounds liberating. No legacy baggage. No inherited constraints. No limitations from existing systems.

But here’s the hidden truth every insurer learns sooner or later:

Greenfield equals freedom… and a blank page. And blank pages are slow.

- You need to design core data models.

- You need to create policy, claims, billing, rating engines.

- You need to build all integrations.

- Every workflow, permission, dashboard—everything—starts at zero.

A 2023 Novarica study estimated that building a full insurance system from scratch often takes 24–36 months, sometimes more for multi-line carriers. That’s two to three years before a single customer sees value.

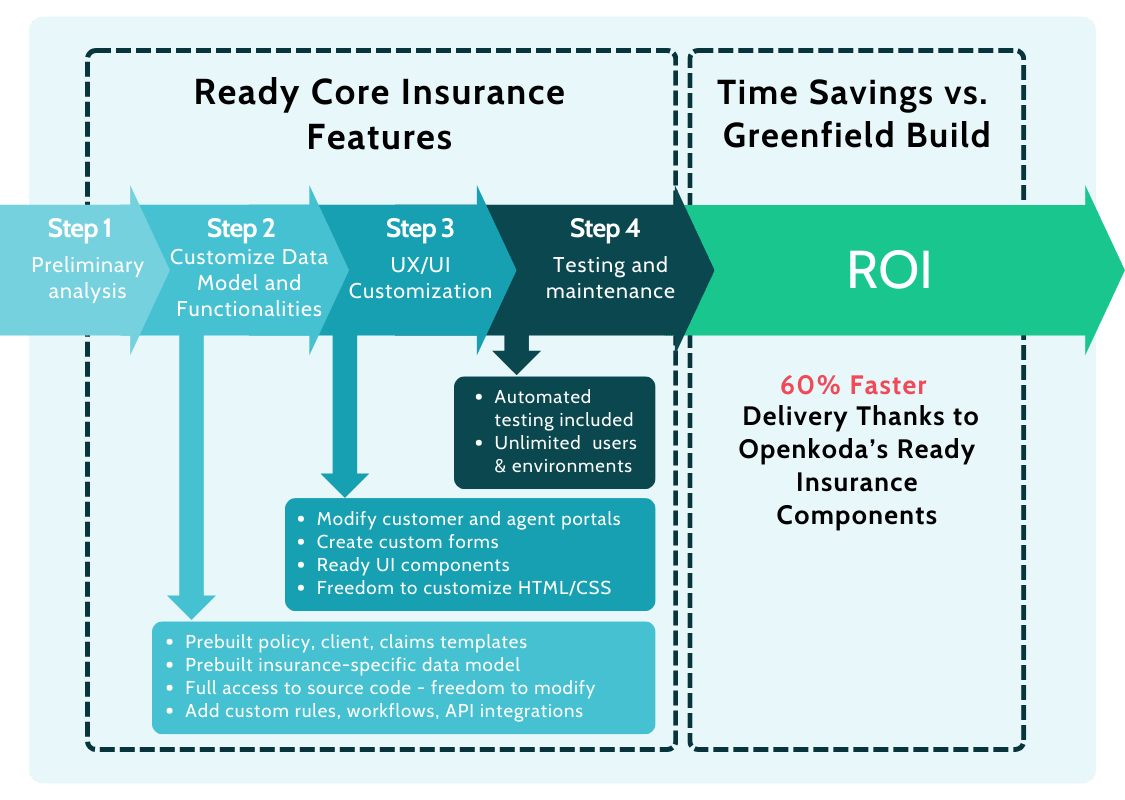

Now compare this to building on a modern insurance core platform.

You get a ready-made foundation: policy admin, claims handling, billing modules, rating, workflows, user management, integration layers – all tested, all production-ready.

You’re not reinventing infrastructure but customizing the parts that create business value.

That’s why insurers report 40–60% faster development cycles when working with configurable platforms versus greenfield builds (Gartner, 2022). Some platforms cut time-to-market even more by offering:

- Pre-built low-code or no-code components

- API-ready integration layers

- Automated testing

- Module reuse across product lines

- Built-in compliance and security frameworks

This is what makes core platforms shine: acceleration without vendor lock-in (at least in the best-designed platforms).

You can prototype a new P&C product in weeks.

Iterate in days.

Deploy in months – not years resulting in substantial cost savings.

Best Core Systems on The Market in 2025

Below we compare five leading core platforms that solve the same insurance sector fundamentals in very different ways.

Together, they show that 2025’s “best” core depends less on features – each has policy, claims, and billing – and more on which deployment, ownership, and innovation model fits your business vision.

Openkoda Platform

Openkoda is a core insurance system that helps insurance companies and startups build and scale modern systems.

Openkoda is a cost‑effective alternative to heavyweight suites like Guidewire and DuckCreek and because the entire stack is accessible as plain Java, Spring Boot and React code, carriers keep full ownership of the IP and avoid the long‑term lock‑in.

Openkoda ships with templates for Embedded Insurance, Claims Processing, and Policy Administration. Each template contains domain objects, workflows, and UI components, so actuaries and product managers can model coverages or claims rules instead of wiring CRUD screens.

It gives insurers and insurtechs a ready‑made foundation – user management, security, multitenancy, reporting AI, API integrations – so teams can start from working software instead of an empty repository.

This efficiency is shown by how much faster the deployment of new insurance products is with Openkoda – development cycles cut by roughly 60%: what would have taken 12 months on a green‑field stack can often be piloted in three to six.

Key Features

- Open‑source foundation (Java, PostgreSQL) with unlimited users and no vendor lock‑in.

- Generative‑AI components such as Reporting AI for natural‑language data queries and document generation.

- Pre‑built templates for policy document management, claims management, billing, and embedded insurance products.

- Modular micro‑services & multi‑tenant clustering for horizontal scalability.

- Rich API layer (REST & GraphQL) and event streaming for easy ecosystem integration.

- In‑platform dashboard builder and role‑based analytics out of the box

Key Strengths

- Extreme flexibility: full code ownership lets IT teams customise everything—no black‑box limitations.

- Speed to market: open templates cut development time by 50‑60 %, ideal for MVPs and new lines.

- Total cost control: perpetual license with zero per‑seat or transaction fees;

Best For

- Greenfield insurtechs launching products or embedded‑insurance propositions on limited budgets.

- Mid‑tier carriers replacing multiple legacy systems but wary of long, expensive “big‑bang” programs.

- Legacy carriers wanting to complete their digital transformation process.

- Innovation teams that need rapid prototyping sandboxes with production‑grade security and scale.

Insurity Sure Suite

Insurity’s Sure Suite (Sure Commercial, Sure Personal & Sure Workers’ Comp) is an end‑to‑end, cloud‑native core insurance system that unifies insurance operations such as policy administration, billing, and claims on a single, multi‑tenant SaaS architecture.

All modules share one data model and are delivered as containerized micro‑services running on AWS or Azure, giving insurers elastic scale and automatic quarterly upgrades without on‑prem maintenance.

Key Features

- Unified core modules – Policy, Billing, Claims, Rating, and Underwriting tools built on one code‑base with a common data store.

- Low‑/no‑code product designer – Visual configuration of rates, rules, and forms lets business users launch or tweak products quickly with an intuitive toolset.

- AI‑enabled claims automation – Embedded AI Assistant, fraud scoring, and straight‑through processing; Document Intelligence extracts data from unstructured documents with 99 % accuracy.

Key Strengths

- Cloud‑native, multi‑tenant SaaS eliminates infrastructure overhead and delivers continuous security patches and feature releases.

- Fast speed‑to‑market via low‑code tooling and pre‑configured line‑of‑business content: insurers can introduce new products or territories in weeks instead of months.

Best For

- Carriers and MGAs that want a pure‑SaaS core with continuous upgrades and no data‑center footprint.

- Product teams seeking rapid configuration and low‑code tooling to shorten filing and launch cycles.

- Insurers prioritizing AI‑driven claims and analytics without integrating separate point solutions.

Guidewire InsuranceSuite

Guidewire’s InsuranceSuite is a modular, cloud‑native core system built around three flagship insurance applications – PolicyCenter, ClaimCenter, and BillingCenter – running on the Guidewire Cloud Platform (GWCP).

All modules sit on a shared data model and are delivered as containerised micro‑services managed by GWCP, which provides CI/CD pipelines, blue‑green deployments, and automated quarterly upgrades.

InsuranceSuite is tightly coupled with Guidewire Data Platform and embedded analytics apps (Predict, Cyence, HazardHub).

Key Features

- Unified core modules – Policy, Claims, and Billing share one data schema, ensuring real‑time consistency across the insurance lifecycle.

- Guidewire Cloud Platform (GWCP) – Containerised micro‑services with built‑in CI/CD, blue‑green deployments, and self‑service environment management.

- Advanced Product Designer (APD) – Low‑code product builder supporting multi‑line, multi‑currency products and rating logic externalised as a standalone service for more advanced business challenges.

Key Strengths

- Comprehensive functional breadth covering policy, billing, claims, rating, digital, data, and AI on a single platform.

- DevOps self‑service (environment spin‑up, data masking, quality gates) speeds innovation and reduces reliance on vendor services.

- Low‑code product agility via APD and rating‑app templates slashes time‑to‑market for new or seasonal products.

Best for

- Large and upper‑mid P&C carriers seeking a feature‑rich, future‑proof SaaS core with guaranteed evergreen upgrades.

Duck Creek Suite

Duck Creek’s platform is built as a micro‑service ecosystem anchanced with cloud technology for insurance carriers – every module (Policy, Billing, Claims, Rating, Reinsurance, Loss Control, Payments, Clarity for data & BI, and more) sits on the same code line and data model, so changes ripple across the whole suite instantly.

A feature that sets it apart from other insurance core systems is its low‑code configuration studio that separates product content from platform code; business analysts drag‑and‑drop rates, rules, pages, and claims workflows and push to production.

Key Features

- Modular end‑to‑end suite: Policy, Billing, Claims, Rating, Reinsurance, Loss Control, Payments, Clarity analytics—adopt à‑la‑carte or as one stack.

- OnDemand evergreen SaaS: auto‑upgrades, 99.9 % SLA, control hub, and rapid (3‑‑6 month) implementations.

Key Strengths

- Evergreen, no‑upgrade projects keep carriers current and free IT from version‑lock.

- Open, headless architecture lets digital teams craft bespoke web/mobile experiences while re‑using core logic.

- Insurance‑specific low‑code tooling compresses product launch or bureau‑update cycles to weeks.

Best For

- P&C carriers (personal, commercial, specialty) that want an evergreen SaaS core with minimal infrastructure overhead.

- Digital‑first insurers and MGAs building custom, headless portals or embedded‑insurance channels on open APIs.

Britecore

BriteCore is a cloud‑native, API‑first software suite built for property‑and‑casualty insurers that need rapid product agility without the overhead of traditional upgrade projects.

Deployed on AWS and delivered purely as SaaS, the platform unifies policy, billing, claims, rating, portals, and analytics on a single data model.

Key Features

- Unified core modules for policy administration, billing, claims, and rating, plus agent / policyholder portals that share one data store.

- Low‑code product configuration—point‑and‑click editors, version‑controlled templates, and in‑memory rating let business users stand up or modify products quickly.

- API‑first architecture with REST/GraphQL endpoints and event webhooks, purpose‑built for ecosystem integrations and AI agents.

Key Strengths

- Rapid product agility: low‑code tools and templates slash time‑to‑market for new lines or state filings.

- Scalable, cloud‑native architecture leverages AWS services for resilience, performance, and rapid environment provisioning.

Best For

- Mid‑size P&C carriers and MGAs that want a modern, end‑to‑end core without heavy IT overhead.

- Product teams seeking fast configuration and frequent iteration rather than annual release cycles.

The Cost Story: Where Core Platforms Change the Math

Speed is important, but cost savings matter just as much. Greenfield builds incur high upfront engineering investment before any business outcome appears. Core platforms distribute that cost across multiple clients, making your development more affordable.

Industry benchmarks show:

- Up to 50% lower total cost of ownership over 5 years when deploying on a configurable insurance platform vs. custom build

- 30–45% reduction in maintenance costs because foundational updates, security patches, and performance improvements come baked in

- Teams of 2–4× smaller than greenfield project teams

Less engineering overhead → more focus on customer value.

Less time lost to rebuilding infrastructure → more time for rapid product iteration.

For insurers navigating thin margins in the P&C segment, these efficiencies are game-changing.

Why Core Platforms Win in 2025 and Beyond

The insurance business is shifting. Products are becoming digital-first. Customers expect instant quotes, AI-driven interactions, embedded experiences, and smooth claims journeys.

To keep up, insurers need platforms that:

- Integrate cleanly with existing systems

- Let teams experiment without penalty

- Reduce time-to-market for new P&C offerings

- Automate repetitive work

- Support modern data flows and analytics

- Scale globally, not just locally

Greenfield can still work for niche innovation labs and large legacy insurers with huge development budgets.

But for 90% of insurers?

A modern insurance core platform is just smarter. It reduces risk, compresses development cycles, and frees teams to focus on where the real competitive advantage lies: product design, customer experience, and operational precision.